El Salvador, the first nation to adopt Bitcoin as legal tender, is preparing to scale back its cryptocurrency policies to secure a $1.3 billion loan agreement with the International Monetary Fund (IMF).

The country made it compulsory for businesses to accept Bitcoin as a payment method in 2021.

El Salvador’s Bitcoin Policy to Shift Amid IMF Pressure

According to reports from the Finance Times, the deal is expected to be finalized in the coming weeks. It would reportedly remove the legal requirement for businesses to accept Bitcoin as payment, making it optional instead.

This shift would significantly change the country’s Bitcoin law. El Salvador and its president Nayib Bukele consistently faced criticism from international financial institutions, including the IMF.

In addition to the IMF loan, the agreement could unlock $1 billion in financing from the World Bank and another $1 billion from the Inter-American Development Bank over the next few years.

“El Salvador found 50 million ounces of gold worth $131 billion at current prices and Bukele is absolutely going to rush to mine all that gold and sell it as fast as possible to buy BTC,” Travis Kling wrote on X (formarly Twitter).

As part of the loan conditions, the Salvadoran government has also agreed to implement broader fiscal reforms. These include reducing the budget deficit by 3.5% points of GDP over three years, introducing spending cuts and tax increases, and improving anti-corruption legislation.

The country is also planning to raise financial reserves from $11 billion to $15 billion. Currently, El Salvador has approximately $556.7 million in BTC as a part of its reserve, sitting on 118% unrealized profits.

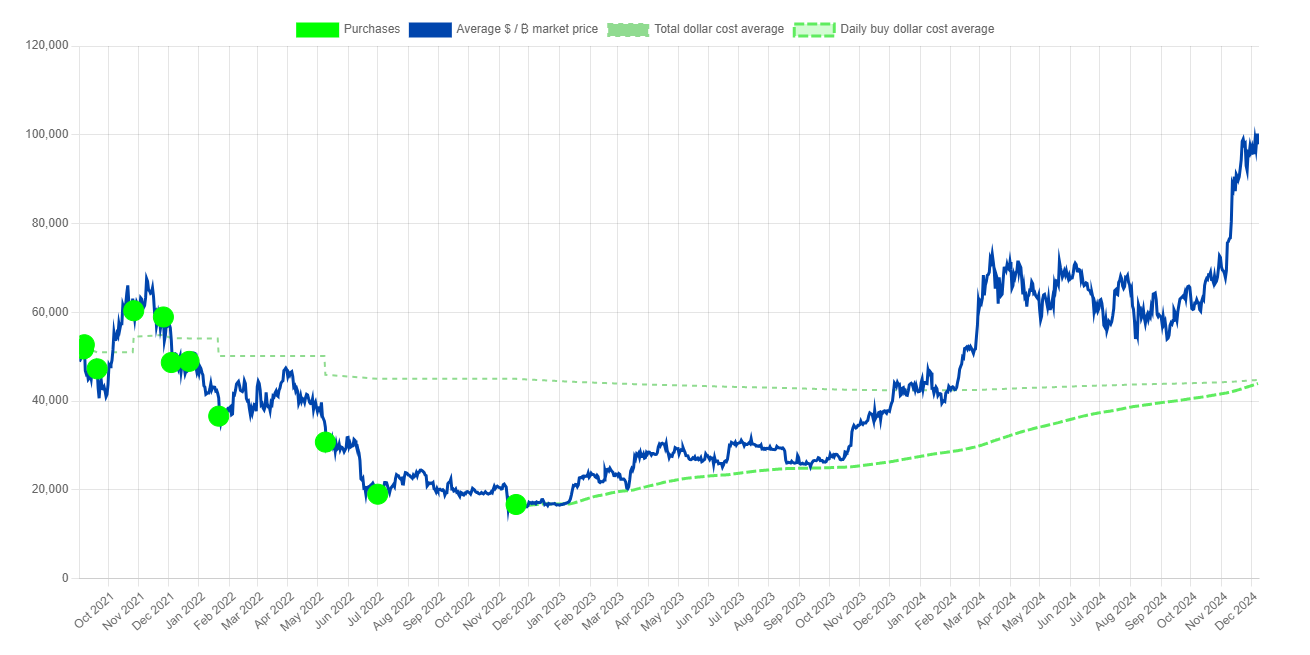

El Salvador’s Bitcoin Purchases Since 2021. Source: Naib Tracker

El Salvador’s Bitcoin Purchases Since 2021. Source: Naib TrackerDespite the IMF’s scrutiny, Bukele’s government has benefited significantly from its Bitcoin investment. Earlier this year, BTC’s all-time high helped the country buy back more debt and boost its economy. El Salvador is also planning to build a Bitcoin city funded by government-issued BTC bonds.

Meanwhile, more countries are following El Salvador’s Bitcoin reserve strategy. As BeInCrypto reported earlier, Bhutan currently holds over $1 billion in BTC, becoming the fifth-largest government holder of the digital asset.

Countries that Own Most Bitcoin. Source: Bitcoin Treasuries

Countries that Own Most Bitcoin. Source: Bitcoin TreasuriesThe US is also likely to establish a national Bitcoin reserve under Donald Trump’s upcoming administration. Just last month, Pennsylvania already proposed a bill to dedicate state funding toward a Bitcoin reserve.

The post El Salvador to Change Bitcoin Payment Law for $1.3 Billion IMF Loan appeared first on BeInCrypto.

3 months ago

30

3 months ago

30

English (US) ·

English (US) ·