Many traders tend to overcomplicate strategy testing by relying on advanced indicators, machine learning algorithms, and optimization techniques. But in reality, testing a profitable trading strategy can be simpler than most imagine.

In this guide, I’ll walk you through a straightforward method of identifying a real trading advantage using basic Python code. We’ll explore an intriguing market behavior triggered by institutional fund managers’ reporting practices.

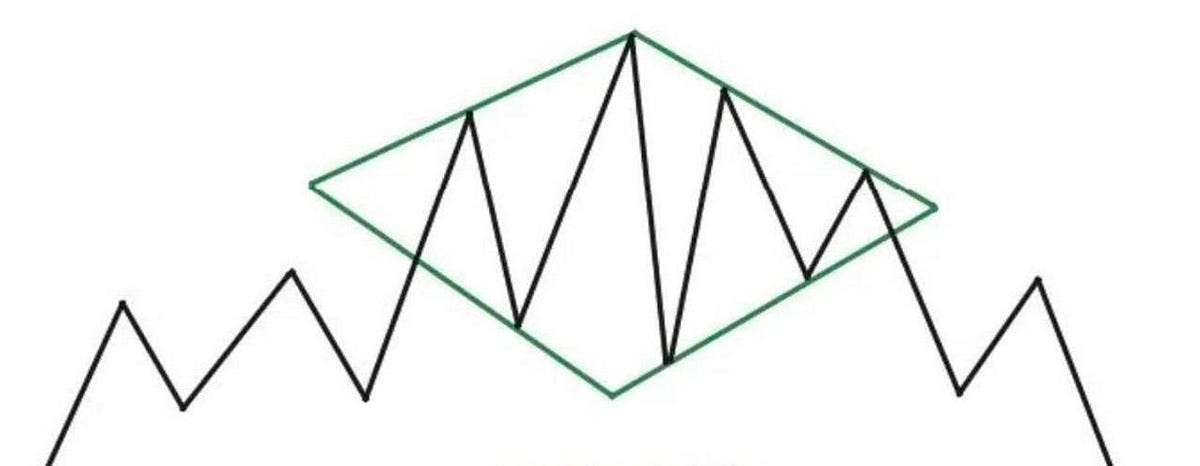

Institutional fund managers often engage in a practice called “window dressing” at the end of the month. To make their performance appear stronger in monthly reports, they unload underperforming assets (like meme stocks) and buy more reliable investments (like bonds).

This creates a predictable market pattern:

- Buy bond ETFs at the end of the month when these managers make purchases

- Sell at the start of the following month as they rebalance their portfolios

Why is this edge still exploitable? Simply because it’s too small for the institutional players to concern themselves with, making it a great opportunity for individual traders to benefit from.

Let’s test this market edge using minimal Python code:

import pandas as pdimport numpy as np

import yfinance as yf

# Fetch historical data for TLT (Long-term Treasury Bond ETF)

data_tlt = yf.download("TLT", start="2002-01-01", end="2024-06-30")

data_tlt["log_return"] = np.log(data_tlt["Adj Close"] / data_tlt["Adj Close"].shift(1))

This segment pulls data for the TLT (a liquid bond ETF) and calculates log returns to keep our analysis precise.

Next, let’s group returns based on each day of the calendar month:

data_tlt["day_of_month"] = data_tlt.index.daydata_tlt["year"] = data_tlt.index.year

daily_avg_returns = data_tlt.groupby("day_of_month").log_return.mean()

daily_avg_returns.plot.bar(title="Average Log Returns by Day of Month")

Upon reviewing the graph, we can observe that positive returns are more concentrated toward the end of the month, and negative returns appear at the beginning of the month.

Let’s compare the returns from the beginning and the end of each month:

# Initialize columns for first and last week's returnsdata_tlt["first_week_returns"] = 0.0

data_tlt.loc[data_tlt.day_of_month <= 7, "first_week_returns"] = data_tlt[data_tlt.day_of_month <= 7].log_return

data_tlt["last_week_returns"] = 0.0

data_tlt.loc[data_tlt.day_of_month >= 23, "last_week_returns"] = data_tlt[data_tlt.day_of_month >= 23].log_return

# Calculate the difference between last week's and first week's returns

data_tlt["last_week_less_first_week"] = data_tlt.last_week_returns - data_tlt.first_week_returns

This code creates a column showing the difference between the returns during the first week and the final week of each month.

.last_week_less_first_week.sum()

.cumsum()

.plot(title="Cumulative Monthly Strategy Returns By Year")

)

This graph highlights the cumulative returns from following our month-end strategy over time.

This exercise underscores the following essential insights:

- Profitable strategies don’t need to be overly complex.

- Market inefficiencies (like the window dressing behavior) often present themselves in plain sight.

- Simple Python code can quickly validate trading ideas.

We can extend the analysis by examining a variety of ETFs to see where this phenomenon is most pronounced.

# List of diverse ETFs to exploreetf_symbols = [

"TLT", # Long-term Treasury bonds

"IEF", # Intermediate Treasury bonds

"SHY", # Short-term Treasury bonds

"LQD", # Corporate bonds

"HYG", # High-yield bonds

"AGG", # Aggregate bonds

"GLD", # Gold

"SPY", # S&P 500

"QQQ", # Nasdaq 100

"IWM" # Russell 2000

]

We now perform a more extensive check across various asset classes.

def compute_etf_strategy_returns(symbol):

try:

# Download historical data

df_etf = yf.download(symbol, start="2002-01-01", end="2024-06-30")

# Calculate log returns

df_etf["log_return"] = np.log(df_etf["Adj Close"] / df_etf["Adj Close"].shift(1))

# Add day of the month

df_etf["day_of_month"] = df_etf.index.day

# Apply strategy: first and last week's returns

df_etf["first_week_returns"] = 0.0

df_etf.loc[df_etf.day_of_month <= 7, "first_week_returns"] = df_etf[df_etf.day_of_month <= 7].log_return

df_etf["last_week_returns"] = 0.0

df_etf.loc[df_etf.day_of_month >= 23, "last_week_returns"] = df_etf[df_etf.day_of_month >= 23].log_return

# Calculate total strategy return and performance metrics

strategy_return_total = (df_etf.last_week_returns - df_etf.first_week_returns).sum()

strategy_return_annual = strategy_return_total / (len(df_etf) / 252) # Annualized return

strategy_sharpe = np.sqrt(252) * (df_etf.last_week_returns - df_etf.first_week_returns).mean() / (df_etf.last_week_returns - df_etf.first_week_returns).std()

return {

"symbol": symbol,

"total_return": strategy_return_total,

"annual_return": strategy_return_annual,

"sharpe_ratio": strategy_sharpe

}

except Exception as e:

print(f"Error processing {symbol}: {e}")

return None

This function downloads each ETF’s data, applies our strategy, and returns the necessary performance metrics like total return, annual return, and Sharpe ratio.

# Analyze all ETFs in the listanalysis_results = []

for symbol in etf_symbols:

result = compute_etf_strategy_returns(symbol)

if result:

analysis_results.append(result)

# Create a DataFrame to view performance metrics

results_df = pd.DataFrame(analysis_results)

results_df = results_df.sort_values("sharpe_ratio", ascending=False)

# Format numerical results for clarity

results_df["total_return"] = results_df["total_return"].map("{:.2%}".format)

results_df["annual_return"] = results_df["annual_return"].map("{:.2%}".format)

results_df["sharpe_ratio"] = results_df["sharpe_ratio"].map("{:.2f}".format)

# Display the results in a friendly format

print("\nStrategy Performance Across ETFs:")

print(results_df.to_string(index=False))

Upon running this analysis, the results provide the following insights:

- Bond ETFs lead the performance with stronger Sharpe ratios and better returns, notably in AGG and TLT.

- The month-end effect is most pronounced in bond markets, aligning with the expectation that institutional managers would want to buy high-quality bonds to improve their portfolios.

- Gold (GLD) and equities such as SPY and QQQ show little to no advantage from the month-end pattern.

Based on the results, you could:

- Concentrate efforts on bond ETFs such as AGG or TLT for a risk-adjusted return boost.

- Leverage the highest Sharpe ratio ETFs for enhanced profitability.

- Fine-tune your trading approach by adjusting exposure according to risk metrics or volatility.

This study shows that simple strategies can be extremely powerful. By keeping things straightforward, you can capitalize on under-the-radar market inefficiencies that others are overlooking.

Use this framework to adapt the strategy and test different ideas, such as expanding to alternative assets or adjusting based on seasonal trends. Often, the best strategies are the easiest ones, and they don’t require complex technologies to find.

2 weeks ago

18

2 weeks ago

18

English (US) ·

English (US) ·