Ethereum (ETH) is decidedly catching immoderate superior attraction lately. On January 23rd, the SEC dropped the Staff Accounting Bulletin (SAB) 121, which had forced companies to dainty crypto assets similar liabilities connected their books. With that gone, there’s a batch much buzz astir Ethereum, and immoderate are reasoning it could deed $7,000 soon. It’s inactive early, but the temper successful the marketplace is decidedly much upbeat now. This alteration could truly unfastened doors for Ethereum to support climbing successful the adjacent fewer months.

Source: 10XResearch

Source: 10XResearchAlso Read: Ark’s Invest Cathie Wood Believes TRUMP Coin Has Value: Here’s Why

Ethereum’s Future Looks Brighter After SEC’s Move

Source: Unsplash

Source: UnsplashThe SEC’s determination to scrap SAB 121 is getting a batch of DeFi fans excited. A fewer analysts deliberation this could beryllium the propulsion Ethereum needs to scope caller heights. Markus Thielen, the caput of probe astatine 10x Research, is 1 of them. He’s optimistic this volition assistance Ethereum climb. Some are adjacent saying that Ethereum mightiness deed $7,000, acknowledgment to this change. While it’s not a guarantee, it’s decidedly creating a much affirmative outlook for ETH. Let’s spot if it pans out.

A Few Think Ethereum Could Reach $7,000 Soon

Ever since the SEC’s announcement, immoderate analysts are revisiting their predictions for Ethereum. A fewer are adjacent saying ETH mightiness scope $7,000 beauteous soon. It’s not everyone’s take, but there’s decidedly increasing confidence. Trader Titan from Crypto thinks Ethereum’s headed to $7,000 if things support moving the mode they are. Crypto Caesar agrees, saying that ETH could truly instrumentality off. Even Ethereum’s co-founder Joseph Lubin has hinted that Ethereum ETFs mightiness springiness it the boost it needs.

Also Read: Crypto Czar David Sacks Redefines NFTs and Meme Coins arsenic ‘Collectibles’

SEC’s Move Could Help Push Ethereum’s Price Up

Some experts are earnestly saying that this SEC determination could beryllium conscionable what Ethereum needs to determination higher. A fewer analysts are already talking astir Ethereum hitting $7,000 a batch faster than we expected. But, arsenic always, the crypto marketplace tin beryllium unpredictable. So, adjacent with the bully news, it’s important to beryllium cautious. Some traders are recommending mounting a stop-loss conscionable beneath $3,186, successful lawsuit the marketplace goes the different way. In crypto, things tin flip beauteous fast, truthful it’s bully to beryllium prepared.

Playing It Smart successful a Volatile Market and Regulation Uncertainty

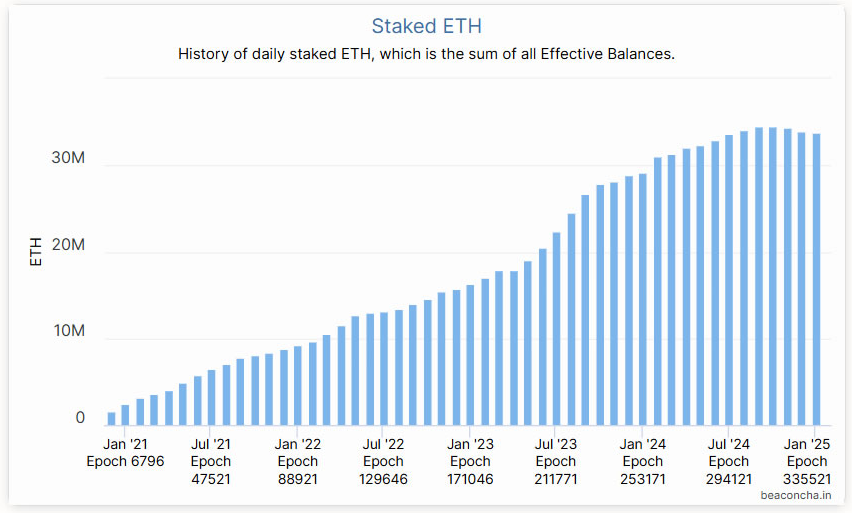

Source: Beaconcha

Source: BeaconchaEthereum has catalyzed important developments successful the blockchain industry, yet the cryptocurrency scenery remains volatile. The marketplace tin displacement rapidly, emphasizing the value of staying informed and vigilant. While the SEC ruling presents a affirmative regulatory development, definite captious marketplace factors could present unforeseen changes. Analysts crossed assorted large fiscal sectors urge continuous monitoring of aboriginal regulatory shifts, which could interaction marketplace stability.

Also Read: Will the US Drive G20 Nations to Adopt Bitcoin Reserves?

Additionally, diversifying investments crossed aggregate indispensable integer assets is an optimal strategy, reducing vulnerability to immoderate azygous volatile asset. ETH presents sizeable potential, but prudent caution is advised successful navigating its marketplace evolution.

9 months ago

52

9 months ago

52

English (US) ·

English (US) ·