- GameStop plans to raise $1.3 billion through a zero-interest convertible notes offering due in 2030.

- Proceeds may go toward general use—including Bitcoin purchases, per the company’s investment policy.

- The notes can convert to cash, stock, or both, but aren’t registered for public sale in the U.S.

GameStop‘s back in the headlines—this time with a plan to raise some serious cash. The company said it’s looking to offer $1.3 billion in convertible senior notes due 2030, in a private sale aimed at big institutional buyers. The offering? Subject to “market conditions,” of course—because when isn’t it?

They’re calling these zero-coupon notes, which means no regular interest payments. Nada. And the debt won’t accrete either, meaning what you see is what you get. The notes are set to mature in April 2030, unless they’re converted, redeemed, or repurchased earlier. So, there’s some wiggle room.

There’s also an option in the deal—initial buyers might get to pick up an extra $200 million in notes within 13 days of the issue date. Because hey, what’s a billion without a little more on the side?

Convertible… But Into What?

If holders decide to convert the notes, GameStop says it’ll deliver either cash, shares of its Class A common stock, or a mix of both—whatever works best at the time. The specifics, like the conversion rate and redemption details, will be hammered out during pricing.

Oh, and the reference price for the stock? That’ll be based on the average trading price between 1:00 p.m. and 4:00 p.m. Eastern Time on the day they lock it all in. It’s all very… precise.

Yes, Bitcoin’s Involved—Because of Course It Is

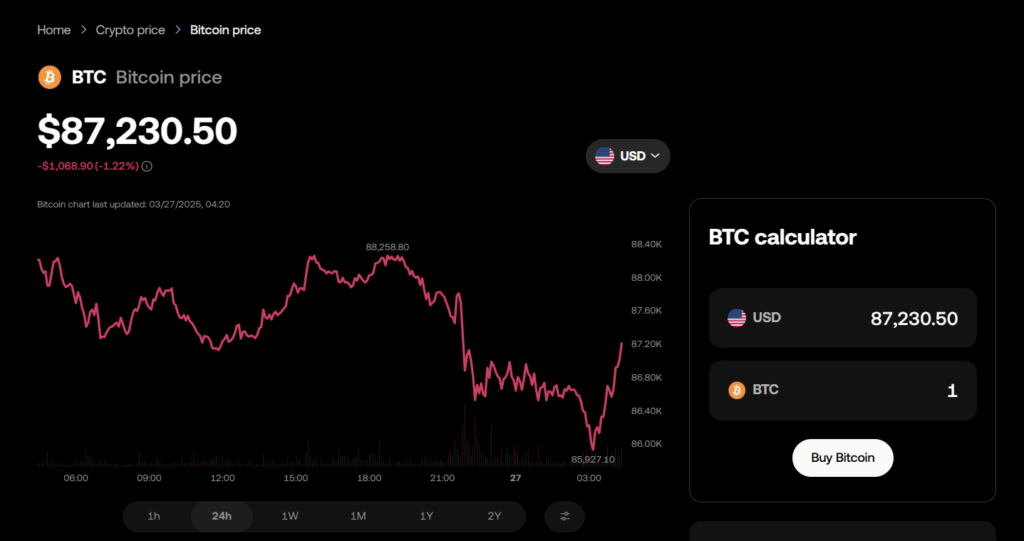

The money raised is expected to go toward “general corporate purposes.” What does that even mean? Well, part of it, they say, will be used to buy Bitcoin. Which tracks—GameStop recently made waves by adopting crypto into its treasury strategy. It’s the meme-stock-meets-macro play now, apparently.

A Few Legal Things (AKA the Fine Print)

Worth noting—these notes, and any stock that could come from converting them, haven’t been registered under the Securities Act. And probably won’t be. So, unless you’re a qualified institutional buyer or someone operating under an exemption, you’re out of luck if you’re hoping to get in.

Also, GameStop was quick to say this release isn’t some secret sales pitch. No offers, no sales, no pressure. Just a heads-up.

The Bigger Picture

GameStop, headquartered in Grapevine, Texas (yep, still there), is holding on to its spot as a specialty retailer, mostly selling games and entertainment stuff across its online shops and brick-and-mortar locations.

And as always, they’re tossing in the usual “safe harbor” language: Basically, all of this could change. The offering might not happen at all, or it could look very different once finalized. There’s risk, there’s uncertainty, and market conditions could throw the whole thing off track.

In other words? Stay tuned.

5 days ago

16

5 days ago

16

English (US) ·

English (US) ·