- Ethereum is down over 45% in 2025, nearing a fresh yearly low of $1,759.

- The Petra upgrade launches April 30, offering a possible catalyst for a short-term bounce.

- Despite potential for a brief rally, ETH’s long-term trend remains bearish.

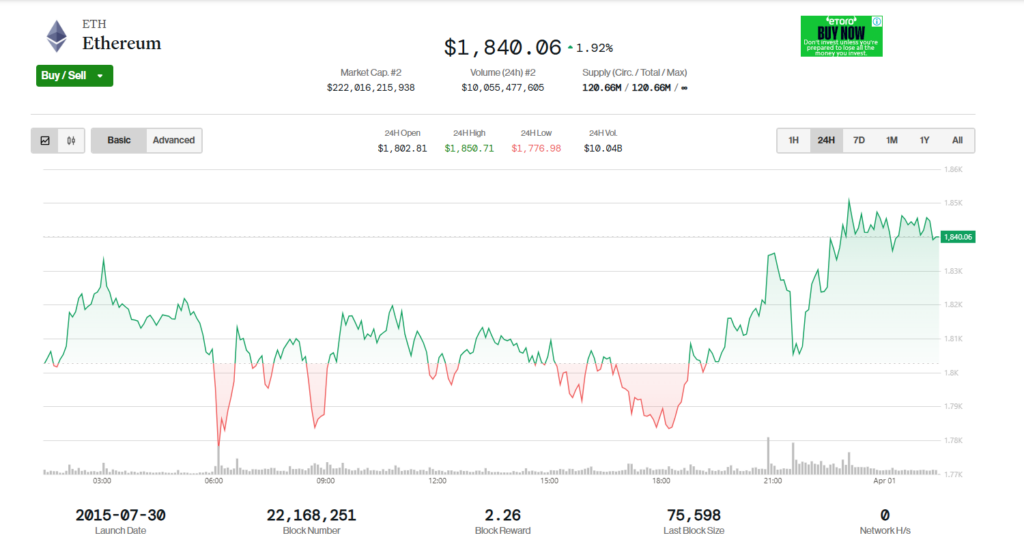

Ethereum’s not having the best 2025 so far. It’s dropped over 45% since January and just hit a new yearly low at $1,759. There was a short-lived rally that kicked off around March 11—pushed ETH over $2,000 for a hot second—but it fizzled fast. The bounce didn’t hold, and price slid again, almost breaking that new low.

So yeah… not exactly the kind of chart you frame on your wall.

But Hey, There’s Some Good News

Despite the price action being, well, kind of a disaster, there’s still something to look forward to. Petra—Ethereum’s next major network upgrade—has officially launched on the Hoodi testnet, and it’s scheduled to go live on April 30.

People in the Ethereum community are watching it closely. Upgrades tend to bring attention, sometimes even a price push. The question is: will Petra give ETH a reason to rally—or is it just another headline in a bearish market?

What the Charts Are Saying

Ethereum had been in a downtrend for, like, 85 days straight. That rally in mid-March? It lasted 13 days and took ETH up to $2,104. But it stayed inside an ascending parallel channel, which basically screams “correction” rather than “real recovery.”

And sure enough, on March 28, ETH dropped out of that channel and hit $1,769—just $10 above its lowest point this year. It didn’t even manage a bounce from the key 0.618 Fibonacci retracement level, which usually offers at least a bit of support.

Not a great look.

Also—yeah, the RSI is oversold, but it’s still dropping. No bullish divergence, no signal to jump in yet.

If ETH breaks below $1,759, the next major support isn’t close. We’re talking $1,547—which lines up with the 1.61 external Fib retracement. And that, honestly, could hit fast if momentum keeps diving.

A Short-Term Bounce? Maybe

Zooming in on the 2-hour chart, ETH is in the middle of a five-wave decline that started on March 23. If you’re into wave theory, this is probably the fifth and final leg down—possibly forming an ending diagonal (which usually means a bounce is coming).

There’s a bit of hope here. The MACD and RSI on the short-term charts are showing bullish divergence, and ETH’s price is sitting inside a descending wedge—a classic breakout setup.

So, yeah… maybe a small relief rally is brewing. If that plays out, ETH could climb back up to the $1,900–$1,938 range (that’s the 0.382–0.5 Fib resistance area). But don’t get too comfy—this would probably just be a bounce, not a trend reversal.

Long-Term Picture? Still Bearish

Let’s not sugarcoat it—ETH might rally a little, but the long-term trend is still pointing down.

The March rally was short-lived, and the drop last week almost sent ETH crashing through its yearly low. Petra could stir up some optimism, sure. But unless it triggers serious buying momentum, Ethereum’s likely heading for another leg down.

So yeah—enjoy the bounce if it happens. Just don’t mistake it for the beginning of a bull run. Not yet.

1 day ago

18

1 day ago

18

English (US) ·

English (US) ·