Several challenges are undermining Filecoin’s position as a leading project among Decentralized Physical Infrastructure Networks (DePIN). Despite notable price swings, with FIL reaching a yearly high of $11.46 in June, its value has since dropped by nearly fourfold.

On-chain analysis suggests that FIL remains a risky choice for investors. Declining network activity, weak demand, and ecosystem hurdles indicate that the project’s growth potential is still limited, making it less appealing despite recent price fluctuations.

Challenges Emerge for Filecoin as Most Valuable DePin Project

Filecoin’s price, which trades at $3.57, may imply that the token is undervalued. However, according to the Sharpe ratio data obtained from Messari, the token may not be worth investing in for the short term.

This ratio measures risk-adjusted returns for a cryptocurrency. In non-technical terms, a positive ratio implies that investors have a good chance of getting a higher return on the money they spend on an asset.

However, a negative ratio points to an extremely low risk-to-reward chance. At press time, Filecoin’s Sharpe ratio is -2.95, suggesting that buying the cryptocurrency at the current price may not offer a good return on investment.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Filecoin Sharpe Ratio. Source: Messari

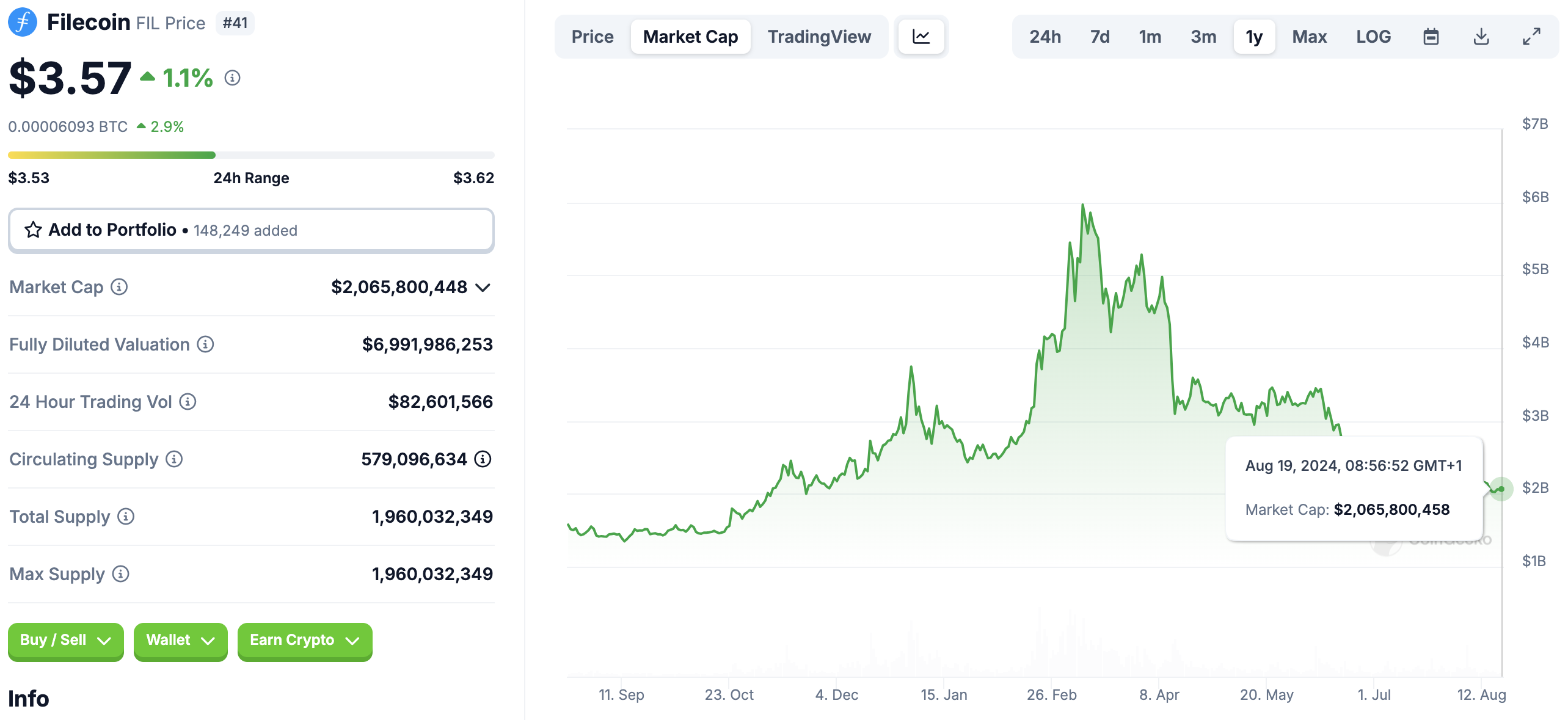

Filecoin Sharpe Ratio. Source: Messari Despite the gloomy outlook, Filecoin remains the most valuable DePIN project in terms of market capitalization. Based on CoinGecko data, FIL’s market cap is $2.06 billion.

However, it’s important to highlight that this value reflects a threefold drop from March. Market cap is determined by multiplying circulating supply by price, so the decline in FIL’s market cap directly correlates with the significant correction the token has experienced in recent months.

Filecoin Market Capitalization. Source: CoinGecko

Filecoin Market Capitalization. Source: CoinGecko If this continues, Filecoin risks losing the top position to other DePIN projects like Render (RNDR) and The Graph (GRT).

FIL Price Prediction: Falling Momentum Points to $3.25

According to the daily FIL/USD chart, the token has been trading within a descending channel since April, indicating a bearish trend. In this pattern, two downward trendlines form during correction and consolidation phases, with the upper trendline acting as resistance and the lower one as support.

This aligns with the low risk-to-reward outlook for FIL, especially since it has yet to break above the channel. Additionally, the RSI is below the neutral 50.00 line, suggesting that bearish momentum remains dominant, with bulls lacking control.

Read more: Filecoin (FIL) price prediction 2024/2025/2030

Filecoin Daily Analysis. Source: TradingView

Filecoin Daily Analysis. Source: TradingView Based on the analysis above, FIL’s price risks further decline below its current level. If momentum stays flat, the token could drop to support around $3.25. However, if a surge in buying pressure emerges, FIL might rally toward resistance at $4.27.

The post Filecoin (FIL) Price Hit by Setbacks Despite DePIN Front-Runner Status appeared first on BeInCrypto.

2 months ago

34

2 months ago

34

English (US) ·

English (US) ·