thereum’s (ETH) price remains stuck below a key resistance level that could open the door for a push toward $3,000.

However, hesitant investor sentiment is stalling the recovery, preventing ETH from gaining the momentum needed to break out.

Ethereum Investors Stand Unsure

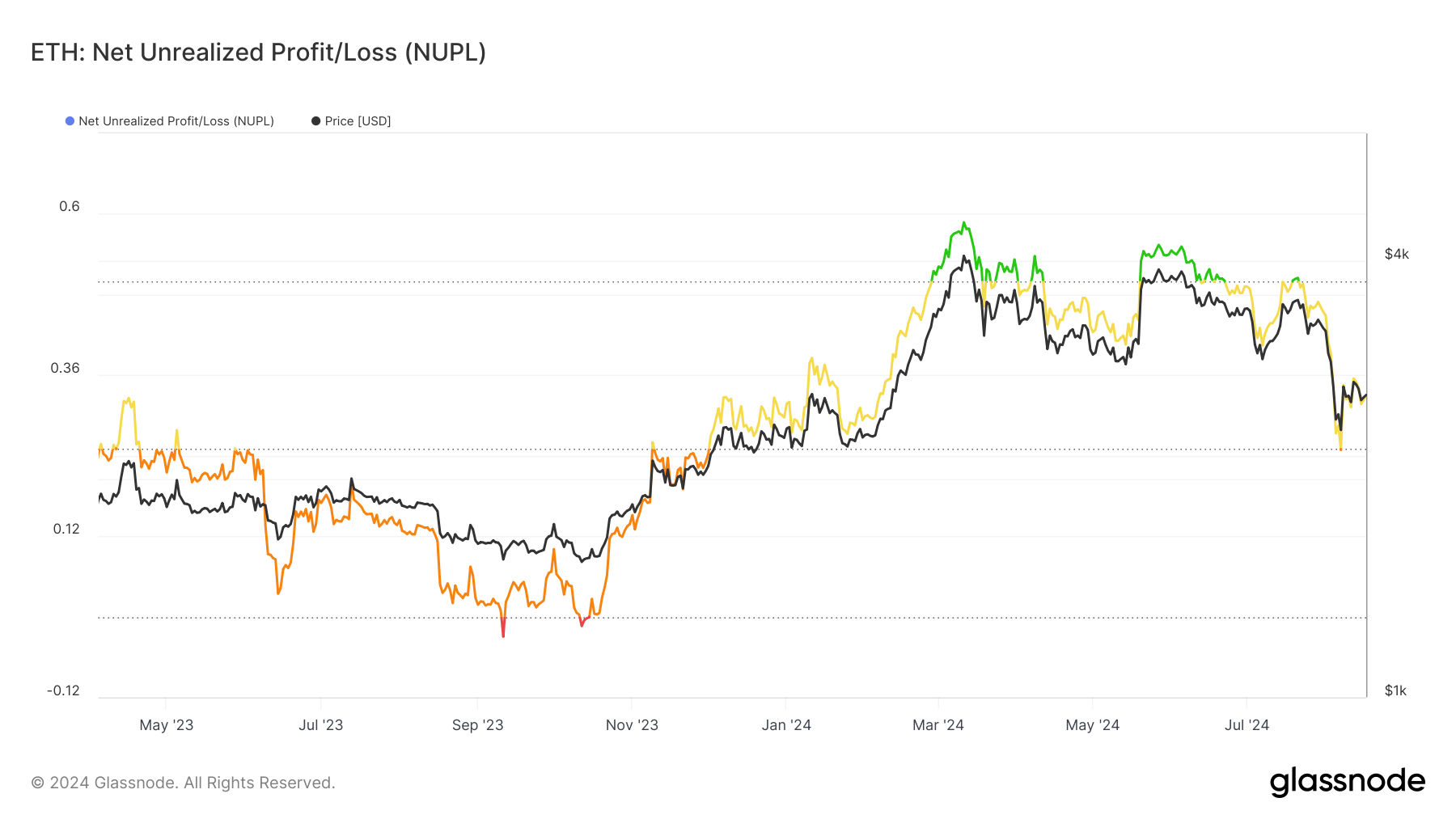

Ethereum’s price could continue its sideways movement or slow recovery owing to the uncertainty among investors. The Net Unrealized Profit/Loss (NUPL) indicator recently came close to slipping into the Fear zone, which reflects a significant decline in investor optimism.

The near-dip into the Fear zone signals rising caution among market participants, who are increasingly concerned about a potential price reversal. The NUPL (Net Unrealized Profit/Loss) indicator, which measures investor sentiment, shows a shift toward the Fear zone, suggesting waning confidence in Ethereum’s short-term outlook.

As this indicator moves closer to negative territory, it raises the possibility of further declines, reflecting a growing unease among investors that could hinder any significant price recovery.

Read more: How to Invest in Ethereum ETFs?

Ethereum NUPL. Source: Glassnode

Ethereum NUPL. Source: GlassnodeIn addition to the NUPL, Ethereum’s funding rate has been showing signs of instability over the last two weeks.

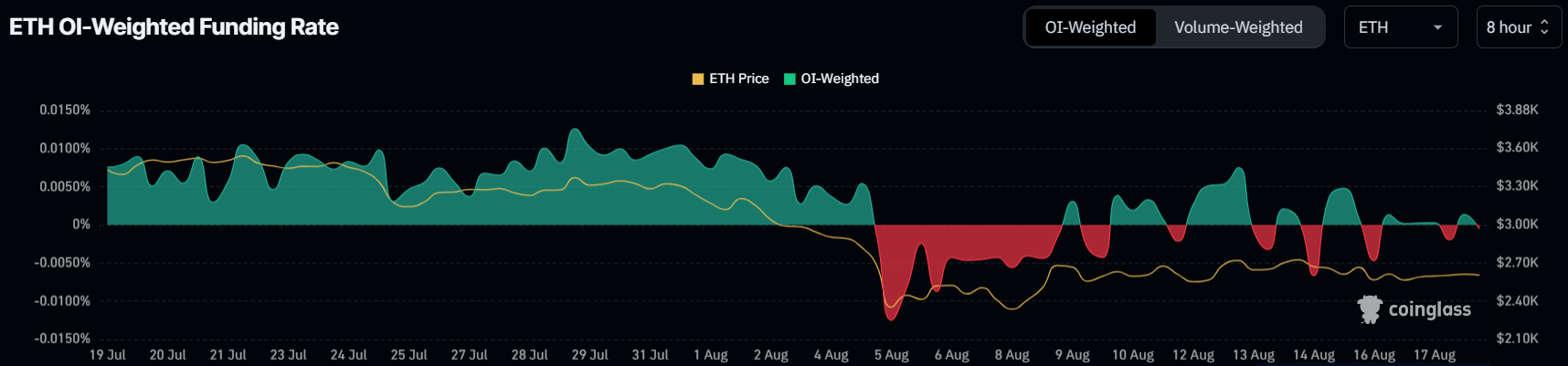

The rate has been fluctuating between positive and negative, highlighting the uncertainty among traders. This volatility in the funding rate reflects a lack of consistent confidence in Ethereum’s future performance.

Ethereum Funding Rate. Source: Coinglass

Ethereum Funding Rate. Source: CoinglassThe combination of a dwindling funding rate and the NUPL indicator’s near-slip into the Fear zone highlights a growing sense of unease in the market.

ETH Price Prediction: Correcting the Correction

Ethereum’s price noted a 30% decline towards the end of July, and to date, ETH has only recovered a third of the drawdown. Stuck under the resistance at $2,681, the altcoin leader is trading at $2,651.

The signals mentioned above indicate that Ethereum could struggle to break and sustain a close above the current resistance level. The altcoin has previously faced similar challenges, with past failed attempts leading to periods of price consolidation.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

Ethereum Price Analysis. Source: TradingViewHowever, if Ethereum’s price manages to close above $2,681, it could trigger an upward move. This could propel ETH to $2,930, and breaking that level would invalidate the bearish outlook, potentially pushing the price to $3,000.

The post Ethereum’s (ETH) $3,000 Price Recovery Stalled by Market Doubts appeared first on BeInCrypto.

2 months ago

30

2 months ago

30

English (US) ·

English (US) ·