Ethereum is currently attempting to recover after months of bearish pressure, but key resistance levels and liquidation dynamics suggest caution is still warranted.

Technical Analysis

The Daily Chart

On the daily chart, ETH has managed to bounce from the $1,900 support zone and is now pushing toward the $2,200 resistance area. However, the asset remains well below the 200-day moving average, which is around $2,900, which continues to act as a major hurdle.

The RSI is gradually climbing but still hasn’t entered overbought territory. Unless ETH decisively breaks above $2,400 and holds, the downtrend structure remains intact, with the $1,900 and $1,600 levels acting as key supports to watch.

The 4-Hour Chart

The 4-hour chart shows Ethereum forming an ascending channel, recently pushing towards the upper boundary near $2,150. This rally from the $1,900 support zone has been strong, but the asset is approaching a confluence of resistance levels, including the $2,200 zone marked by previous breakdowns.

RSI has also entered the overbought region, hinting at possible exhaustion. A breakout above $2,200 could shift the short-term bias bullish, while rejection from the current range could pull ETH back toward the $1,900 zone.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

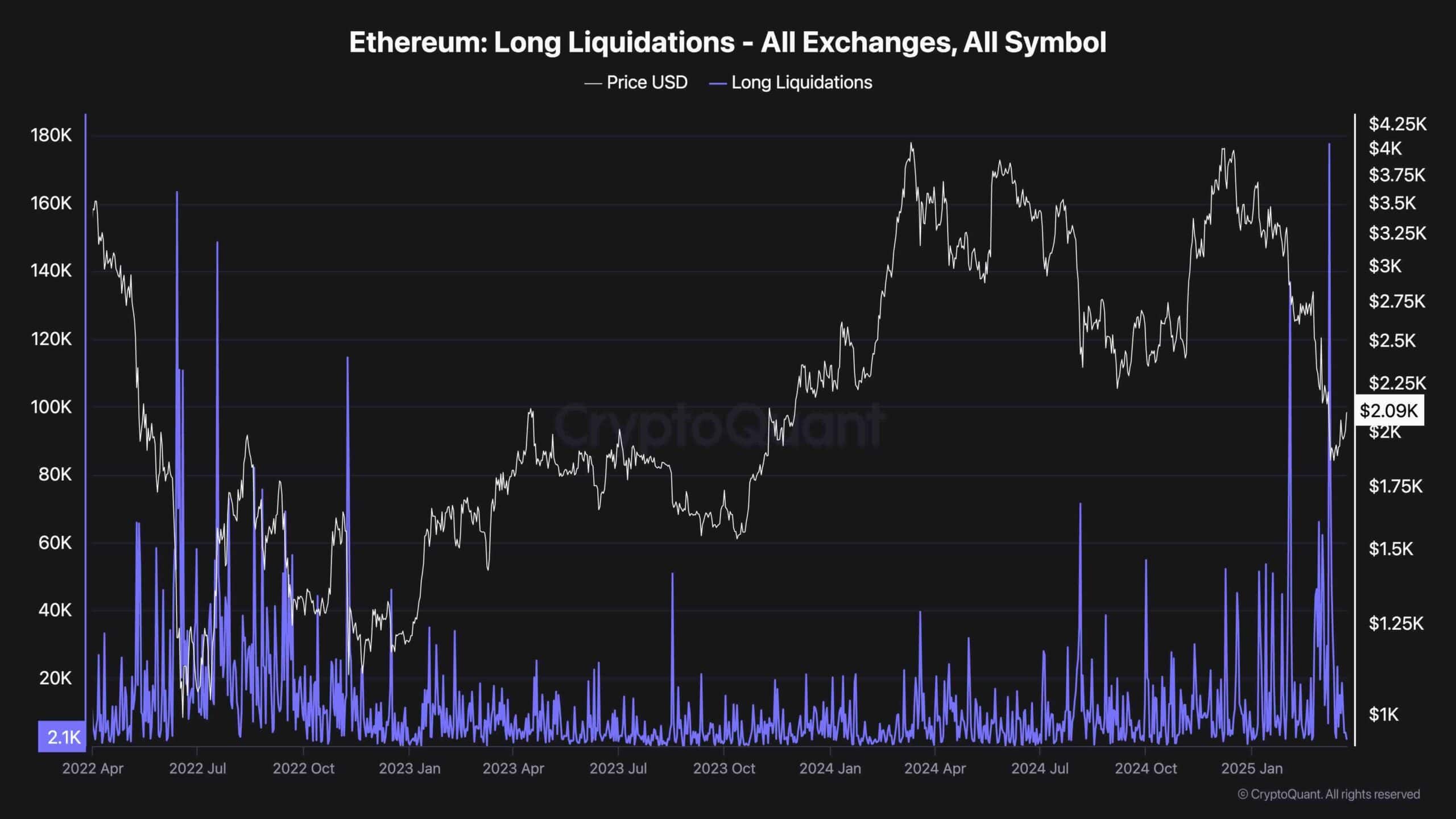

Long Liquidations

The long liquidations chart reveals a sharp spike in recent months, particularly during ETH’s drop below $2,000. These mass liquidations wiped out leveraged long positions, contributing to heightened volatility. Although liquidation events have now cooled down, the market remains vulnerable to sharp moves if leverage builds up again.

The previous spikes indicate a fragile sentiment among speculators, and any sharp rejection at resistance zones could trigger another cascade of long liquidations, reinforcing bearish pressure. Overall, price stability and a sustainable recovery will require a reduction in excessive leverage and stronger spot-driven demand.

The post Ethereum Price Analysis: What’s Ahead for ETH After Reclaiming $2K? appeared first on CryptoPotato.

1 day ago

13

1 day ago

13

English (US) ·

English (US) ·