Ethereum, the second-largest cryptocurrency, recently failed to breach $3,524, triggering a sharp price drop. Since then, recovery efforts have remained weak as volatility persists.

However, the current conditions suggest Ethereum may be preparing for a comeback as the market stabilizes.

Ethereum Has Room For Recovery

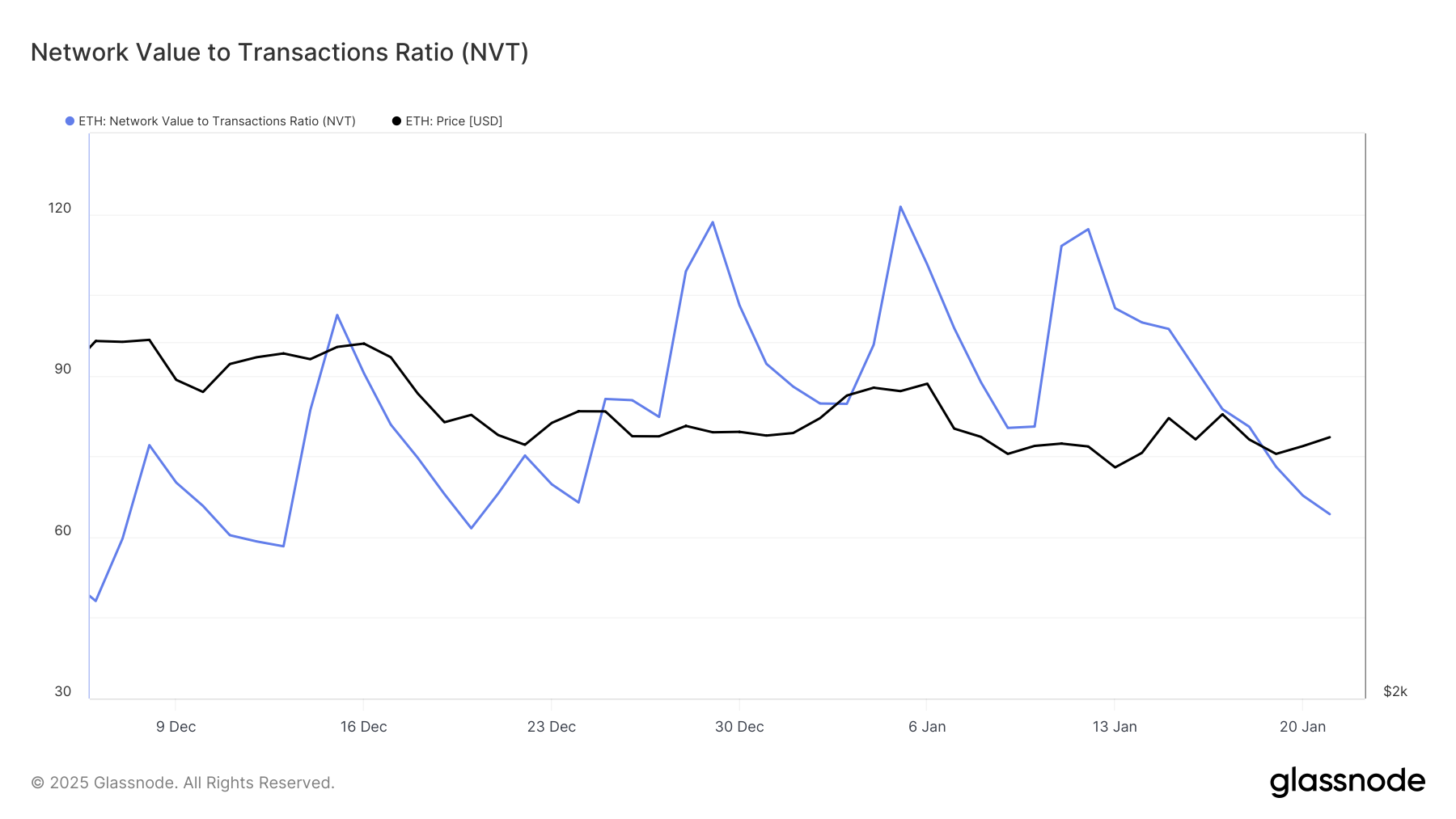

Ethereum’s Network Value to Transaction (NVT) Ratio is experiencing a decline, recently hitting a monthly low. A low NVT indicates that transaction activity is balanced with network value, reflecting reduced volatility. This creates an environment conducive to price recovery, something Ethereum urgently needs to regain its footing.

With the NVT ratio signaling healthy network activity, Ethereum is positioned to stabilize in the short term. Declining volatility often fosters investor confidence, making it more likely for the cryptocurrency to see renewed buying interest. As speculative activity wanes, Ethereum has an opportunity to chart a path toward meaningful recovery.

Ethereum NVT Ratio. Source: Glassnode

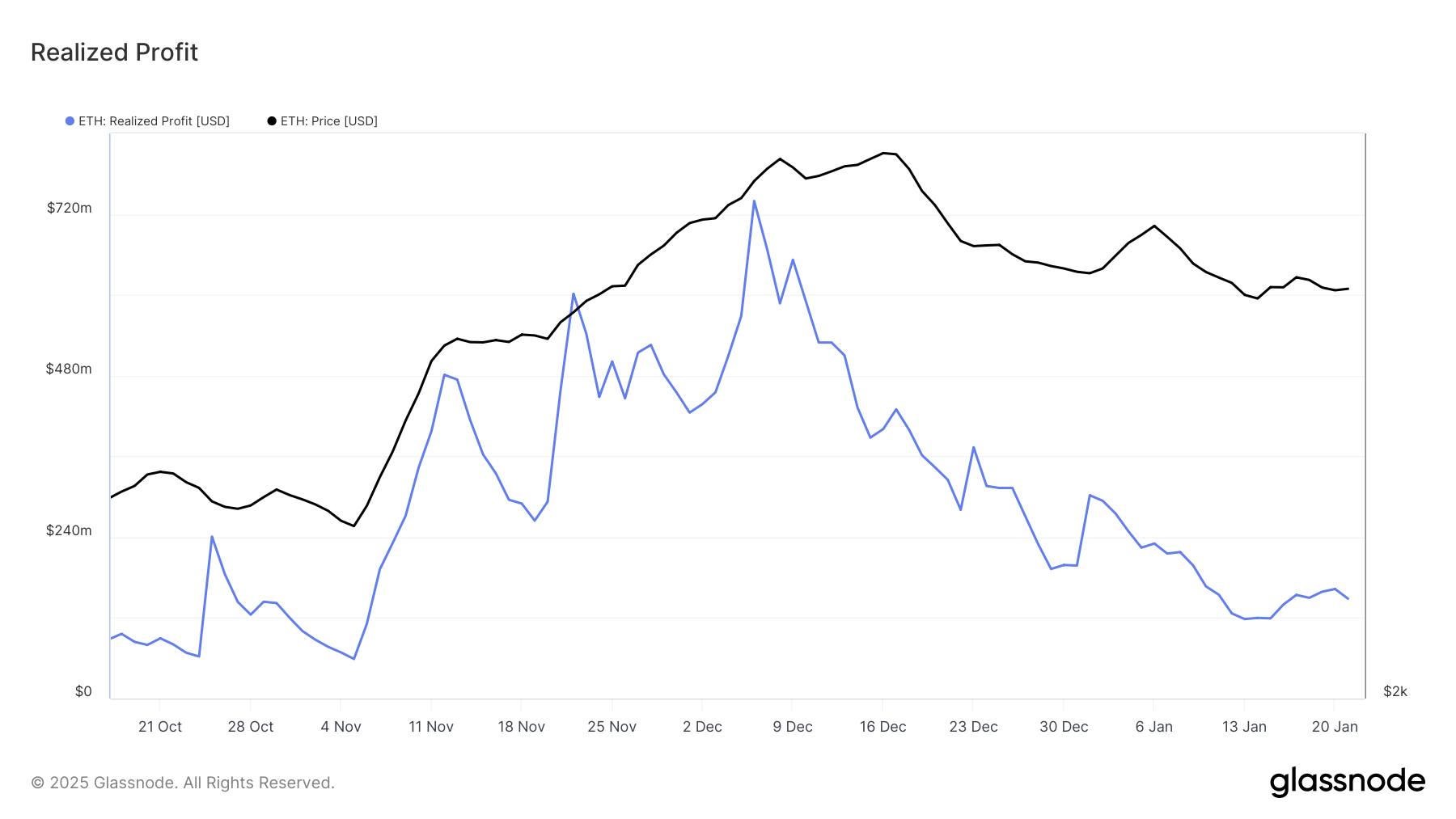

Ethereum NVT Ratio. Source: GlassnodeEthereum’s realized profits recently dropped to a six-week low, pointing to a significant reduction in selling pressure from investors. This trend highlights the market’s shifting sentiment, with fewer participants looking to offload their holdings. Such conditions could provide Ethereum with the breathing room required to capitalize on broader bullish cues.

The lack of an uptick in realized profits suggests that the selling lull may persist, allowing Ethereum to focus on building upward momentum. With investors holding onto their coins, market conditions are primed for a gradual recovery, provided external factors remain favorable.

Ethereum Realized Profits. Source: Glassnode

Ethereum Realized Profits. Source: GlassnodeETH Price Prediction: Breaking The Barrier

Ethereum is currently trading near $3,300, just below the critical resistance level of $3,327. Flipping this into support is essential for ETH to initiate a rally toward $3,524, representing a 6% increase from current levels. This move would mark a partial recovery from recent losses.

Breaking through the $3,524 resistance is crucial for Ethereum’s recovery. Achieving this would erase the recent downturn and also position the altcoin for further gains, potentially targeting $3,711. Such a move would underscore Ethereum’s resilience and align with the broader market’s bullish sentiment.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingViewHowever, failing to establish $3,327 as a support level could stall Ethereum’s recovery. This scenario would leave the cryptocurrency vulnerable to a retracement toward $3,200, undermining recent progress and potentially delaying its path to $3,500.

The post Ethereum Price Eyes Recovery: Market Stabilizes with Decreased Selling Pressure appeared first on BeInCrypto.

9 months ago

52

9 months ago

52

English (US) ·

English (US) ·