- Ethereum kept its dominance in DeFi despite a $27B TVL drop.

- ETH ETFs brought in over $12B through 2025, supporting long-term demand.

- The Fusaka upgrade aims to boost mainnet performance and reduce reliance on L2s.

With just one month left before 2025 wraps up, Ethereum’s year has been… well, a rollercoaster. Not only did ETH grab attention for its price moves, but the network itself hit several major milestones across adoption, performance, and long-term growth.

Despite the ups and downs, Ethereum stayed dominant in core areas like DeFi. Even after shedding over $27 billion in Total Value Locked (TVL) from its November peak, it still held the No. 1 spot — a sign investors haven’t quite abandoned the network’s fundamentals.

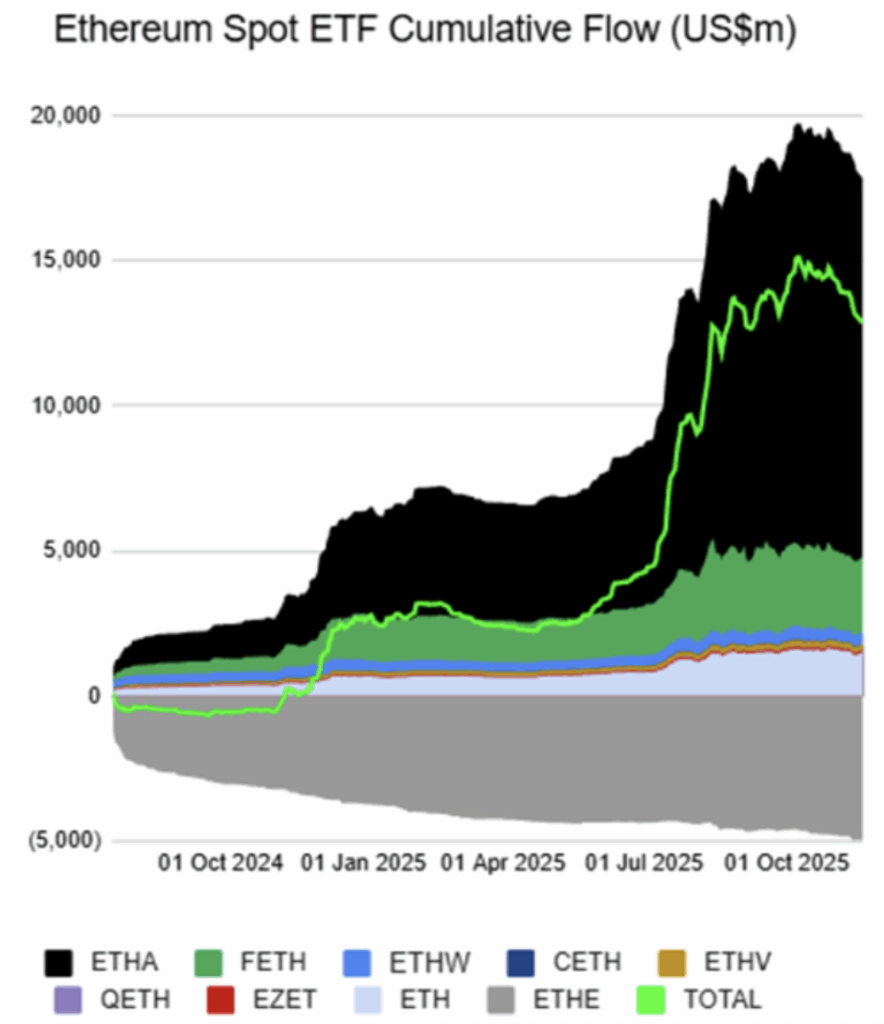

Strong TVL also shows confidence from heavy hitters. And they absolutely showed up: between April and October 2025, Ethereum ETFs recorded more than $12 billion in total inflows. Even with recent pullbacks hitting ETF allocations, issuers continue holding a massive amount of ETH, cushioning downside moves.

Why some investors are still uneasy about ETH demand

Even with all the positive data, concerns continue to linger — mainly around Ethereum’s own Layer-2 ecosystem. Many investors argue that the value generated by Ethereum’s network does not automatically translate into demand for ETH itself.

Layer-2s like Arbitrum, zkSync, Base, and Optimism processed huge volumes over the past two years. And while they help the mainnet by lowering congestion and fees, that activity doesn’t always show up as ETH buying pressure. Some believe these networks fragment demand — siphoning transactions that would’ve boosted ETH’s value more directly.

Still, the mainnet handles an enormous chunk of the entire Web3 space. And despite L2 fragmentation, Ethereum ETFs have consistently reinforced ETH’s liquidity and long-term investor demand. Institutional buyers clearly aren’t worried about layer-2 “competition.”

The Fusaka upgrade could be a turning point

Developer activity on Ethereum has stayed among the highest in the industry over the last 12 months — and much of it has been funneling into a major update: the Fusaka upgrade, scheduled for 3 December.

This upgrade is expected to address some of the concerns that have been hanging over the network. Early details show:

- More transactions per block, with gas limits moving toward 60 million

- Validators no longer needing to download full blob data, but instead sampling pieces

- Higher mainnet efficiency, reducing network strain

- Lower operational costs, improving the economic structure for validators and DeFi apps

Put simply: Ethereum becomes more efficient, cheaper, and a lot more scalable — without leaning so heavily on layer-2 networks.

If Fusaka works as intended, organic mainnet activity could grow again, which means actual demand for ETH — not just L2 gas tokens — could rise. Increased activity generally leads to stronger confidence, and stronger confidence tends to fuel price momentum.

What this could mean for ETH in 2026

2025 may have been chaotic, but it revealed two incredibly important themes:

- Institutional demand for Ethereum is real and persistent.

- Ethereum’s network remains one of the most actively developed ecosystems in crypto.

These form a foundation heading into 2026 that many investors consider extremely strong. If demand continues — particularly from ETFs and L2 migration patterns — analysts say ETH could push above $5,000 in the coming months.

Not guaranteed, of course. But with a major upgrade ahead, rising adoption, and resilience through a tough year… Ethereum enters 2026 with more momentum than many expected. Here is where things could turn interesting again.

The post Ethereum Heads Into 2026 With New Momentum — Here Is Why Investors Expect a Bigger Shift After the Fusaka Upgrade first appeared on BlockNews.

3 weeks ago

35

3 weeks ago

35

English (US) ·

English (US) ·