The post How Donald Trump’s Presidency Could Fuel a Bitcoin Price Surge! appeared first on Coinpedia Fintech News

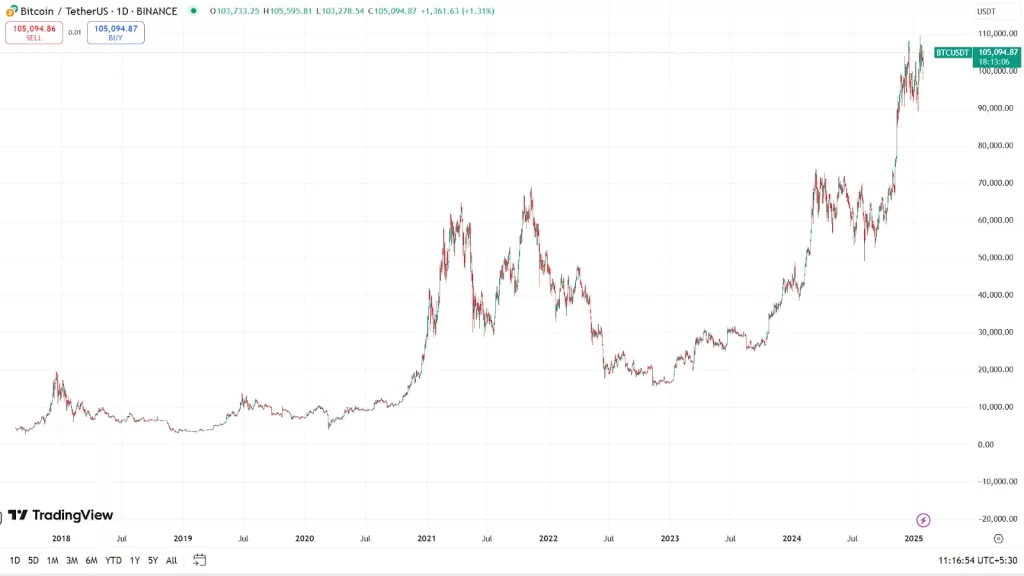

In 2014, Bitcoin showed a change of -57.6%. In 2018 and 2022, it also showcased -73.3% and -64.3% changes, respectively. This implies that the Bitcoin market follows a four-year boom and bust cycle. In short, every fourth year, the market experiences a crash. In that sense, the year 2026 may be a tough year for BTC.

A recent statement from Matt Hougan, the Global Head of Research for Bitwise Asset Management, indicates that not many experts believe BTC would experience a severe crash in 2016. Why? Curious to know more? Read on!

Bitcoin’s Traditional 4-Year Cycle Explained

The -57.6% change that the Bitcoin market recorded in 2014 was the lowest in the first cycle. In 2011 and 2012, the market experienced +1,435% and +183.5% change, respectively. In 2013, the third year of the cycle, the market demonstrated a massive growth of +5,435%.

Likewise, the -73.3% decline that the BTC market registered in 2018 was the lowest in the second cycle. In 2015 and 2016, the market saw +34.4% and +123.8%, respectively. In 2017, the market reported an impressive growth of +1,369%.

The scenario was not different in the third cycle, in which the market reported a change of -64.3% in the fourth year (2022), except for the market’s inability to perform better than second year’s +304.1 in the third year (+59.6%).

Causes of the Past Crypto Market Crashes

One of the primary reasons for the Bitcoin market’s collapse in 2014 was the failure of Mt. Gox. In 2018, the main reason was the Securities and Exchange Commission’s crackdown on Initial Coin Offerings. In 2022, the cause was the bankruptcies of major players like FTX, Three Arrows Capital, Celsius and BlockFi.

Could the Bitcoin Cycle Change?

Considering the historical trend, it is reasonable to expect a crash in 2026. Then, why do experts like Matt Hougan disagree?

Well! Hougan’s primary argument is that the crypto market is far more mature than it was in 2014, 2018 or 2022.

The political climate in the US shifted in favour of the crypto industry after Donald Trump’s victory last November.

Soon after assuming office as the president of the United States, he signed an executive order, aimed at bringing more clarity to the crypto regulation framework and exploring the possibility of creating a digital assets reserve for the country.

Experts like Hougan believe that this development could bring trillions of dollars into the Bitcoin market.

Highlighting the favourable environment created by the withdrawal of the controversial Staff Accounting Bulletin 121 rule, which required financial firms holding crypto to record them as liabilities on their balance sheets, Hougan, in a recent statement, shared his extreme optimistic view about the BTC market. However, he added that Bitcoin may not see the impact of these developments immediately.

Bitcoin’s Price Prediction

Hougan forecasted that the Bitcoin market will reach as high as $200,000 before the end of this year 2025. Interestingly, he claimed that the creation of a Bitcoin reserve by the US is not a prerequisite to achieving this price milestone.

Bitcoin’s four-year cycle has been a strong pattern in the past, but Trump’s crypto-friendly policies and Wall Street’s increasing involvement may change the game. While 2026 could still bring volatility, experts believe the market is stronger than ever. With predictions of $200,000 BTC by 2025, the coming years could reshape the future of crypto.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

7 months ago

32

7 months ago

32

English (US) ·

English (US) ·