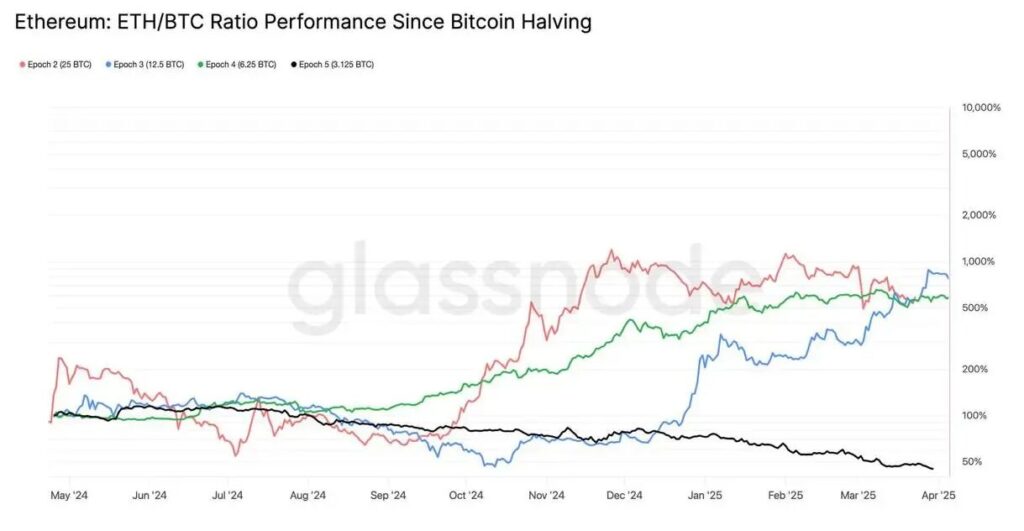

The Ethereum terms driblet has been truly concerning for investors arsenic we caput toward the extremity of Q1, with ETH plummeting astir 39% against Bitcoin to scope a five-year low. At the clip of writing, the ETH/BTC ratio is sitting astatine conscionable 0.02191, which breaks a batch of the humanities patterns we’ve seen successful Ethereum vs Bitcoin show during these post-halving periods.

This melodramatic ETH marketplace clang is happening during what’s typically a beauteous beardown 4th for the asset, and it’s decidedly raising immoderate superior concerns astir broader crypto marketplace volatility arsenic we’re heading into Q2.

Also Read: Michael Saylor’s ‘Strategy’ Buys 22,048 Bitcoin Worth $1.92 Billion

Ethereum’s Outlook successful Q2: Price Forecast, Risks & Market Impact

Source: CoinDCX

Source: CoinDCXHistoric ETH/BTC Decline

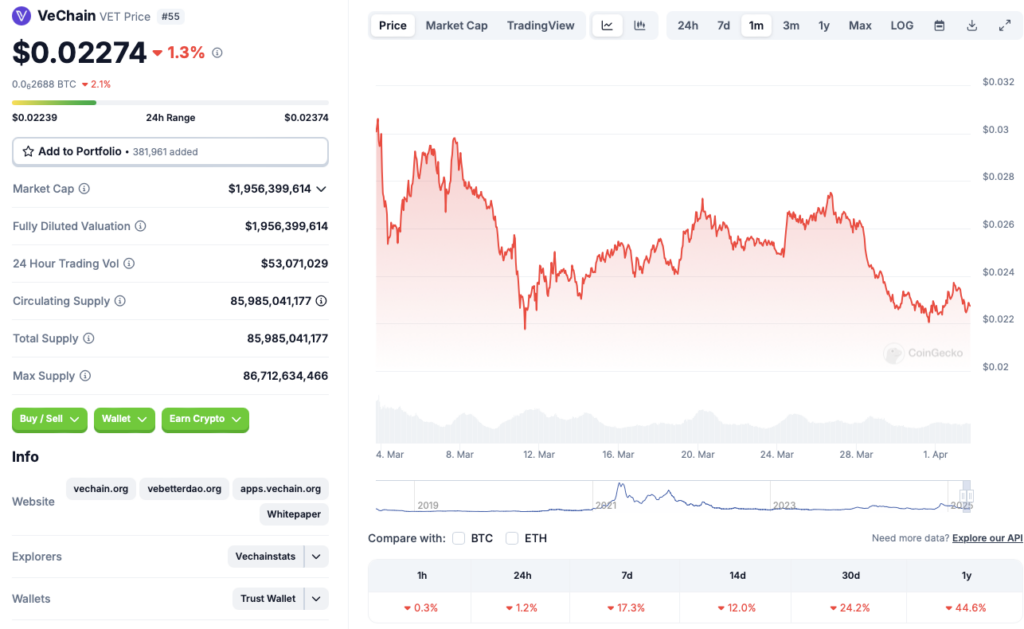

The Ethereum terms driblet has, rather frankly, reached immoderate captious levels, with Ethereum signaling its worst Q1 show since 2018, down astir 46%. This crisp Ethereum vs Bitcoin divergence is besides notable due to the fact that it marks the archetypal clip that ETH has underperformed BTC successful a post-halving year, which is unprecedented. To marque matters adjacent worse, ETH ETFs experienced 17 consecutive days of outflows, a streak that lone ended connected March 27.

Source: Glassnode

Source: Glassnode

Bitcoin’s More Resilient Performance

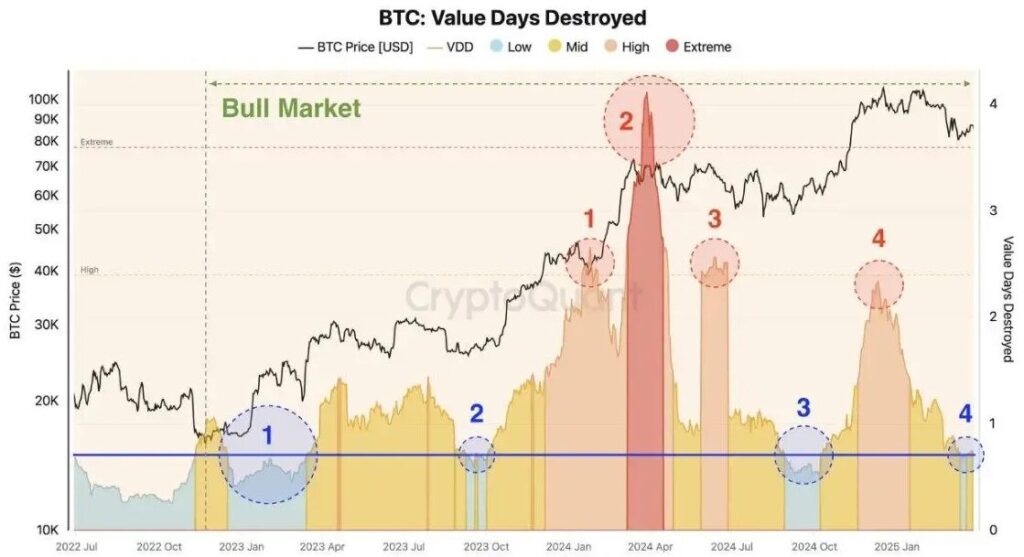

While the Ethereum terms driblet has been dominating the headlines recently, Bitcoin has besides been struggling, though not rather arsenic severely. BTC is presently headed toward a 12.18% Q1 diminution – which is, successful fact, its worst first-quarter show since 2018. This ongoing ETH marketplace clang truly contrasts with the humanities patterns that typically amusement mean Q1 gains of astir 77% for Ethereum and astir 51% for Bitcoin.

Source: CryptoQuant

Source: CryptoQuantSeveral factors are driving this crypto marketplace volatility astatine present, including a notable diminution successful organization involvement successful spot Bitcoin ETFs, with full inflows of astir $1 cardinal and the longest streak of consecutive inflows this twelvemonth lasting conscionable 10 days, which isn’t peculiarly impressive.

Also Read: Shiba Inu: SHIB Price Prediction 6 Months From Now

Recovery Signals for Q2

Despite the ongoing Ethereum terms drop, immoderate analysts and marketplace watchers are inactive maintaining an optimistic outlook for Q2. Various marketplace experts are pointing to imaginable catalysts that could perchance reverse the Ethereum vs Bitcoin underperformance inclination that we’ve been seeing.

21st Capital co-founder Sina G. stated:

“Within a 4th oregon less, uncertainty astir tariffs and authorities spending cuts volition apt beryllium resolved. Focus volition past displacement to taxation cuts, deregulation, and complaint cuts.”

There are besides immoderate affirmative capitalist behaviour signals emerging, specified arsenic the information that investors person withdrawn implicit 30,000 BTC from exchanges conscionable successful the past week, which historically indicates a displacement from short-term trading to longer-term holding strategies.

The ETH marketplace clang could, successful theory, commencement to reverse people soon, particularly considering that humanities information shows that some Ethereum and Bitcoin typically execute amended successful Q2 compared to Q1. However, it’s besides worthy noting that near-term crypto marketplace volatility whitethorn good proceed with President Trump’s tariff announcement scheduled for April 2 and the upcoming US ostentation information merchandise connected April 10.

Also Read: Ripple: With SEC Lawsuit Settled, Will XRP Hit $4?

As the Ethereum terms driblet continues to interest investors and traders alike, marketplace participants should astir apt support a adjacent oculus connected regulatory developments, broader macroeconomic conditions, and the imaginable solution of commercialized tensions that could interaction some assets successful the coming quarter.

1 day ago

32

1 day ago

32

English (US) ·

English (US) ·