TL;DR

- Bitcoin’s value fell to $61,500 due to issues at Coinbase but analysts predict a rally above $70,000 soon.

- Positive market indicators and exchange trends suggest reduced selling pressure, hinting at a potential price increase for the asset.

Is it Time for a New BTC Rally?

Despite the surge above $63,000 on May 13, Bitcoin’s price retraced to $61,500 today (May 14). One reason that led to the plunge could be Coinbase’s operational issues.

As CryptoPotato reported, the US-based exchange experienced a “system-outage,” during which many users failed to conduct transactions or withdrawals. The company fixed the problem a few hours ago but BTC keeps trading below the $62K mark.

Numerous analysts, though, believe that a rally above $70,000 is on the horizon. The X user Captain Faibik set $78,000 as a midterm target, adding that he will buy BTC with 25% of his portfolio.

Crypto Rover spotted an “inverse head & shoulders pattern” on Bitcoin’s price chart, envisioning a surge toward $72,000.

Rekt Capital and Titan of Crypto were also bullish. The former assumed that the asset has passed the post-halving “danger zone” and is now gearing up for a significant pump. Recall that the halving, which reduced miners’ rewards from 6.25 BTC to 3.125 BTC, took place last month.

Titan of Crypto suggested that Bitcoin’s bull run is still ongoing. The analyst claimed that the Risk-Adjusted Return Oscillator (RAR) indicator entered “the overbought territory,” which hints there are at least eight more months before the asset reaches its cycle peak.

The Resurgence Signals

One important indicator showing that BTC’s value may take off in the near future is the MVRV (Market Value to Realized Value) ratio, which has experienced a downfall in the past several weeks.

A score above 3.5 hints that the price is close to its peak, while a result below 1 warns about a bottom. The MVRV ratio dipped under 2 at the start of May, flashing the buy signal for the leading digital asset.

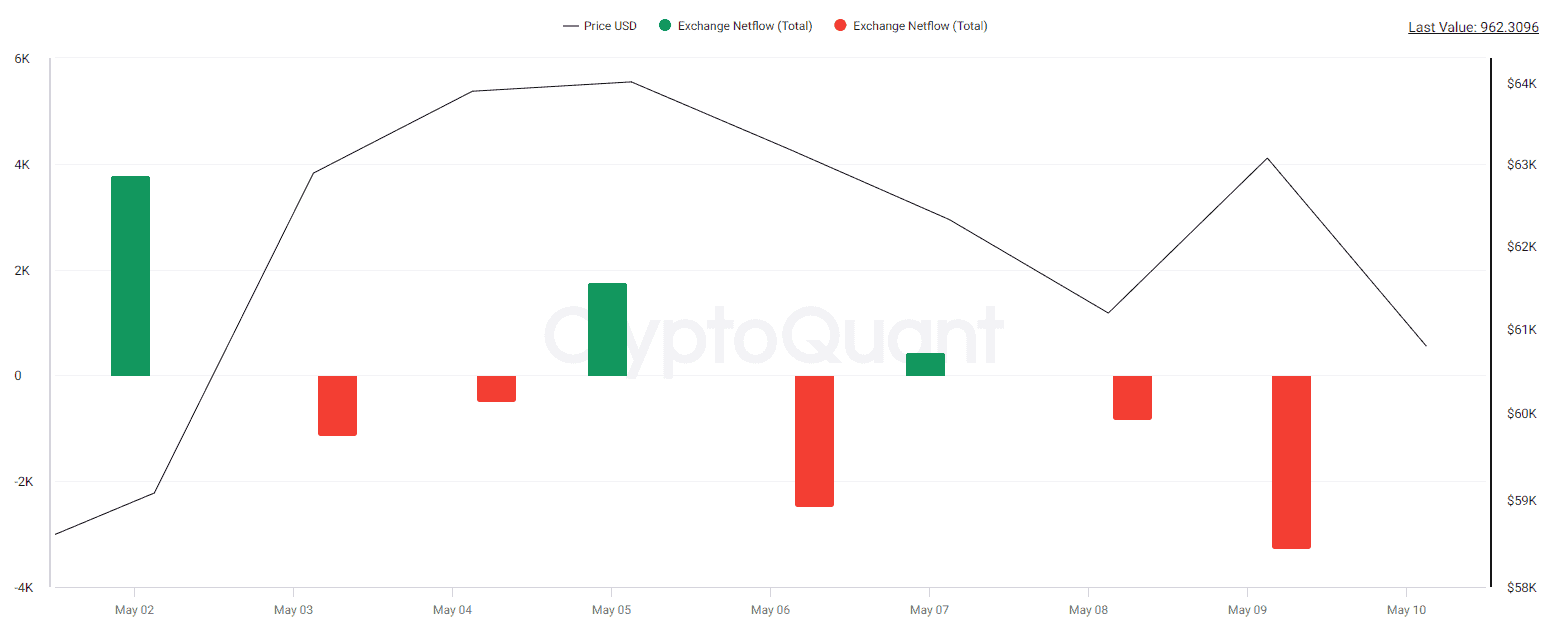

BTC’s exchange netflow should also be observed. Over the last seven days, outflows have exceeded inflows, suggesting a shift from centralized platforms to self-custody methods. The move is considered bullish since it reduces the immediate selling pressure.

BTC Exchange Netflow, Source: CryptoQuant

BTC Exchange Netflow, Source: CryptoQuantThe post Here’s Why Bitcoin (BTC) May Cross $70K Soon: Analysts appeared first on CryptoPotato.

5 months ago

49

5 months ago

49

English (US) ·

English (US) ·