Ethereum (ETH) hit a new yearly low of $2,076 earlier today, further weakening sentiment around the second-largest cryptocurrency by market cap. If Ethereum falls below $2,000, it could trigger additional losses for investors.

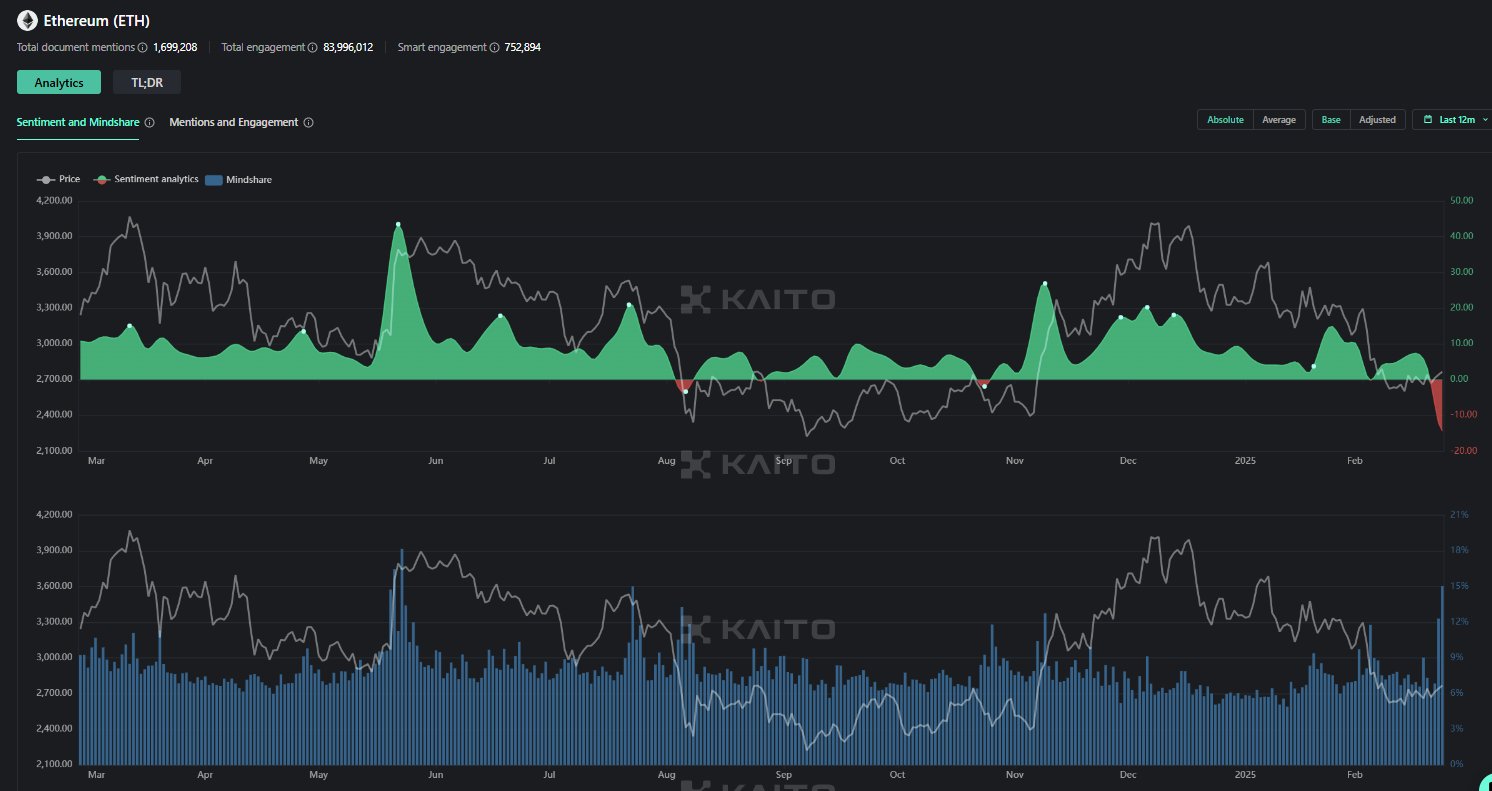

Ethereum Sentiment At A 12-Month Low

According to data from CoinGecko, Ethereum has dropped roughly 28% over the past 30 days and is currently trading around the $2,200 level. The cryptocurrency has shed more than $230 billion in market capitalization since December 2024.

Crypto investment manager 0xLouisT took to X to share a chart indicating that sentiment around Ethereum is at its lowest point in a year. A drop below $2,000 could intensify bearish sentiment, putting further pressure on ETH.

Similarly, Bitcoin (BTC) trader and investor Jason Pizzino remarked that ETH could be “in more trouble than expected” if it closes below the $2,000 to $2,100 range. He added:

Remember, February was when most influencers were beating the drum for $ETH and told us to “follow the money” because Trump et al., were buying millions of dollars. That always sounds fishy to me.

A close below $2,000 would complete a bearish double-top pattern on the monthly chart, potentially sending ETH into the low $1,000 range. For context, the last time Ethereum traded in the $1,500 range was in October 2023.

Fellow crypto analyst Morin highlighted ETH’s weekly demand level between $1,900 and $2,100, with the weekly supply zone positioned around $2,600. The analyst expects the digital asset to fluctuate within this range “in the near future.”

Some Positive Signs For ETH

While the short-term outlook for ETH appears uncertain, some indicators suggest that investors have not completely lost confidence in the asset. For instance, using on-chain data, crypto analyst Ali Martinez emphasized that large holders – also known as crypto whales – have bought more than 110,000 ETH in the last 72 hours.

Similarly, Leon Waidmann, Head of Research at Onchain Foundation, pointed out that despite ETH’s price decline, exchange reserves continue to drop. Waidmann noted that falling exchange reserves indicate investor confidence, as fewer ETH tokens are being moved to exchanges for potential selling.

However, concerns remain for Ethereum, particularly as the network’s staking percentage has seen a sharp decline from its peak in November 2024. On the other hand, crypto analyst Ted Pillows remains bullish, predicting that ETH is still on track to surpass $10,000. At press time, ETH is trading at $2,222, down 3.6% in the past 24 hours.

7 months ago

64

7 months ago

64

English (US) ·

English (US) ·