DYDX price noted a 32% increase on Sunday, fueled by the hype surrounding dYdX Day in Dubai. This surge attracted significant attention from investors.

However, this recent rally is not necessarily the start of another prolonged upward trend. The increase in price may face challenges as profit-taking behavior starts to impact the market.

DYDX Investors Start Booking Profit

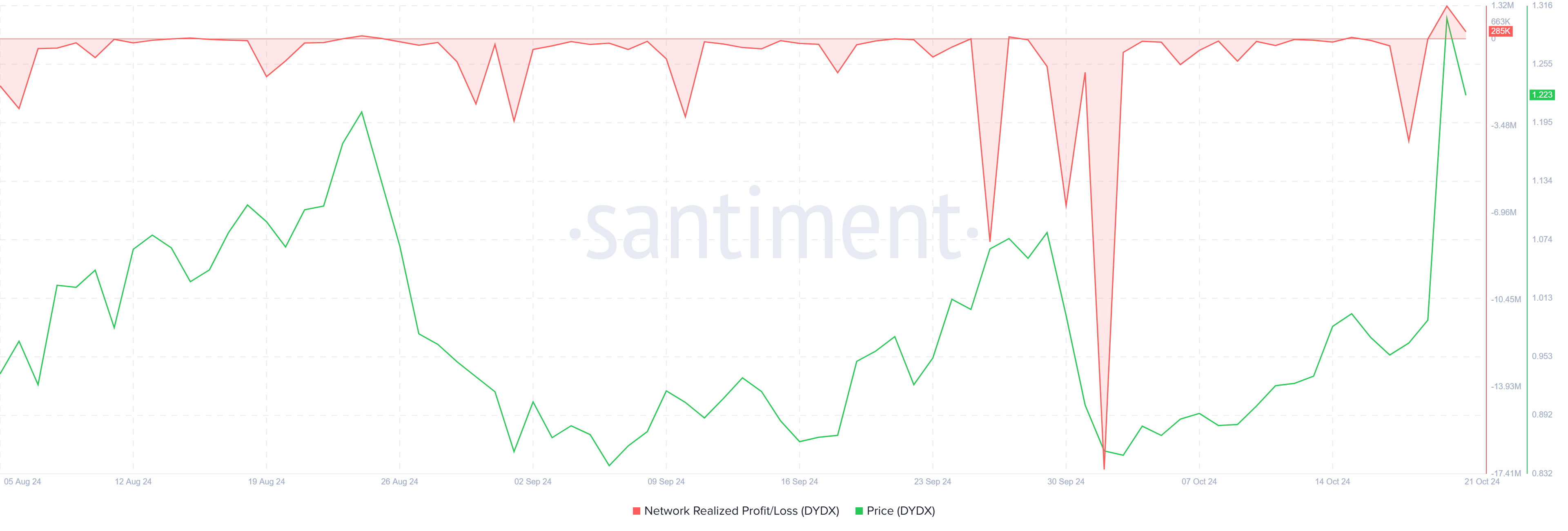

Investors have already begun locking in their profits following the weekend’s price surge. The realized profits metric has shown its first significant spike since March, marking a seven-month high.

This sudden wave of profit-taking could potentially drag the price of DYDX lower as large numbers of traders move to secure their gains. Historically, such behavior often leads to a temporary market downturn as selling pressure increases.

With many investors cashing in on their profits, the market sentiment is leaning bearish. The influx of selling may cause a negative impact on DYDX’s price, especially as more traders look to offload their holdings. This pattern suggests that the recent rally could lose steam, leading to further market correction.

Read more: Understanding dYdX: A Guide to the Decentralized Perpetual Exchange

dYdX Realized Profits. Source: Santiment

dYdX Realized Profits. Source: SantimentFrom a technical standpoint, DYDX’s momentum appears fragile. The Relative Strength Index (RSI), a key indicator of overbought and oversold conditions, is currently sitting in the overbought zone.

This is an uncommon occurrence for the altcoin and typically signals that the asset is due for a price correction. In previous instances, when the RSI entered this zone, the price of DYDX experienced a drawdown shortly afterward.

Given the elevated RSI levels, a similar outcome is expected this time. If the overbought conditions persist without a strong catalyst to push prices higher, DYDX may face increasing selling pressure, leading to a decline in price.

DYDX RSI. Source: TradingView

DYDX RSI. Source: TradingViewDYDX Price Prediction: Focusing On Not Losing

Following its 32% rise on Sunday, DYDX’s price has settled just below the key resistance level of $1.33. However, today alone, the asset has dropped by 6%, largely due to the profit-taking behavior mentioned above. This pullback suggests that the recent rally may have reached its peak for now.

Considering the factors at play, DYDX is likely to face further bearish pressure. The altcoin could lose support at $1.16, a critical level. If this occurs, the next significant support lies at $0.91, which could lead to a larger drawdown, erasing recent gains.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

DYDX Price Analysis. Source: TradingView

DYDX Price Analysis. Source: TradingViewShould DYDX manage to bounce off the $1.16 support level, it could preserve some of the recent profits. A successful rebound would give DYDX another chance at breaching the $1.33 resistance, potentially invalidating the bearish outlook.

The post DYDX Sees 32% Surge Amid Dubai Conference Hype, But Traders Start to Cash Out appeared first on BeInCrypto.

2 weeks ago

16

2 weeks ago

16

English (US) ·

English (US) ·