Ethereum faces immoderate mounting unit amid marketplace volatility and regulatory uncertainty, arsenic cryptocurrency investments brushwood expanding scrutiny successful 2025. The second-largest cryptocurrency by marketplace headdress has entered a play of prolonged terms consolidation, drafting immoderate stark parallels to XRP’s erstwhile regulatory challenges. This improvement has sparked immoderate concerns astir imaginable information risks and broader implications for the integer plus market.

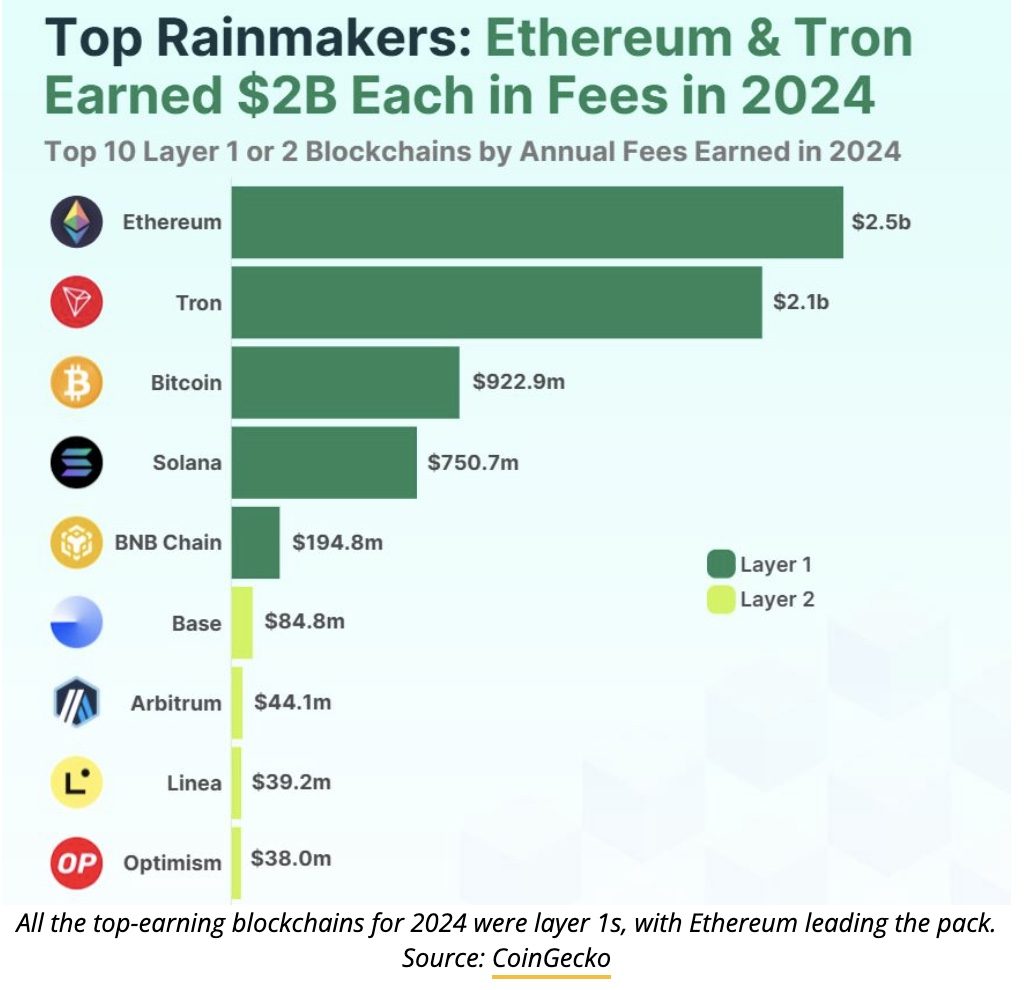

Source: CoinGecko

Source: CoinGeckoAlso Read: CME Set to Launch XRP and SOL Futures successful February – Major Market Shift Incoming

Ethereum’s Legal Troubles, Market Volatility, Security Risks & Regulatory Uncertainty Explained

Source: Unsplash

Source: UnsplashPrice Stagnation Sparks Market Concerns

$ETH seems to beryllium getting the $XRP attraction present with hatred being thrown astatine it from each absorption due to the fact that terms has been going sideways for a twelvemonth

Fascinating to see…

Dw $ETH loyalists, erstwhile fig goes up the hatred volition mysteriously vanish

A staggering fig of analysts present way Ethereum’s trading scope astatine $3,303.64, with countless terms swings betwixt $3,228.32 and $3,350.92. Cryptocurrency expert CrediBULL Crypto observes:

“$ETH seems to beryllium getting the $XRP attraction present with hatred being thrown astatine it from each absorption due to the fact that terms has been going sideways for a year… Dw $ETH loyalists, erstwhile fig goes up the hatred volition mysteriously vanish.”

Quite a fewer marketplace volatility indicators overgarment a concerning representation astir Ethereum’s cardinal worth proposition.

Regulatory Environment Intensifies

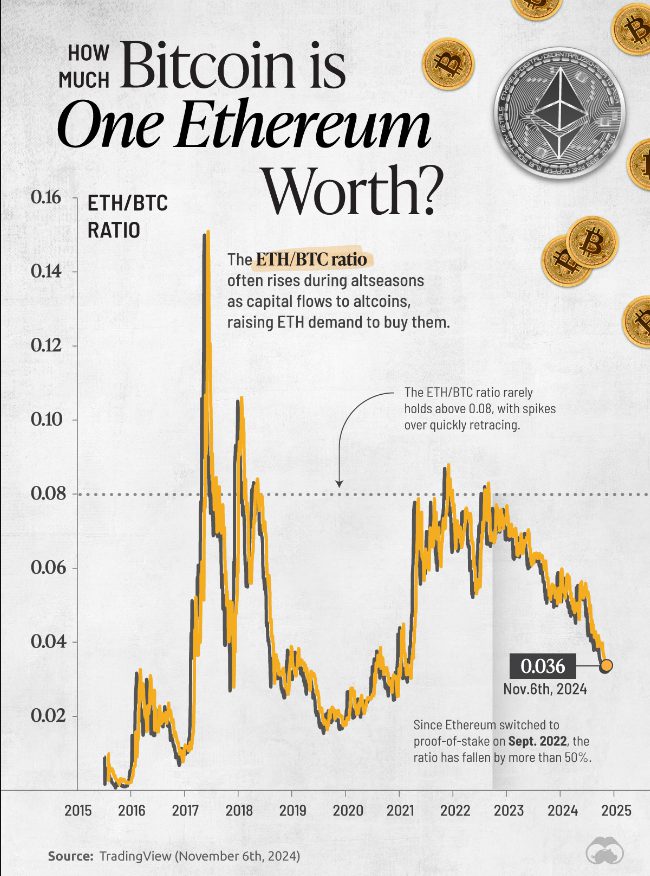

An overwhelming fig of information risks surrounding Ethereum person grabbed the attraction of countless regulatory bodies examining cryptocurrency classifications. Dozens of experts stress that Ethereum’s modulation to proof-of-stake has reduced vigor depletion by astir 99%, yet a sizeable magnitude of regulatory uncertainty looms regarding its status. Numerous analysts gully striking parallels with regulatory challenges antecedently faced by XRP.

Also Read: Binance’s BNB Predicted To Breach $1000: Here’s When

Market Sentiment and Trading Patterns

Source: VisualCapitalist

Source: VisualCapitalistCountless trading patterns constituent to persistent marketplace volatility for Ethereum, arsenic a flood of investors measure imaginable regulatory actions. Scores of organization players admit the cryptocurrency’s expanding relation successful decentralized finance, though an array of information risks stay nether the microscope.

Technical Development and Network Growth

A important fig of method indicators uncover Ethereum’s instauration maintaining stableness amid marketplace turbulence. The level present processes thousands upon thousands of astute contracts daily, with galore measures addressing regulatory uncertainty done enhanced compliance. A important fig of scalability concerns persist arsenic web usage grows, contributing to wide marketplace volatility.

Also Read: Dogecoin Drops 6% After Logo Removal and Ramawsami Exits D.O.G.E.

Investment Landscape Evolution

Recent marketplace conditions for Ethereum reflector an astounding fig of erstwhile cycles, with dozens of consolidation periods preceding melodramatic terms movements. A singular surge successful trading volumes demonstrates unprecedented spot astatine cardinal terms levels, portion hundreds of organization interests stay steadfast contempt mounting regulatory headwinds. An bonzer postulation of level responses to information risks, including astir 30 large method upgrades, has fundamentally transformed its presumption successful the cryptocurrency concern landscape, attracting attraction from countless marketplace participants.

9 months ago

90

9 months ago

90

English (US) ·

English (US) ·