ENA, the native token of Ethena—an Ethereum-based synthetic dollar protocol—has been the market’s top loser over the past 24 hours. The altcoin trades at $0.42, plunging over 10% during that period.

The price decline comes as one of the largest ENA stakers unstakes their entire holdings and sends them to crypto exchange Binance.

ENA Whale Triggers Selloff

During the early Asian trading hours on February 11, a major Ethena whale, identified as wallet 0x8f9, unstaked its entire holding of 17.875 million ENA (valued at $8.78 million) and deposited it to Binance.

0x8f9 PNL. Source: Spotonchain

0x8f9 PNL. Source: SpotonchainAccording to on-chain sleuth Spotonchain, this whale had accumulated ENA at an average purchase price of $1.167, mostly during price peaks. With the altcoin currently trading at $0.43, selling at this level would result in a massive loss for the whale.

When whales transfer large amounts of their tokens to exchanges, it signals a potential sell-off, increasing market supply and lowering prices. This can trigger bearish sentiment among traders, leading to heightened volatility and further price declines.

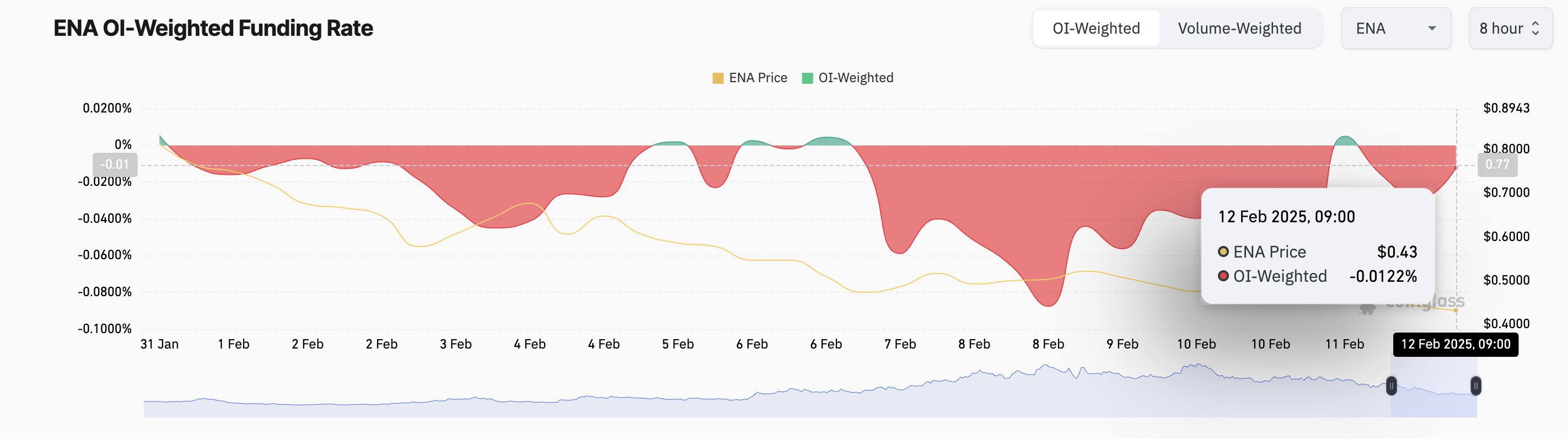

The negative funding rate that currently trails ENA reflects this bearish sentiment. According to Coinglass, this is at -0.012%.

ENA Funding Rate. Source: Coinglass

ENA Funding Rate. Source: CoinglassFunding rates are periodic payments between long and short traders in perpetual futures contracts. It ensures that the asset’s contract price aligns with its spot price.

When an asset’s funding rate turns negative, it indicates that short positions are dominant. It means traders are paying to stay short, which can signal strong bearish sentiment but also increase the risk of a short squeeze if sentiment shifts.

ENA Price Outlook: Will Selling Pressure Push It Lower?

ENA is currently trading at a three-month low of $0.42, facing heightened selling pressure. If whale 0x8f9 offloads its 17.875 million ENA on Binance, the lack of sufficient buy-side demand could drive the price further down, potentially breaking below $0.41 and sliding toward $0.31.

ENA Price Analysis. Source: TradingView

ENA Price Analysis. Source: TradingViewHowever, a surge in overall demand for ENA could absorb the selling pressure, counteracting the whale’s potential exit. In a bullish scenario, increased buying momentum could push the token’s price to $0.51.

The post Ethena Takes a Hit as Whale Moves 18 Million ENA Tokens to Binance appeared first on BeInCrypto.

6 months ago

43

6 months ago

43

English (US) ·

English (US) ·