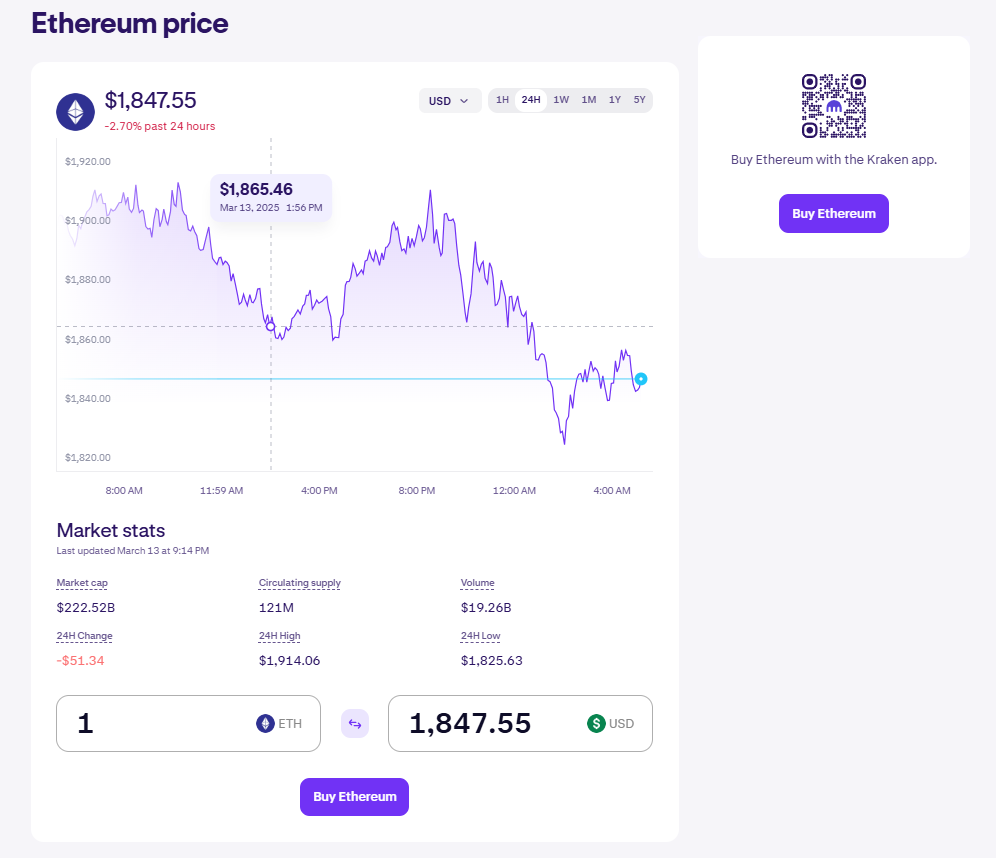

- Ethereum has dropped to $1,758, marking its third straight week in decline and its lowest level since October 2023.

- Spot Ethereum ETFs have lost over $513 million in outflows, while TRON and layer-2 networks are taking market share from ETH.

- Technical indicators signal more downside, with Ethereum potentially falling to $1,500 or even $1,000 if selling pressure continues.

Ethereum’s price has been stuck in the red for three consecutive weeks, sliding to $1,758, its lowest level since October 2023. With over 55% lost since its November peak, investors are stepping back, leaving ETH in a vulnerable position.

JUST IN: Ethereum $ETH is on track to close its worst Q1 ever 🤯

Closing in the red every month, which has NEVER happened before

Down an average 44% in Q1 2025, just 2% off its 2018 Q1 loss of -46% pic.twitter.com/3TTnZnenxt

Why Is Ethereum Falling?

Ethereum’s decline isn’t random—it’s a combination of factors weighing it down:

- Spot Ethereum ETFs are bleeding, with outflows exceeding $513 million in the last three weeks, signaling weak Wall Street demand.

- Ethereum is losing market dominance in key sectors like stablecoin transfers and decentralized exchanges. TRON now leads Tether transactions, while layer-2 solutions like Arbitrum and Base are eating into its market share.

- ETH’s profitability has taken a hit, with just $210 million in revenue this year, lagging behind Uniswap, Solana, Circle, Jito, TRON, and Tether—a stark contrast to its once-dominant position.

On-chain data isn’t looking great either. Santiment reports that daily active Ethereum addresses have plummeted, dropping from 717,000 earlier this year to just 293,000 on March 12. Social volume has also declined, reflecting waning retail interest.

Technical Analysis: More Downside Ahead?

Ethereum’s weekly chart paints a bleak picture:

- ETH broke below the $2,135 support level, confirming a triple-top pattern.

- The 50-week moving average was breached, signaling a strong bearish trend.

- The Relative Strength Index (RSI) is at 33, showing there’s still room for more downside.

- The Awesome Oscillator is below zero, adding to the bearish momentum.

If the current trajectory holds, ETH could target $1,500 next, with a potential 45% plunge to $1,000 if selling pressure accelerates. A move above $2,500 would invalidate this bearish outlook, but for now, the path remains downward.

7 months ago

65

7 months ago

65

English (US) ·

English (US) ·