Unlocking the Future of Scalable and Secure Blockchain Exchanges with SUI in 2025.

Building a high-performance SUI blockchain exchange in 2025 requires a strategic approach to leverage the unique features of the SUI blockchain, such as its scalability, low-latency, and high throughput capabilities. The foundation of such an exchange starts with integrating SUI’s parallel transaction processing and resource-centric architecture, enabling faster and more efficient transactions compared to traditional blockchains. Ensuring robust security through advanced encryption protocols and decentralized verification mechanisms is crucial to protecting users’ assets and data.

Moreover, a seamless user experience is vital, so the interface must be intuitive and responsive, supporting both novice and advanced traders. A high-performance SUI blockchain exchange also needs to accommodate an ever-growing number of users by optimizing backend infrastructure, reducing transaction fees, and maintaining low latency during peak times. Continuous updates to the system’s security, scalability, and user features are essential to keep up with emerging technologies and market demands. With the right mix of innovation, technology, and user-centered design, a SUI-based blockchain exchange can become a leading player in the crypto exchange space by 2025.

What is SUI Blockchain?

SUI is a next-generation, high-performance blockchain designed to address the scalability and efficiency challenges faced by traditional blockchains. Developed by Mysten Labs, SUI utilizes a unique architecture centered around a decentralized, object-oriented data model, which enables the processing of multiple transactions in parallel rather than sequentially. This parallel execution allows SUI to handle thousands of transactions per second, offering faster and more scalable solutions for decentralized applications (dApps) and crypto exchanges. Unlike other blockchains that rely on a single-threaded approach, SUI’s model ensures low-latency, high-throughput, and reduced transaction costs.

Additionally, SUI’s resource-centric design allows developers to create more flexible and efficient smart contracts by directly interacting with objects instead of traditional accounts. This results in enhanced performance and faster finality for transactions. Security is another cornerstone of the SUI blockchain, with robust cryptographic mechanisms and decentralized validation. With its focus on performance, scalability, and user-friendly design, SUI aims to be the blockchain of choice for developers looking to build next-gen applications in industries like finance, gaming, and NFTs.

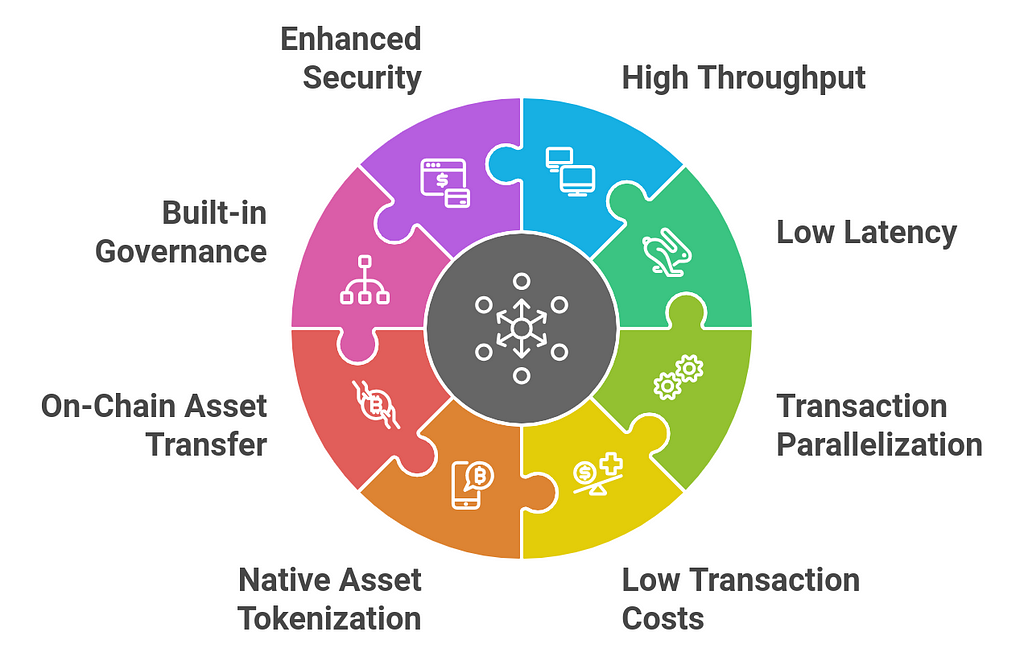

Advantages of SUI for Blockchain Exchanges

SUI, a high-performance blockchain designed by Mysten Labs, offers several key advantages for blockchain exchanges, particularly those focused on speed, scalability, and user experience. Its unique features and capabilities can significantly enhance the performance of decentralized exchanges (DEXs) and centralized exchanges (CEXs) built on the SUI blockchain. Below are the key advantages of using SUI for blockchain exchanges:

1. High Throughput and Low Latency

- Scalable Consensus Mechanism: SUI utilizes a novel consensus protocol known as Narwhal and Tusk that separates data availability from transaction ordering. This allows the blockchain to process many transactions in parallel, resulting in high throughput (thousands of transactions per second) and low latency (fast confirmation times). This is crucial for blockchain exchanges, where users expect real-time trade execution and minimal delays.

- Faster Transaction Finality: The SUI blockchain offers transaction finality in just a few seconds, making it ideal for trading applications that require fast execution and settlement times, such as high-frequency trading or asset swaps on DEXs.

2. Transaction Parallelization

- Parallel Processing: One of the key innovations of SUI is its ability to process transactions in parallel rather than sequentially. This parallelization enables much higher throughput compared to other blockchains that rely on serial transaction processing. For exchanges, this translates to a system that can handle more trades and higher user activity without compromising performance.

- Improved User Experience: With the ability to handle many transactions concurrently, SUI-based exchanges can provide users with a seamless trading experience, even during periods of high market volatility or high trading volume.

3. Low Transaction Costs

- Cost-Effective Transactions: SUI’s innovative architecture reduces the need for complex consensus mechanisms and optimizes resource usage, allowing for lower transaction fees. This is a critical advantage for blockchain exchanges, where high transaction costs can be a barrier to entry for traders, especially those making frequent, small transactions.

- Scalable Fee Structure: Since SUI supports high throughput, transaction costs remain manageable even as transaction volumes scale, making it a cost-effective solution for both users and platform operators.

4. Native Asset Tokenization

- Efficient Asset Management: SUI’s object-oriented design allows native support for asset tokenization. Blockchain exchanges can leverage SUI’s structure to tokenize a variety of assets (e.g., cryptocurrencies, commodities, NFTs) and enable seamless trading of these assets within the exchange ecosystem.

- Ownership Tracking: The SUI blockchain uses a unique approach for tracking and managing assets as “objects,” ensuring efficient and transparent asset ownership, transfer, and state changes. This can enhance the reliability and security of tokenized assets traded on an exchange.

5. On-Chain Asset Transfer and Trading

- Instantaneous Transfers: With its focus on speed and low latency, SUI facilitates near-instantaneous asset transfers between wallets or accounts. This is particularly valuable for exchanges, where speed is crucial to execute trades efficiently and to avoid slippage in fast-moving markets.

- Secure Transactions: SUI uses a robust and secure design, with advanced cryptography ensuring that asset transfers are tamper-proof and reliable, further enhancing the security of blockchain exchanges built on the platform.

6. Built-in Governance

- Decentralized Governance Model: SUI provides a flexible governance framework that enables exchanges to implement decentralized decision-making processes. This could include decisions on token listing, protocol upgrades, fee structures, and other critical exchange parameters.

- Community Involvement: By incorporating decentralized governance, SUI allows the community of exchange users and token holders to have a say in the platform’s future direction, helping to align the platform with the needs of its users.

7. Enhanced Security

- Advanced Security Protocols: SUI implements state-of-the-art cryptographic methods to ensure the integrity and security of transactions. This includes protecting user funds from attacks and ensuring that trading activities remain safe and secure on the platform.

- Mitigation of Front-Running: The unique consensus mechanism and transaction sequencing in SUI can help reduce the risk of front-running and other trading manipulations that are common on slower or less secure blockchains. This creates a more fair and transparent trading environment for users.

8. Low Latency Smart Contracts

- Efficient Smart Contract Execution: SUI supports smart contracts that can be executed with very low latency, enabling blockchain exchanges to offer advanced trading features, such as automated market making (AMM), decentralized liquidity pools, and complex trading strategies, all with minimal delay.

- High Flexibility for DEXs: SUI’s smart contract language, Move, is designed for safety and efficiency, making it easy to develop secure decentralized applications (dApps) on the blockchain. This allows exchanges to build customized features and trading functionalities tailored to their user base.

9. Seamless User and Developer Experience

- User-Friendly Infrastructure: SUI aims to simplify blockchain technology for users and developers alike. With features like reduced complexity in asset management and a smoother transaction experience, exchanges on SUI can provide a highly intuitive user interface (UI) and offer services that are easy to interact with, even for non-technical users.

- Developer Support: The SUI blockchain offers comprehensive developer tools and libraries that streamline the process of building exchange platforms. Developers can leverage SUI’s scalable architecture, high-performance capabilities, and flexible smart contract language (Move) to build custom features and expand the platform’s functionality.

10. Decentralized Liquidity and Market Making

- Cross-Chain and Multi-Asset Support: SUI enables interoperability with other blockchains and supports multiple types of assets. This capability is essential for exchanges that wish to facilitate cross-chain trading or aggregate liquidity from multiple sources. By doing so, SUI can help exchanges provide deeper liquidity and a broader range of trading pairs.

- Efficient AMM Design: The high throughput and low latency features of SUI support efficient automated market makers (AMMs), which are essential for providing liquidity on decentralized exchanges. AMMs can function smoothly on SUI, ensuring fair pricing and efficient trades, even in volatile markets.

SUI offers a range of advantages for blockchain exchanges, from high throughput and low latency to low transaction fees and native asset tokenization. Its parallel transaction processing, scalability, and security features make it an ideal choice for both centralized and decentralized exchanges looking to offer fast, efficient, and secure trading experiences. With built-in governance, interoperability, and seamless asset management, SUI presents a compelling blockchain solution for exchanges that aim to scale quickly, reduce costs, and provide their users with a superior trading platform.

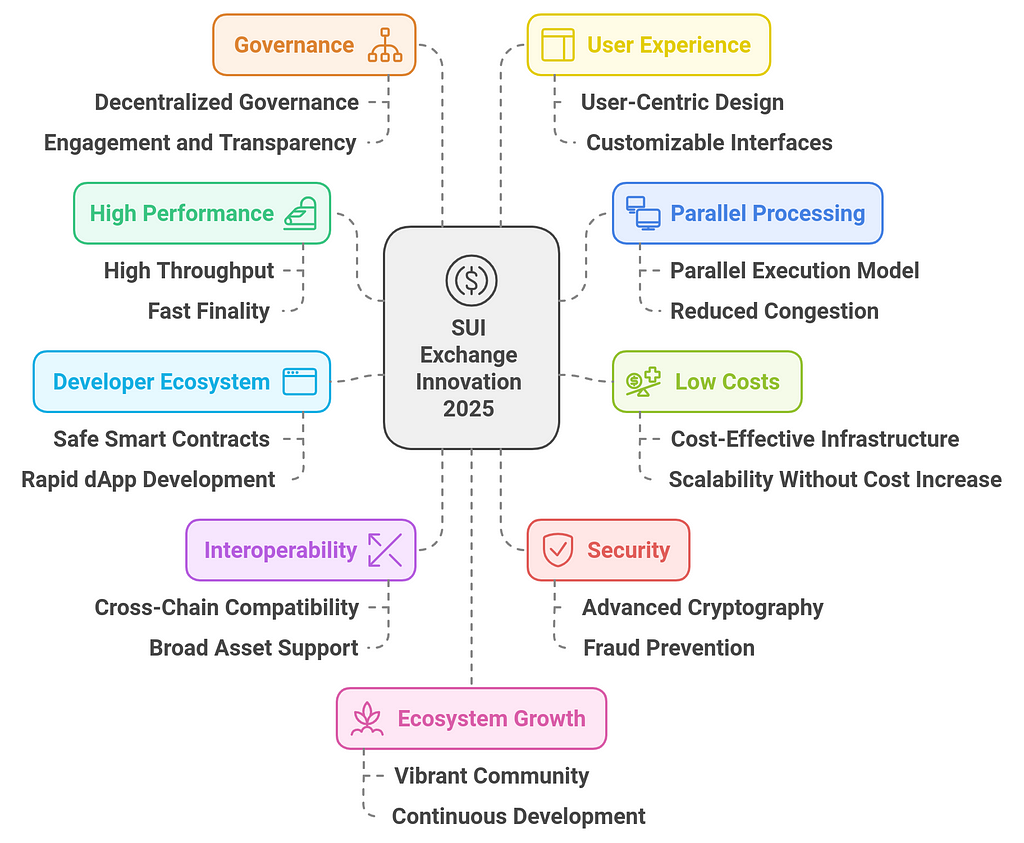

Why SUI is Poised for Exchange Innovation in 2025

SUI is poised for exchange innovation in 2025 due to its unique architecture, high performance, scalability, and developer-friendly features that address the key challenges faced by traditional blockchain networks. As the blockchain space continues to evolve, especially in decentralized finance (DeFi) and digital asset exchanges, SUI stands out as a next-generation blockchain solution. Here’s why it’s positioned to drive exchange innovation in 2025:

1. High Performance and Low Latency

- Unmatched Throughput: SUI’s architecture, powered by the Narwhal and Tusk consensus mechanisms, enables incredibly high transaction throughput, up to thousands of transactions per second (TPS). For exchanges, whether decentralized (DEXs) or centralized (CEXs), this is crucial for handling large volumes of transactions efficiently. With the rise in DeFi trading and NFT markets, a blockchain that can scale quickly and efficiently is necessary for exchanges to accommodate increased activity in the coming years.

- Fast Finality: SUI achieves near-instant finality, meaning that transactions are confirmed in seconds, which reduces the risk of front-running, delays, and errors during high-volume trading periods. This makes it an ideal blockchain for exchanges looking to provide seamless, real-time trading experiences.

2. Parallel Transaction Processing

- Parallel Execution Model: Unlike many blockchain networks that process transactions sequentially, SUI can process multiple transactions in parallel. This allows it to handle a far greater volume of trades without bottlenecks. This parallelization makes SUI uniquely capable of supporting high-frequency trading and complex exchange activities, ensuring that exchanges built on SUI can scale as trading volumes grow exponentially.

- Reduced Congestion: For exchanges, especially those handling large volumes of users and transactions, parallel transaction processing prevents congestion and delays, enhancing the overall user experience. This is particularly important as exchanges face increasing demand for faster trade executions.

3. Low Transaction Costs

- Cost-Effective Infrastructure: SUI’s design optimizes resource usage, resulting in lower transaction fees compared to many other blockchain networks, such as Ethereum. This is crucial for exchanges where high transaction fees can deter users, especially for retail traders engaging in frequent, smaller trades. By reducing the cost per transaction, SUI makes it easier for exchanges to provide competitive fee structures, which can lead to more user adoption and activity.

- Scalability Without Cost Increase: As transaction volumes grow, SUI’s architecture ensures that transaction costs remain low, unlike many other networks where fees increase proportionally with the volume of transactions. This scalability is key to supporting long-term exchange growth without pricing out traders.

4. Developer-Friendly Ecosystem (Move Language)

- Safe and Efficient Smart Contracts: SUI uses the Move programming language, a secure, flexible language specifically designed for creating safe and efficient smart contracts. For exchanges, this is a game-changer because it reduces the risks associated with smart contract vulnerabilities and exploits, while also offering a high degree of flexibility for building custom trading and financial products.

- Rapid dApp Development: With Move, developers can quickly create decentralized applications (dApps) that are optimized for asset trading, lending, borrowing, staking, and other DeFi functionalities. The ease of development encourages innovation, allowing exchanges to roll out new features and tools faster, making SUI a great choice for exchange platforms that want to remain competitive in a fast-moving market.

5. Interoperability and Multi-Asset Support

- Cross-Chain Compatibility: As exchanges look to offer multi-chain support and aggregate liquidity across different blockchain networks, SUI’s interoperability features are crucial. SUI’s ability to seamlessly interact with other blockchains, such as Ethereum, Binance Smart Chain, and Solana, allows exchanges to create cross-chain trading opportunities, enabling users to trade assets from different ecosystems within a single platform.

- Broad Asset Support: SUI’s native asset tokenization and support for various asset classes (e.g., NFTs, DeFi tokens, real-world assets) make it an ideal blockchain for exchanges looking to expand their offerings. Whether it’s a simple token or complex asset-backed security, SUI provides the infrastructure to tokenize and trade a wide variety of assets.

6. Security and Fraud Prevention

- Advanced Cryptography and Security Features: Security remains one of the top concerns for exchanges. SUI’s consensus mechanisms and cryptographic protocols ensure that all transactions are secure and tamper-proof. This prevents fraud, hacking, and other malicious activities that could undermine the trust of users and traders on the platform.

- Prevention of Front-Running: SUI’s low-latency and parallel transaction processing also reduce the risks of front-running in decentralized exchanges. Front-running is a major issue in trading environments, particularly for automated market makers (AMMs), where faster transaction execution can result in unfair advantages. SUI’s ability to quickly confirm transactions helps to create a more fair and transparent trading environment.

7. Built-In Governance

- Decentralized Governance Options: SUI offers a decentralized governance model that can be leveraged by exchanges to enable community-driven decision-making. Exchanges can implement governance mechanisms, allowing token holders to vote on decisions such as protocol upgrades, fee changes, token listings, and more.

- Engagement and Transparency: With on-chain governance, exchanges can be more transparent in their operations, fostering greater trust and engagement within their user base. This decentralized approach also empowers users to have a voice in the evolution of the exchange, which is crucial for long-term growth.

8. Seamless User Experience

- User-Centric Design: SUI’s focus on low latency, high throughput, and ease of use provides an excellent foundation for exchanges to create seamless user experiences. With fast transactions and reduced costs, users can trade assets without worrying about slow confirmation times or high fees.

- Customizable Interfaces: The flexibility provided by SUI’s developer tools allows exchanges to design custom user interfaces tailored to their target audience. Whether it’s a sophisticated professional trading interface or a simple retail trading experience, SUI supports a wide range of exchange designs.

9. Regulatory Compliance and Transparency

- On-Chain Transparency: SUI’s blockchain offers full transparency and traceability of transactions, which can help exchanges comply with regulatory requirements. Users can easily track and verify trades, ensuring accountability and reducing the risk of fraud.

- Programmable Compliance: SUI enables exchanges to implement compliance features directly into smart contracts, such as KYC/AML checks or transaction limits, ensuring that they adhere to regulatory standards without compromising user experience or security.

10. Growing Ecosystem and Community

- Vibrant Developer and User Community: As SUI gains traction in 2025, its growing developer ecosystem and active community will drive innovation and adoption. With continuous development, new tools, and expanding DeFi use cases, exchanges built on SUI can expect to benefit from a thriving ecosystem that supports their growth and provides access to the latest advancements in blockchain technology.

SUI is uniquely positioned to drive exchange innovation in 2025 due to its high-performance blockchain, low-latency transaction processing, scalability, and developer-friendly ecosystem. With features like parallel transaction processing, low transaction fees, high security, and seamless cross-chain interoperability, SUI addresses the critical pain points of traditional and decentralized exchanges. By leveraging SUI’s advanced capabilities, exchanges can create more efficient, secure, and user-friendly platforms that cater to the growing demand for faster and cheaper trading in the blockchain space. With continued development and adoption, SUI is likely to be a dominant force in shaping the future of blockchain-based exchanges.

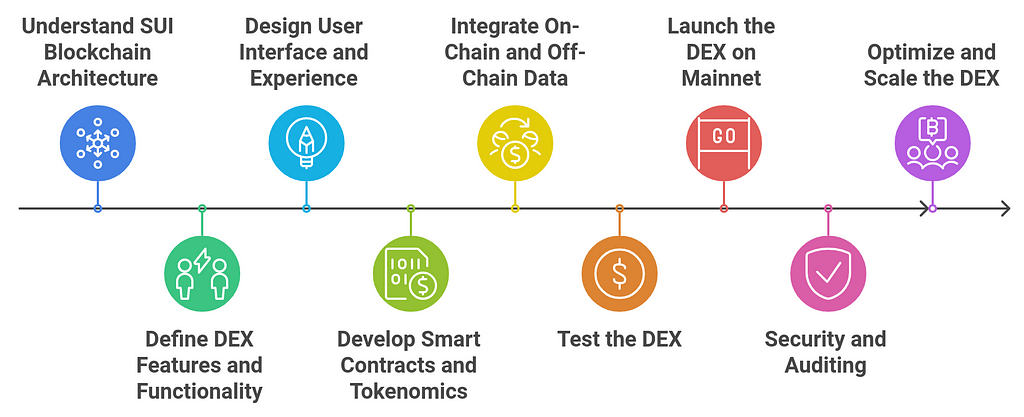

Steps to Build a Decentralized Exchange on SUI

Building a Decentralized Exchange (DEX) on the SUI blockchain requires a series of carefully planned steps, from understanding the blockchain’s architecture to deploying and maintaining the platform. Given SUI’s high throughput, low latency, and flexible features, it’s an ideal blockchain for creating fast and scalable decentralized exchange platforms. Here’s a step-by-step guide to building a DEX on SUI:

1. Understand SUI Blockchain Architecture and Core Features

- Study SUI’s Consensus Mechanism: SUI uses a unique consensus protocol called Narwhal and Tusk, which separates transaction ordering from data availability. This allows for parallel transaction processing and high throughput.

- Learn about the Move Language: SUI’s smart contracts are written in Move, a language designed for security and efficiency. Understanding Move is crucial, as it will be the language used to write the DEX’s smart contracts.

- Explore Object-Oriented Design: SUI’s design treats assets as objects, making it easier to track and manage tokenized assets. This is beneficial for creating a DEX where liquidity and asset ownership are tracked in real-time.

2. Define the DEX Features and Functionality

- Order Matching System: Decide on the type of order book for your DEX, whether it’s an automated market maker (AMM) model (like Uniswap) or a traditional order-book-based exchange (like Binance or Coinbase).

- Liquidity Pools: If using an AMM model, plan out how liquidity pools will be structured. Liquidity providers can deposit assets into these pools to enable trades.

- Token Swapping and Trading Pairs: Create smart contracts for token swaps and determine which token pairs will be supported on your DEX (e.g., SUI-native tokens, stablecoins, wrapped assets).

- Staking and Yield Farming: If your DEX offers additional incentives, such as staking and yield farming, outline how users can earn rewards by participating in the liquidity pools.

3. Design the User Interface (UI) and User Experience (UX)

- Trading Interface: Design a clean and intuitive trading interface where users can view real-time price charts, trading pairs, order books, and past transactions.

- Order Types and Execution: Implement various order types, such as market orders, limit orders, and stop-loss orders, for better trade execution.

- Portfolio and Account Management: Include features for users to view their portfolio, liquidity positions, and transaction history.

- Integration with Wallets: Ensure integration with popular SUI wallets (like SUI wallet or MetaMask if it supports SUI) so users can easily connect and trade on the platform.

4. Smart Contract Development and Tokenomics

- Develop Smart Contracts in Move: Write the smart contracts for the DEX in the Move language. Key components include:

- Token Swap Logic: Create contracts that handle token swaps and determine how assets are exchanged based on liquidity pool data.

- Liquidity Pool Management: Implement logic for adding/removing liquidity, managing liquidity pool shares, and calculating fees.

- Staking and Reward Mechanisms: If your platform supports staking, develop smart contracts that manage staking rewards, APRs, and the locking/unlocking of tokens.

- Tokenomics and Fees: Design the tokenomics model for your exchange, including how fees are structured (e.g., flat fee, sliding scale, etc.) and how rewards are distributed to liquidity providers.

5. Integrate on-Chain and Off-Chain Data

- Oracles for Price Feeds: Integrate price oracles (e.g., Chainlink or SUI-specific oracles) for accurate price data to execute trades and calculate pool balances.

- Off-Chain Data Management: Manage user profiles, transaction logs, and other off-chain data using a secure off-chain storage solution (e.g., IPFS or traditional databases).

- Real-Time Data Updates: Ensure that price charts, order books, and other dynamic data on the exchange are updated in real-time.

6. Testing the DEX

- Test Smart Contracts Locally: Use SUI’s development tools to test your Move smart contracts on a local testnet. This ensures that your token swap, liquidity pool, and staking features are functioning as intended.

- Deploy on SUI Testnet: Once the local testing is successful, deploy your DEX on SUI’s testnet to simulate real-world conditions and identify any potential issues in a controlled environment.

- Stress Testing: Perform stress tests to ensure that the DEX can handle a high volume of transactions without performance degradation. SUI’s high throughput should allow for scalability testing under heavy load.

7. Launch the DEX on the Mainnet

- Deploy on SUI Mainnet: After thorough testing on the testnet, deploy your DEX smart contracts on the SUI mainnet. This will make the platform live and accessible to users.

- User Documentation and Support: Provide clear documentation and user guides to help users understand how to use the DEX, including how to connect wallets, trade tokens, add liquidity, and withdraw funds.

- Governance and Community Building: If your DEX is governed by a community (via a DAO, for instance), ensure that governance mechanisms are in place. This might include voting systems for protocol upgrades, listing new tokens, and fee adjustments.

8. Security and Auditing

- Smart Contract Auditing: Before launching, have the smart contracts audited by a reputable third-party security firm to ensure there are no vulnerabilities or potential exploits.

- Penetration Testing: Perform penetration testing on both the smart contracts and the user interface to identify potential attack vectors and improve the platform’s security.

- Ongoing Security Monitoring: After launch, continue to monitor the platform for security risks and apply patches or upgrades as needed.

9. Optimize and Scale the DEX

- Optimize Gas Fees: SUI’s unique consensus design allows for low transaction fees, but consider optimizations like batching transactions or integrating with Layer 2 solutions (if needed) to further reduce fees.

- Enhance User Experience: Continuously improve the user interface based on feedback from users. Features like multi-chain support, slippage tolerance settings, and limit order book views may be added to enhance the platform.

- Scaling the Platform: As trading volume grows, monitor the performance and optimize the infrastructure to ensure continued high performance and scalability.

10. Marketing and Community Engagement

- Community Incentives: Launch community incentives to encourage early adoption. Consider offering liquidity mining or staking rewards for users who provide liquidity to your pools.

- Partnerships and Integrations: Partner with other DeFi projects, blockchain protocols, and liquidity providers to increase your DEX’s liquidity and user base.

- Ongoing Communication: Engage with your community through social media, developer forums, and live AMAs to keep users informed about new updates, token listings, and other key developments.

Building a decentralized exchange (DEX) on the SUI blockchain involves a series of strategic steps, from understanding SUI’s architecture and smart contract development to deploying and maintaining a live platform. By leveraging SUI’s scalability, low latency, and parallel transaction processing, you can create a high-performance exchange that provides fast, secure, and seamless trading for users. Throughout the process, prioritizing security, user experience, and community engagement will be key to ensuring the success and adoption of your platform in the competitive blockchain space.

The Regulatory Landscape and Compliance

The regulatory landscape and compliance for blockchain and cryptocurrency platforms have become increasingly complex as governments and regulatory bodies around the world seek to address the rapid growth of decentralized technologies. In many regions, blockchain-based platforms are subject to varying regulations, often focusing on financial stability, consumer protection, and anti-money laundering (AML) efforts.

Cryptocurrencies and blockchain applications, such as exchanges and decentralized finance (DeFi) platforms, must navigate a patchwork of rules, including Know Your Customer (KYC) requirements, reporting obligations, and tax compliance. Regulatory frameworks are evolving, with some countries opting for strict oversight while others adopt more progressive or experimental approaches to foster innovation.

Compliance with these laws is critical for the long-term success and legitimacy of blockchain projects. Furthermore, maintaining transparency, providing accurate disclosures, and ensuring robust security measures are essential to meet regulatory standards and protect users. As blockchain technology continues to grow, it will be crucial for developers, businesses, and investors to stay informed of the regulatory shifts to mitigate legal risks and ensure their platforms are compliant with both local and international laws.

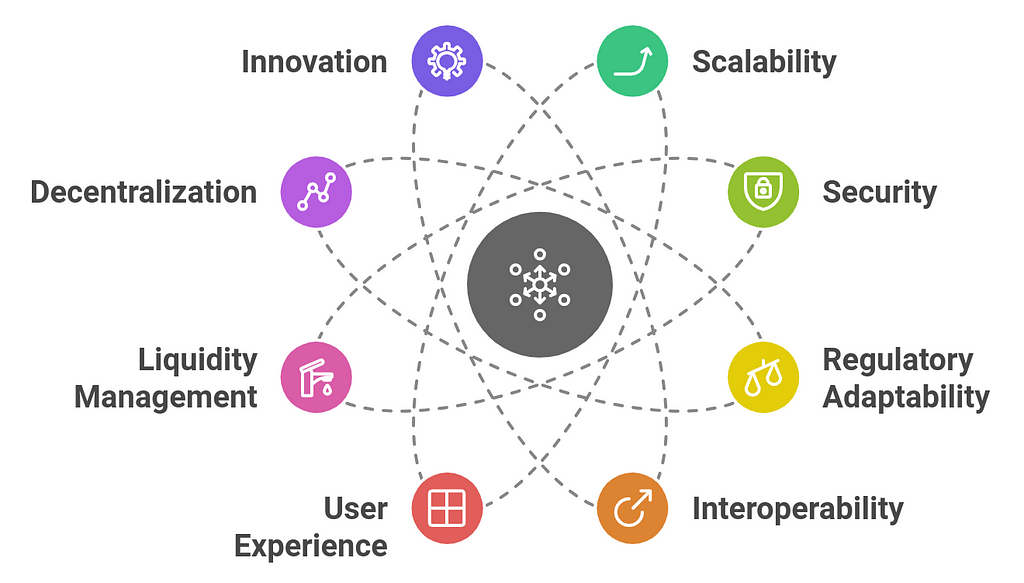

Future-Proofing Your Blockchain Exchange

Future-proofing your blockchain exchange is crucial to ensuring that it remains competitive, secure, scalable, and adaptable to emerging trends and technologies in the fast-evolving blockchain space. With the rapid advancements in blockchain technology, decentralized finance (DeFi), and user expectations, it’s important to design and develop your exchange with flexibility and long-term sustainability in mind.

Here’s how you can future-proof your blockchain exchange:

1. Scalability and High Throughput

- Leverage Layer 2 Solutions: Integrate Layer 2 scaling solutions like Optimistic Rollups, zk-Rollups, or sidechains to offload transaction load from the main chain and significantly reduce fees and transaction times.

- Cross-Chain Interoperability: Ensure your exchange supports trading across multiple blockchains (e.g., Ethereum, Solana, Polkadot, SUI, Avalanche, etc.). Interoperability can be enabled through cross-chain bridges, atomic swaps, or liquidity aggregators, allowing your exchange to evolve with the growing blockchain ecosystem.

- Support for High-Volume Transactions: As your exchange grows, it will need to handle increasing numbers of trades per second. Choose blockchains with high throughput or those that are optimized for decentralized exchanges, like SUI or Solana, to ensure smooth scaling.

2. Security and Compliance

- Continuous Security Audits: Regularly audit your platform’s smart contracts, codebase, and security protocols. Engage with third-party security firms and conduct penetration testing to identify vulnerabilities.

- Multi-Signature Wallets and Cold Storage: Use multi-signature wallets for key management and store the majority of assets in cold storage to reduce the risk of hacks.

- Robust Identity and Privacy Solutions: Incorporate decentralized identity (DID) protocols and zero-knowledge proofs (ZKPs) for privacy and user authentication. This helps in ensuring user data security while complying with KYC/AML regulations in various jurisdictions.

3. Adaptability to Regulatory Changes

- KYC/AML Compliance: Stay ahead of regulatory changes by ensuring that your exchange is ready to implement KYC/AML measures as required by evolving legal frameworks. Integrate with identity verification solutions and provide transparent reporting features for tax compliance.

- Decentralized Governance (DAO): Implement decentralized governance, allowing token holders or community members to participate in decision-making. This includes voting on regulatory updates, token listings, or fee changes, which ensures your platform remains flexible to legal and market shifts.

- Multi-Jurisdiction Support: As blockchain regulation evolves, build a legal infrastructure that can easily adapt to different countries’ regulations. This may include geo-restricted access, local compliance with regulations, and tax reporting.

4. Interoperability and Cross-Chain Functionality

- Blockchain Agnostic Architecture: A blockchain-agnostic architecture allows your exchange to support multiple blockchain ecosystems and token standards, offering your users the ability to trade a variety of assets without being limited to one chain.

- Cross-Chain Liquidity Solutions: Use cross-chain liquidity aggregators to enable seamless trading of assets from different blockchains. This can be achieved through liquidity pools or cross-chain swaps.

- Atomic Swaps and Bridge Technologies: Implement atomic swap technology, enabling direct peer-to-peer trading of tokens from different blockchains without requiring a trusted intermediary. Also, integrates with blockchain bridges to allow asset transfers across different chains.

5. User Experience (UX) and Interface Innovation

- Mobile-First Design: Build a responsive, mobile-first user interface that adapts to the increasing use of mobile devices for trading. This includes providing easy-to-use apps with advanced features like real-time price updates, customizable portfolios, and secure wallet integrations.

- AI and Machine Learning: Integrate AI-powered features to enhance trading experiences, such as predictive analytics, algorithmic trading bots, and personalized recommendations. AI can also be used to improve customer support through chatbots and fraud detection systems.

- Customizable Dashboards: Let users personalize their experience with customizable dashboards that show the information they care about most. Include advanced charting tools, market analysis, and transaction history filters for professional traders.

6. Liquidity Management and Enhanced Trading Features

- Automated Market Making (AMM) and Order Books: Depending on your exchange model, you can integrate AMM-based pools (like Uniswap) or a traditional order-book system to meet the needs of different traders. Both systems have their advantages: AMMs offer easier liquidity provision, while order books can cater to high-frequency traders.

- Liquidity Aggregation: Integrate liquidity aggregators to pull liquidity from multiple exchanges and liquidity pools to reduce slippage and enhance price stability.

- Advanced Order Types: Support for advanced order types such as limit orders, stop-loss, margin trading, futures, and options will attract more sophisticated traders to your platform.

- Staking and Yield Farming: Provide opportunities for liquidity providers and token holders to earn rewards through staking or yield farming programs. This enhances the appeal of your platform to long-term users and liquidity providers.

7. Decentralization and Governance

- DAO Integration: Establish a Decentralized Autonomous Organization (DAO) that allows token holders to vote on important decisions, such as governance, protocol upgrades, and community initiatives. A DAO can help you scale governance as your user base grows.

- User-Controlled Assets: In line with the principles of decentralization, allow users to retain full control of their private keys and assets. This is especially important for decentralized exchanges (DEXs) and platforms that aim to provide trustless trading.

- Community Involvement: Encourage community participation by hosting bounties, hackathons, and liquidity mining programs. Engage with your user base to refine features, introduce new assets, and improve the platform.

8. Continual Upgrades and Innovation

- Modular and Upgradable Architecture: Develop your exchange with a modular architecture that supports future upgrades without disrupting the user experience. Utilize smart contract upgradability mechanisms like proxy contracts or self-upgrading protocols.

- Integration with Emerging Technologies: Stay informed about the latest blockchain and fintech trends, such as NFTs, DeFi protocols, synthetic assets, and cross-chain protocols. Integrate these technologies as they gain traction to stay ahead of competitors.

- Layer 2 and Sidechain Expansion: Keep an eye on the evolution of Layer 2 solutions and consider adopting them as they improve scalability, reduce costs, and enable faster transactions.

9. Sustainability and Ecosystem Development

- Energy-Efficient Blockchain Integration: Choose energy-efficient blockchains or layer-2 solutions to reduce the carbon footprint of your exchange. This not only supports sustainability but also aligns with global shifts toward environmental responsibility.

- Partnerships and Ecosystem Building: Build strategic partnerships with DeFi projects, blockchain protocols, and financial institutions. This helps increase your exchange’s reach, liquidity, and overall ecosystem integration.

- Education and Community Outreach: Build educational resources to help users navigate the complexities of blockchain, trading, and security. Hosting tutorials, webinars, and community events can foster loyalty and user engagement.

10. Advanced Analytics and Reporting

- Blockchain Analytics Tools: Integrate advanced blockchain analytics to provide insights into market movements, transaction volumes, liquidity depths, and price patterns. These tools help users make informed trading decisions and also aid in platform monitoring.

- Tax and Compliance Reporting: Provide tools for users to generate tax reports and track their trading activity. This is particularly important as governments worldwide look to impose regulations on cryptocurrency trading and taxation.

- Real-Time Risk Monitoring: Use AI-driven risk management tools to detect abnormal trading patterns, potential security breaches, or market manipulation.

Future-proofing your blockchain exchange requires a holistic approach that combines scalability, security, compliance, and continuous innovation. By building a platform that is adaptable to new technologies, regulatory changes, and user needs, you can ensure that your exchange remains competitive and sustainable in the rapidly evolving blockchain landscape. Implementing advanced features like cross-chain interoperability, decentralized governance, AI-enhanced trading, and modular infrastructure will position your platform for long-term success, attracting a growing user base while maintaining a secure and efficient ecosystem.

Conclusion

In conclusion, building a high-performance SUI blockchain exchange in 2025 is not only achievable but essential for staying competitive in the rapidly evolving crypto space. By harnessing the power of SUI’s unique architecture featuring scalability, low-latency, and high throughput, developers can create an exchange that offers both speed and efficiency. Integrating cutting-edge security measures ensures that user assets remain protected, while a focus on seamless user experience guarantees that both novice and experienced traders have easy access to the platform’s features.

Moreover, continuous optimization of backend systems and infrastructure is vital for handling increased traffic and reducing operational costs. The success of such an exchange will depend on the ability to innovate consistently, stay ahead of technological advancements, and address the dynamic needs of the market. By prioritizing these elements, a SUI blockchain exchange in 2025 can not only meet the demands of today’s users but also adapt to the challenges and opportunities of the future, positioning itself as a leading platform in the blockchain ecosystem.

How Can a High-Performance SUI Blockchain Exchange Be Built in 2025? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

3 months ago

48

3 months ago

48

English (US) ·

English (US) ·