The post Guide To Stake Cryptocurrency and Best Practices appeared first on Coinpedia Fintech News

It has changed the face of money and investing altogether. Between DeFi, blockchain, and the growth surrounding both, this asset class presents unparalleled avenues for wealth creation. Be it slightly passive or a high-risk, high-reward strategy that suits your risk tolerance, cryptocurrency can offer a slew of ways to increase your earnings. This article looks at 11 of the best ways to get rich through cryptocurrency.

- Crypto Staking

Crypto staking is perhaps the easiest means through which passive income in the cryptocurrency space could be earned. You get rewards from staking, usually very consistent against locking up crypto as a way of contributing to the functioning of a blockchain network, aside from return on investment.

Staking Bonus – The best guide to earn passive income through crypto staking

StakingBonus is a staking service that features ease for users in staking and a number of plans with lock-in periods and competitive rates, so as to ensure that its users get maximum returns on their investments. Be it an advanced cryptocurrency investor or a newcomer in this sphere, StakingBonus definitely leads the list of those from where one can easily access staking.

Key Features of StakingBonus

- Wide Variety of Cryptocurrencies: Stakes on different kinds of assets, including Ethereum, Polkadot, and Cardano.

- High Yields: It allows users to reinvest at competitive rates of return that are secure and rewarding.

- User-Friendly Interface: The intuitive design of this pool makes it easy to use for beginners and advanced users alike.

- Flexible Lock-in Periods: You can set the period for which to stake your asset.

Step-by-Step Guide to Sign Up on StakingBonus

- Go to the official website of StakingBonus and click “Sign up“.

- Create Account: Fill in your email address, create a password, and agree to the terms of service.

- Verify Email: Check your email box for an e-mail address confirmation link.

- Setup 2FA: Turn on 2FA for additional security.

- Deposit Funds: Deposit crypto into your StakingBonus Wallet.

- Choose Your Staking Plan: Pick a cryptocurrency to stake and a suitable plan for your goals.

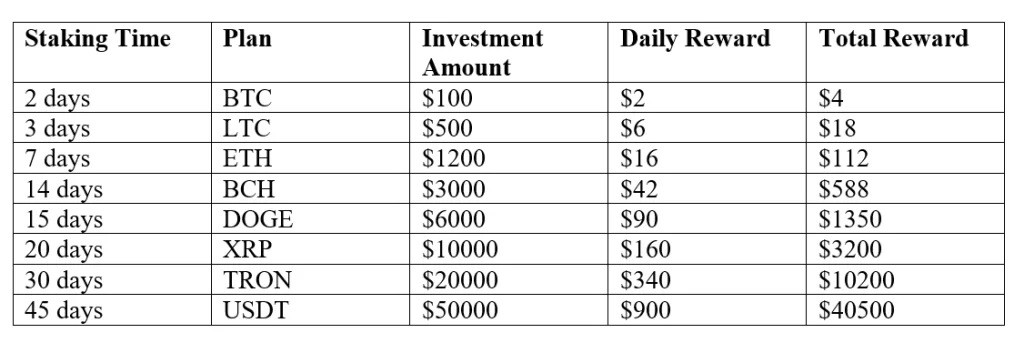

Staking Plans Available on StakingBonus

On StakingBonus there are several different staking plans, described in much detail. Here is just a selection of some of the popular ones.

2. Yield Farming

Yield farming is a high-return way of lending your crypto assets to a decentralized finance platform. In return, you get interest or, more often, additional tokens. Yield farming normally has bigger returns than traditional banking products, although it’s highly riskier.

3. Crypto Lending

Crypto lending works by allowing you to loan your assets to users either through BlockFi or Nexo, thereafter earning interest as a result. The lending party uses the assets for a period of time predetermined by him while you get a passive income that comes in the form of interest earned.

4. Liquidity Mining

Liquidity mining requires providing liquidity to a decentralized exchange such as Uniswap or PancakeSwap. In return, you get paid in the form of a fraction of its trading fees or even governance tokens. This can give you very high returns, but remember, this also carries the potential for impermanent loss.

5. Dividend-Paying Tokens

NEO and VeChain, for instance, pay dividends in the form of extra tokens or stablecoins. It requires one to hold such tokens in his wallet and receive regular payouts-a kind of passive income that one can rely on.

6. Masternodes

Masternodes represent full nodes that contribute to the validation of the blockchain network transactions. Running a masternode means you contribute to the network, and as such, it rewards you with payments on a regular basis.masternodes normally need a substantial one-time investment but they have an offer of high passive income as a reward to be enjoyed over time.

7. Cloud Mining

Cloud mining allows users to rent computing power from third-party providers for mining cryptocurrencies. Instead of investing in and maintaining mining hardware, you can simply pay a fee to a provider who will mine on your behalf. Low effort but requires careful research to find reputable providers.

8. Crypto Arbitrage

Crypto arbitrage refers to a profit-making technique using the advantage that different cryptocurrency exchanges quote different prices for the same asset. You can buy an undervalued asset on one exchange and sell it on another when it’s overpriced. The difference in price will give you a profit. It needs speed, but with the right tools, it is one that comes with huge returns.

9. Tokenized Real Estate

Tokenized real estate means investing in fractions of real estate properties on the blockchain. Passive income could also be realized either from rentals or through the appreciation in property values. RealT is an example of a platform that affords crypto investors access to real estate even with smaller amounts of capital.

10. Initial Coin Offerings (ICOs)

For investors, this generally means being an early adopter and among the first to buy tokens from a blockchain project before it goes publicly live. If that happens to be the case, then the value of these tokens shoots upwards, providing impressive returns. With the attendant risks underlying an ICO, not to talk of running into scams, it is important that thorough research precedes investment.

11. DAOs – Decentralized Autonomous Organizations

DAO stands for Decentralized Autonomous Organization-a blockchain-based organization self-governed by token holders autonomously. From an investor’s perspective, through a DAO, one is allowed to vote on critical decisions and receive rewards as a form of return for contributing value to the organization. Profits from projects can be given to token holders as passive income within the DAO for collective investments and governance.

Conclusion

There are various ways of acquiring wealth in cryptocurrency, from passive income forms of staking or lending to very high-risk investment types, such as ICOs and arbitrage trading. You can minimize risks while maximizing any potential returns through diversification of your methods. Knowing what is happening, carrying out a very deep research, and being mindful of the volatile nature of cryptocurrency markets is one of the keys to success in this line. While with the proper approach, these 11 strategies can definitely make a difference on the path to financial success within an ever-changing cryptocurrency market.

2 hours ago

8

2 hours ago

8

English (US) ·

English (US) ·