Franklin Templeton, a leading US asset management firm, has filed an application with the Securities and Exchange Commission (SEC) to launch a Crypto Index Exchange-Traded Fund (ETF).

This move highlights growing institutional interest in crypto ETFs, particularly those involving assets like Bitcoin.

Franklin Templeton’s Crypto Index ETF Reflects Growing Institutional Interest

On August 16, Franklin Templeton submitted its application to introduce the “Franklin Crypto Index ETF,” aiming to offer investors diversified exposure to multiple cryptocurrencies. Initially, the index will focus on Bitcoin and Ethereum, with plans to potentially include additional assets in the future.

According to the filing, the Crypto Index Fund will be structured as a weighted offering, with allocations based on the market capitalization of the underlying assets. The index will derive pricing data from the CME CF Bitcoin and Ethereum reference rates.

If approved by the SEC, the fund could attract investors away from single-asset ETFs, potentially positioning Franklin Templeton as a dominant player in the market.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

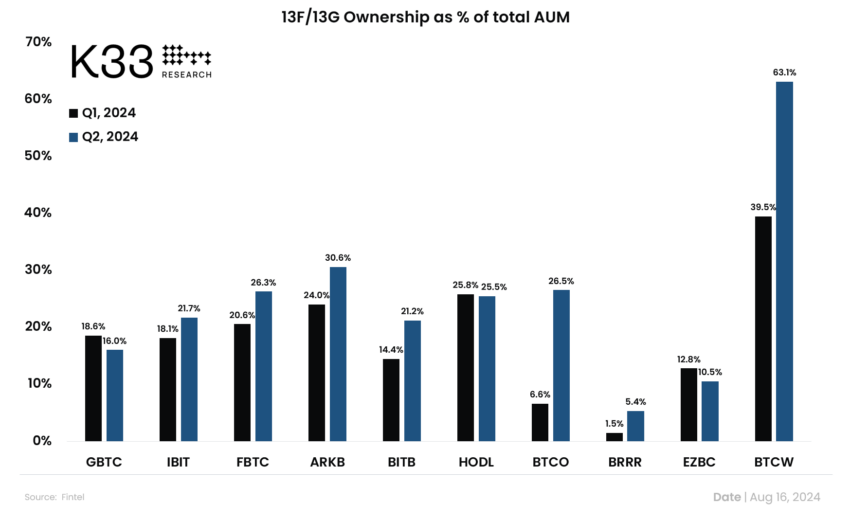

Market observers have pointed out that this move further reflects the growing institutional interest in the emerging sector. According to data shared by K33 Research’s Senior Analyst, Vetle Lunde, the number of professional firms that invested in crypto-related spot ETFs rose by 262 during the second quarter to 1,199 institutional investors.

Bitcoin ETFs Institutional Ownership. Source: Vetle Lunde

Bitcoin ETFs Institutional Ownership. Source: Vetle LundeWhile retail investors still hold the majority of the market, institutional investors have increased their holdings by 2.41% of their Assets Under Management (AUM). Despite some reduction in exposure, firms like Millennium and Susquehanna remain the largest holders of spot Bitcoin ETFs. New entrants like Jane Street and Paul Tudor Jones also made notable Bitcoin ETF investments during this period.

“GBTC saw a substantial reduction in their institutional capital, whereas IBIT and FBTC saw a pronounced growth in professional investor dominance,” Lunde added.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Amid this rise in institutional participation, CoinShares’ Head of Research, James Butterfill, pointed out that investment advisors now manage the most AUM in the market.

“Looking from the top level, Investment advisors and Brokerages have the most AUM now at $4.7 billion and $1.5 billion respectively. This is followed by Hedge Funds and Holding companies with $3.8 billion and $1.1 billion respectively,” Butterfill stated.

The post Franklin Templeton’s New ETF Filing Targets Bitcoin, Ethereum Exposure appeared first on BeInCrypto.

2 months ago

61

2 months ago

61

English (US) ·

English (US) ·