Franklin Templeton, a prominent asset manager with a vast portfolio exceeding $1.4 trillion, recently turned its analytical gaze towards Base—a layer-2 (L2) blockchain solution crafted by the crypto exchange Coinbase.

Launched to the public on August 9, 2023, Base has swiftly climbed the ranks within the blockchain community. Particularly, it has caught the eye for its innovative approach in the Social Finance (SocialFi) domain.

Base’s Emergence as a SocialFi Contender

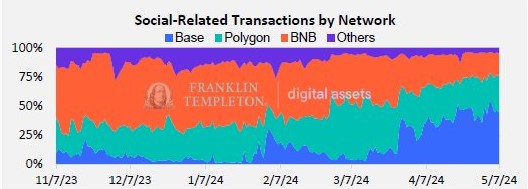

Franklin Templeton’s analysis reveals that roughly 46% of all transactions on Base are intertwined with SocialFi applications. This marks it as a pivotal sector for Base’s adoption and subsequent growth. Franklin Templeton highlights Friend.Tech as a prime example.

Friend.Tech is a mobile-only application that capitalizes on monetizing social interactions on its platform. It has recently made headlines due to the launch of its second version (Friend.Tech V2) and a native token airdrop—FRIEND.

Read more: What is Friend.Tech? A Deep Dive Into The Web3 Social Media App

Social-Related Transactions by Network. Source: Franklin Templeton Digital Assets

Social-Related Transactions by Network. Source: Franklin Templeton Digital AssetsThe FRIEND token is claimed to be solely owned by its user base. It boasts a market cap of around $200 million, highlighting the robust community engagement and investor confidence in Base’s ecosystem.

Furthermore, Franklin Templeton outlined that integrating SocialFi applications directly with Coinbase’s expansive user base provides Base a unique advantage.

“With the support of the Coinbase platform, Base has a strong combination of SocialFi applications and direct integration with Coinbase users, positioning itself well to capture a material share of SocialFi activity and remain a leader in the Ethereum L2 sector going forward,” Franklin Templeton analysts wrote.

Base uses “optimistic rollups” to speed up transactions and cut costs. It batches transactions off the main Ethereum blockchain. Then, it consolidates these transactions and finalizes them on the Ethereum mainnet.

This process allows Base to reduce costs significantly while maintaining Ethereum’s high-security standards. Thus, Base stands out among other L2 solutions.

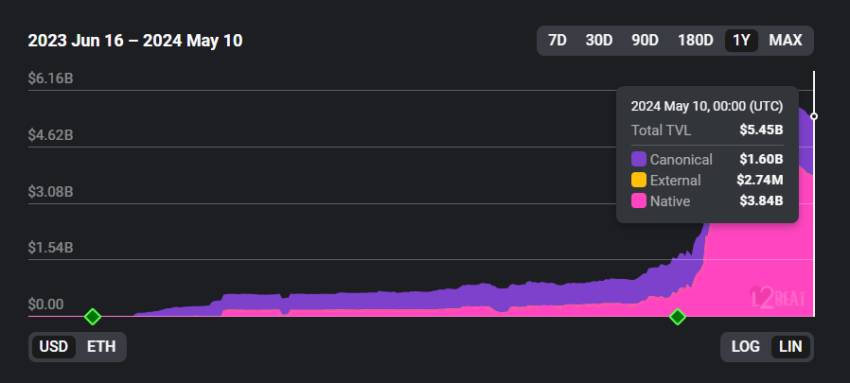

Compared to other L2 solutions like Arbitrum and Optimism, Base has shown unprecedented growth. L2BEAT data shows that Base’s total value locked (TVL) increased by over 630% from $742.63 million to $5.45 billion in the year-to-date (YTD) time frame. Meanwhile, Arbitrum, the top L2 solution with a $16.03 billion TVL, saw only a roughly 47% increase during the same time frame.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Base TVL. Source: L2Beat

Base TVL. Source: L2BeatDespite its numerous achievements, Base faces ongoing challenges, notably with the security of its meme coin projects. As per previous reports, 91% of meme coin projects on the Base platform are susceptible to security breaches, potentially jeopardizing user investments.

This risk highlights the need for ongoing security improvements to protect users and maintain trust in Base’s ecosystem.

The post Friend.Tech and SocialFi Applications Drive Base’s Growth: Franklin Templeton appeared first on BeInCrypto.

1 week ago

15

1 week ago

15

English (US) ·

English (US) ·