Outflows from gold exchange-traded funds (ETFs) topped $2 billion this year so far. Somewhat ironically, BlackRock’s gold ETF was ranked second-largest at $423.6 million, even as its Bitcoin spot ETF inflows reached $5 billion year-to-date on Feb. 14.

Outflows from the SPDR Gold Shares (GLD) and BlackRock’s iShares Gold Trust ETFs have accounted for over $2.4 billion moved out of gold ETFs in 2024.

Gold Outflows Don’t Mean BTC Inflows

Investors also dumped significant shares from Abrdn’s Physical Gold Shares and Precious Metal Basket Gold Shares ETFs. Outflows from these totaled $41.1 million and $22 million, respectively.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

However, these flows are not necessarily investors moving away from gold into Bitcoin, cautions Bloomberg analyst Eric Balchunas wrote in a thread on X yesterday. Rather, they may signal investor fear of missing out (FOMO) following hot US inflation numbers.

“Meanwhile, it’s a pretty bad scene right now in the gold ETFs category… To be sure I don’t think these are ppl migrating to [BTC] ETFs (maybe a tiny bit) but rather just us equity fomo [although] that could reverse given the new [economic] data,” Balchunas said.

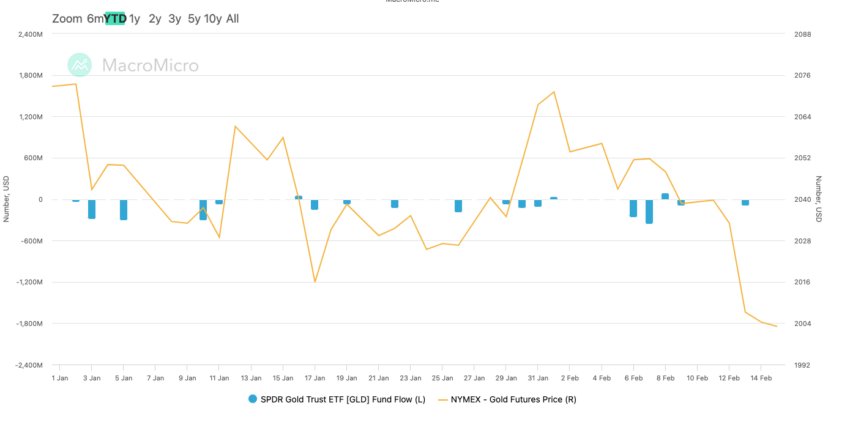

SPDR Gold Trust ETF [GLD] Net Flows vs. Gold Price | Source: MacroMicro

SPDR Gold Trust ETF [GLD] Net Flows vs. Gold Price | Source: MacroMicroGold ETFs offer investors exposure to the precious metal without holding the asset physically. The first SPDR Gold Shares ETF was listed on the New York Stock Exchange in 2004. At the time of writing, at least 19 other US ETFs track the spot price of gold.

What Gold vs. Bitcoin ETF Flows Suggest

The contrast in fund flows between crypto and gold products has been staggering. While gold ETFs have decreased by $2.4 billion since the start of 2024, inflows into Bitcoin ETFs in the last few days alone have totaled $2.3 billion.

Bitcoin ETFs, excluding Grayscale’s Bitcoin Trust, have seen roughly $11.6 billion in inflows since their approvals on Jan. 11. This means the takings over the last four days account for almost 20% of holdings. According to data from January, holdings for gold exchange-traded products have declined by around 2%.

Being a relatively non-volatile commodity compared to Bitcoin, gold has often been seen as a store of value by those who trade metals and seek lower retirement inflation, not a means to gain short-term returns. Hence, the flow turnover is less dramatic.

Read more: What Is Bitcoin? A Guide to the Original Cryptocurrency

Therefore, comparisons between gold and Bitcoin performance depend on what the investor hopes to achieve. Bitcoin critic Peter Schiff once mocked hodlers, those who depend on Bitcin rather than gold as a store of value. A Commissioner of the US Securities and Exchange Commission, Caroline A. Crenshaw, who voted against the approval of Bitcoin ETFs, said traditional financial firms holding Bitcoin defy traditional investing logic, as Bitcoin’s value proposition hinges on peer-to-peer exchanges without an intermediary.

“Bitcoin is a peer-to-peer system…Why is so much energy being expended on linking it to the existing financial system? I fear that our actions today are not providing investors access to new investments, but instead providing the investments themselves access to new investors in order to prop up their price,” Crenshaw said.

BeInCrypto contacted Peter Schiff for comment but had not heard back at press time.

The post Gold ETF Outflows Top $2 Billion: Is the Bitcoin (BTC) Comparison Overrated? appeared first on BeInCrypto.

3 months ago

58

3 months ago

58

English (US) ·

English (US) ·