Leading altcoin Ethereum has defied the overall market trend, witnessing a 2% drop in price over the past 24 hours. This comes amid the persistent decline in the demand for the coin.

As buying pressure wanes, ETH risks falling below $3000 soon. This analysis has the details.

Ethereum’s Demand Loses Steam

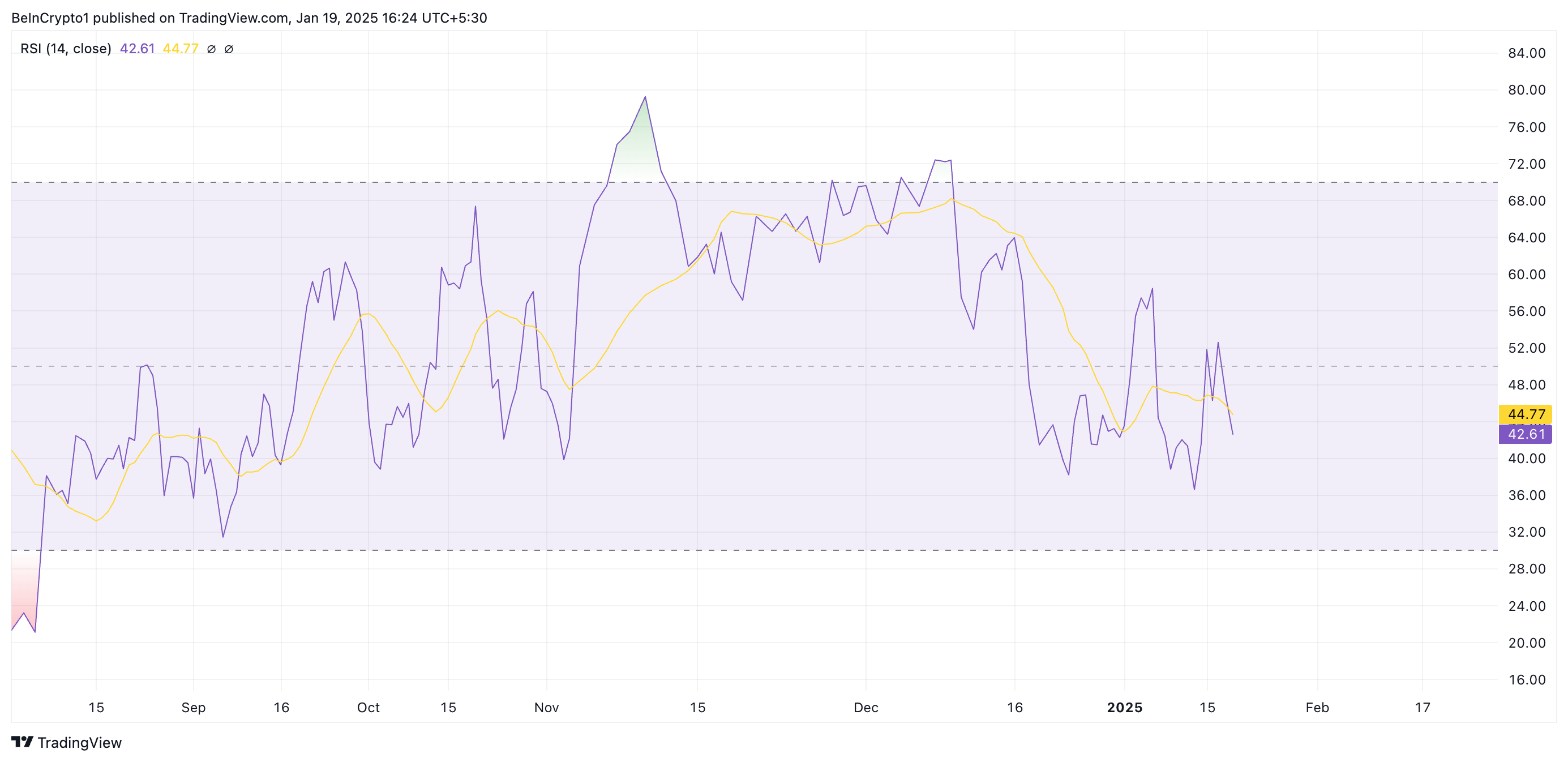

An assessment of ETH’s momentum indicators on the ETH/USD one-day chart reveals the altcoin’s waning demand. For example, its Relative Strength Index (RSI) is in a downward trend and below the 50 neutral line. As of this writing, its value is 42.61.

An asset’s RSI measures its overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought, while values below 30 suggest it is oversold.

Ethereum RSI. Source: TradingView

Ethereum RSI. Source: TradingViewETH’s RSI setup signals weakening momentum and suggests that the asset may be losing buying interest, potentially leading to further price declines.

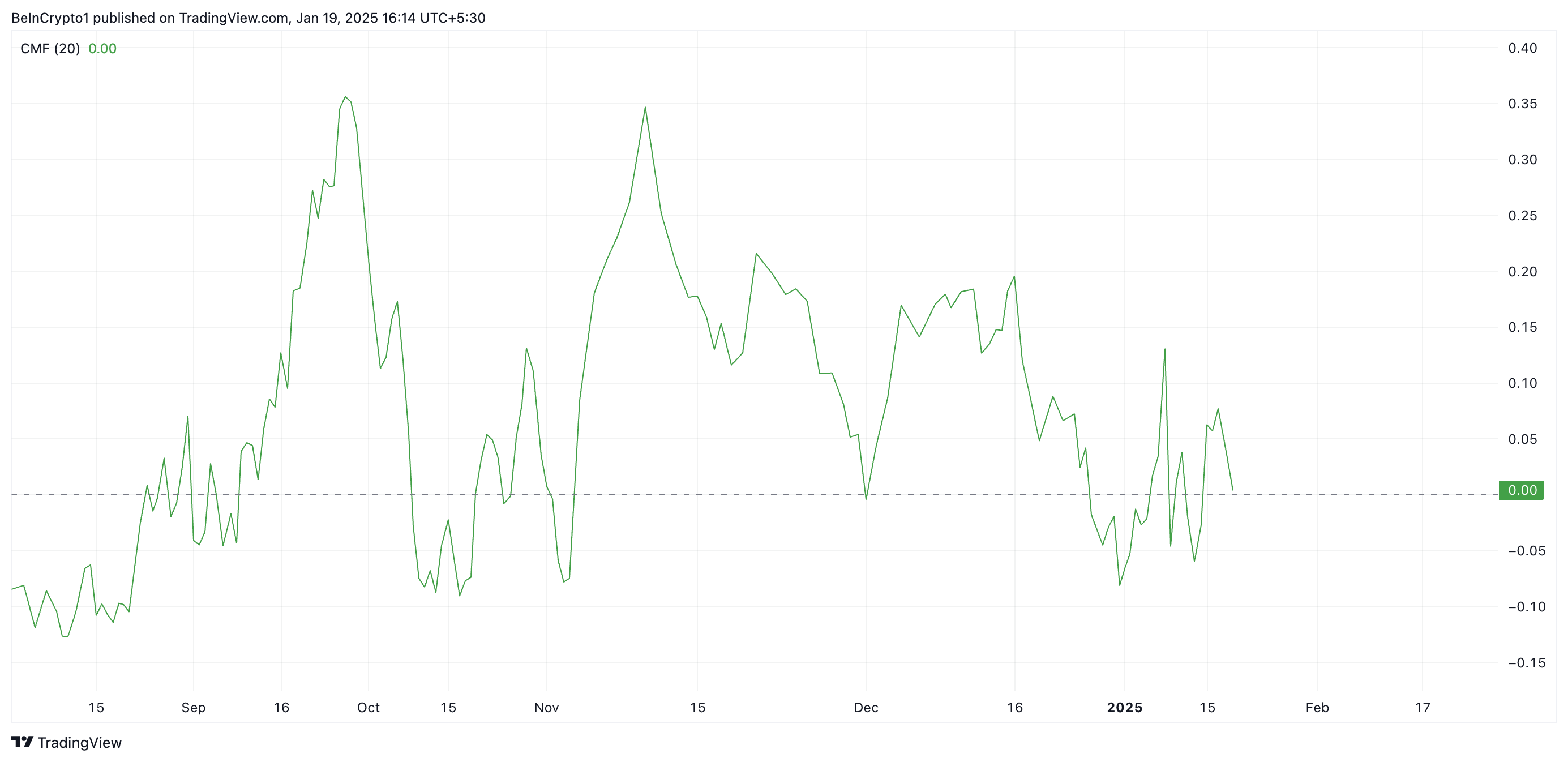

Moreover, as of this writing, the coin’s Chaikin Money Flow (CMF) is poised to fall below the zero line, confirming the weakening demand for ETH.

Ethereum CMF. Source: TradingView

Ethereum CMF. Source: TradingViewThe CMF indicator measures the amount of money flowing into or out of an asset over a specific period. When the CMF is about to fall below the zero line, selling pressure is increasing, indicating potential bearish momentum and a possible price decline.

ETH Price Prediction: Drop to $2,811 or Rally to $3,476?

At press time, ETH trades at $3,175, below the resistance formed at $3,249. With weakening buying pressure, the coin’s price could fall below $3,000 to trade at $2,811 in the near term.

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingViewHowever, if market sentiments improve, it could push ETH’s price above $3,249 toward $3,476.

The post Ethereum’s Dropping Demand Could Send It Under $3,000 appeared first on BeInCrypto.

9 months ago

69

9 months ago

69

English (US) ·

English (US) ·