Data-driven Bitcoin Price Prediction.

It’s a new day, and Bitcoin sets yet a new all-time high, now trading at $84k. There is a lot of anticipation and speculation in the air, and greed is really starting to kick in.

I’ve seen predictions anywhere between $100k to $500k and over, and I wanted to give my take on where the market, and naturally Bitcoin, is ultimately headed for during this bull run.

Note that, at best, this is just an educated guess based on the available information and in no way an absolute target.

For our analysis, we’ll be mainly looking at:

- Market Data

- ETF Impact

- Political and other Macro factors

Bitcoin Market Data Prediction

If we go purely by market trends based on the Bitcoin halving cycles and do not include any other external factors, we’re looking at an all-time high for this bull run of around $120,000 US dollars. Let’s break it down.

The Bitcoin Halving Cycle

Bitcoin is programmed to half its mining rewards roughly once every 4 years, or once every 210,000 blocks, to be more precise. On average, each block takes about 10 minutes to complete, hence the 4 year period.

This has a profound impact on the Bitcoin supply, which historically has been a consistent indicator preceding a new bull run.

Post-halving price movement

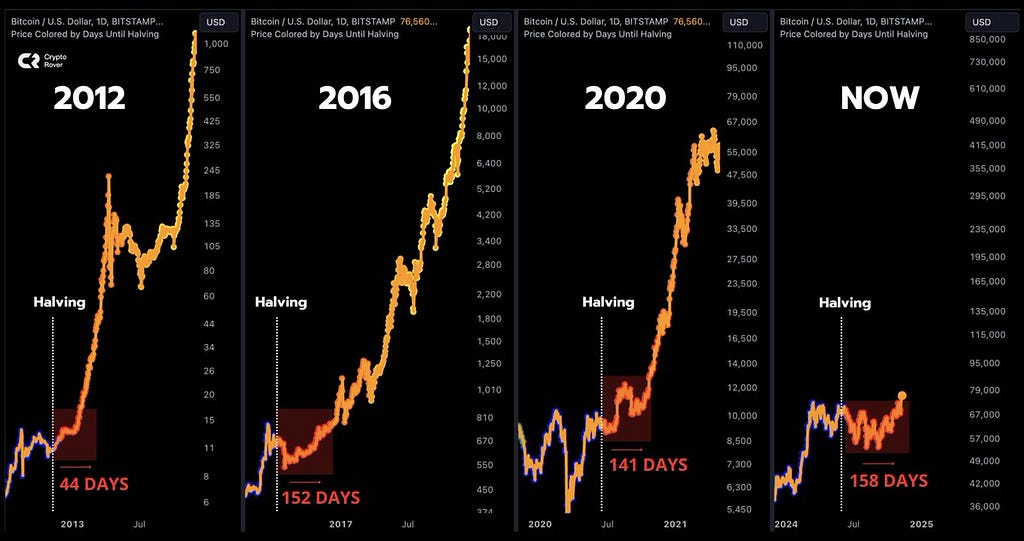

Now, what’s really going to bake your noodle is we can plot and predict the Bitcoin all-time high based on the existing pattern. The bull cycle doesn’t reach its peak until about a year (give or take a couple of months) after the halving.

Take a look at the above chart for a second. You’ll see that regardless of when the halving actually took place (whether it’s April, July, or November), a new all-time high always happens in November the following year.

In this cycle, that would be November 2025. Assuming the date remains consistent, we just plot the price based on our trendline.

One way to do this is to draw a resistance line at the peak of each bull market cycle. The final step is to check where the resistance line crosses November 2025. According to this trendline, we’re looking at a potential price of around $120,000 for this bull run around this time next year.

However, there may very well be considerably more upside to this, as we will continue to explore below.

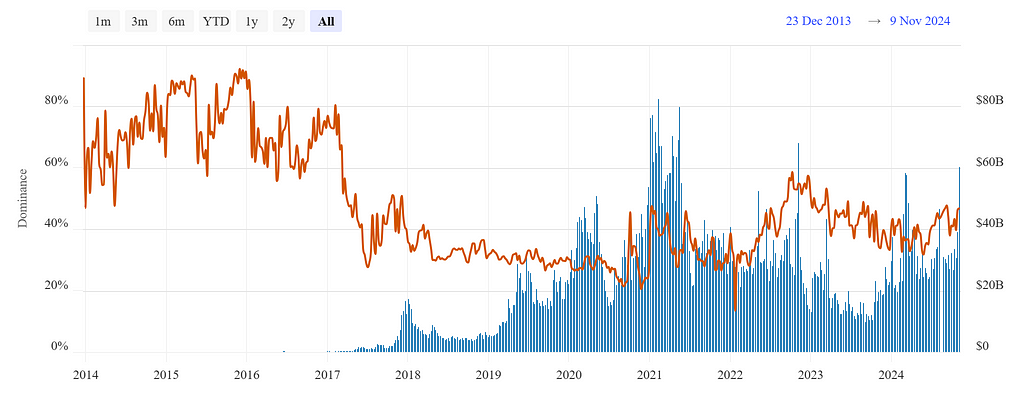

Bitcoin Daily Trading Volume

The chart below shows the daily Bitcoin trading volume according to CoinMarketCap data.

We haven’t even reached the previous all-time high levels of volume, confirming that there is still quite a bit of upside left.

Bitcoin ETF Impact

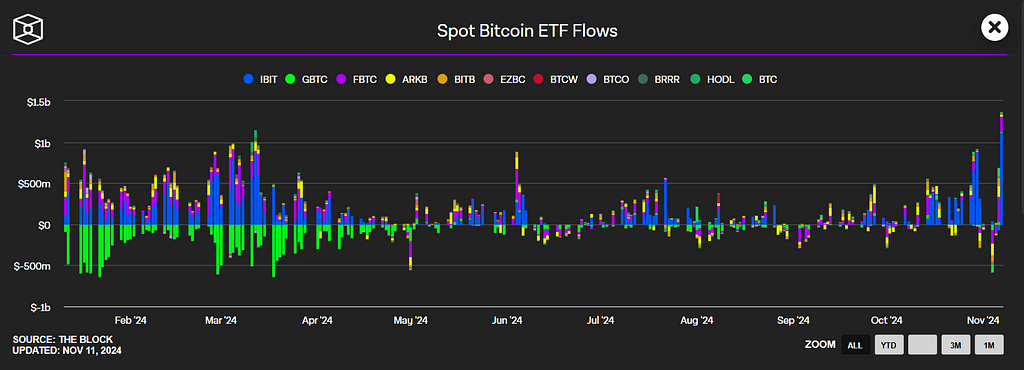

This section seeks to highlight the impact of institutional adoption. On November 11, 2024, BTC ETF inflows broke $1.3B — the highest-ever figure we’ve seen so far.

However, this is where you can really gauge the potential. As of today, the total Cryptocurrency market cap is at a record high of $3.14 Trillion US dollars.

Binance, the biggest cryptocurrency exchange, has recorded a Spot volume of over $5 billion US dollars, and about 50% of those are buys — or in-flows.

That means that currently, Binance is experiencing twice as much Bitcoin inflow volume than all other ETF offerings combined.

Now consider that the Global Stock Market — which ETFs are a part of — has an estimated market cap of over $110 Trillion US dollars — nearly x40 bigger than the total cryptocurrency market cap.

The fact that Binance is seeing considerably more inflows than all ETF offerings combined is extremely bullish. It means that retail is not in. But that might not be for long.

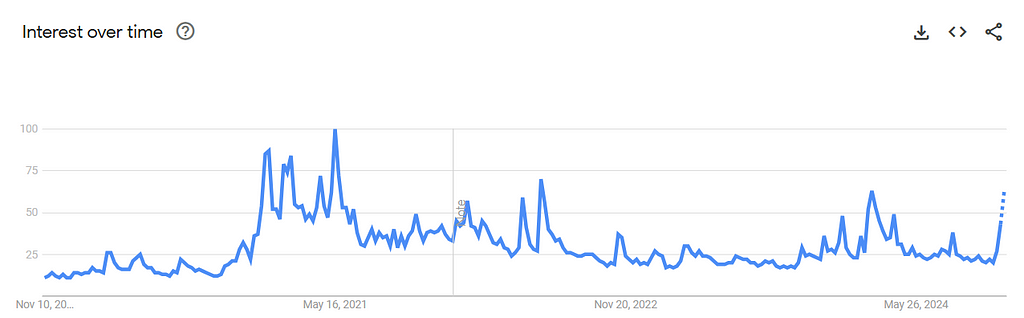

Bitcoin Google Trends Data

Google Trends shows a sharp uptick in Bitcoin searches recently, reaching local highs, but there’s plenty more room to grow before recording a new all-time high in searches.

This supports the theory that retail is not in yet — but well on its way.

This section is not so much predicting a specific price but rather making the case that while we’re on our way to target $120,000 — there’s more, and I mean a lot more upside this market cycle.

It’s entirely possible for Bitcoin to break through the $120,000 resistance, which is why most predictions should be taken with a pinch of salt.

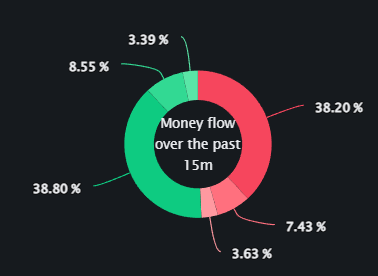

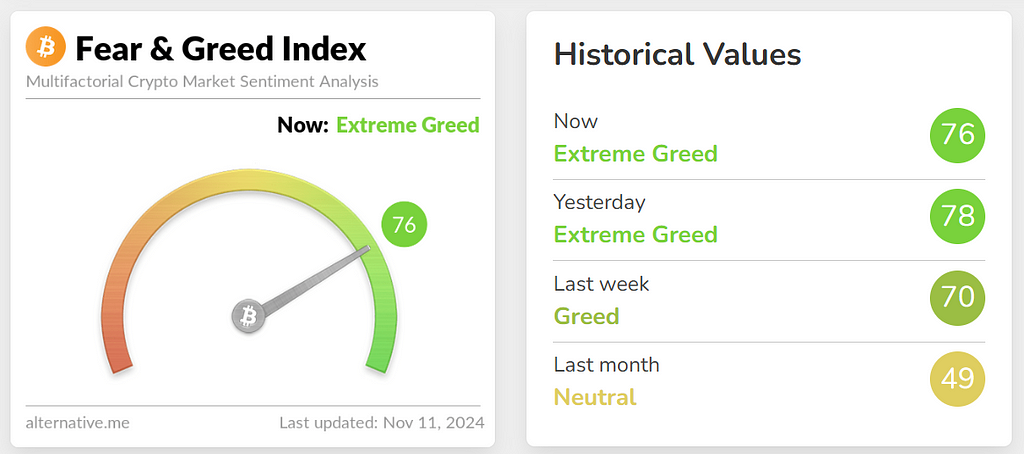

Bitcoin Fear and Grid Index

This one’s not so much of a long-term indicator, but I decided to throw it into the mix anyway for anyone looking for more short-term decisions.

The needle is in the Extreme Greed territory. This is a dangerous territory, as money keeps flowing in and pressure builds towards an inevitable correction.

This is not to say that it will happen right away — but any rally eventually sees a correction.

In the previous bull run, we saw a strong rally, a sharp correction followed by a very short period of consolidation, and then another massive rally.

The only difference is that we’re a bit early for that during this cycle — which means we could go higher than $120,000.

Political Impact

One of Trump’s key promises is to establish a strategic Bitcoin reserve for the U.S., aligning with proposals by prominent pro-Bitcoin lawmakers like Senator Cynthia Lummis.

Naturally, this could drive institutional interest and set a precedent for other nations to follow, thereby boosting Bitcoin’s status as a digital reserve asset. This would not only strengthen Bitcoin’s price but also its credibility as a store of value, akin to gold.

We’re still waiting for an official plan to be outlined by the administration. However, Robert F. Kennedy Jr. was more specific in his plans, stating that he would begin purchasing 500 BTC daily until reaching a total of 4 million BTC.

This would represent nearly 20% of Bitcoin’s total supply, potentially exerting significant upward pressure on its price due to the reduction in circulating supply.

Conclusion

To sum it all up — the most conservative estimate for this run would be $120,000, however, with institutional adoption starting to roll in and potential plans for the US government to roll out a strategic Bitcoin reserve plan — the bull case for Bitcoin could look a lot more optimistic.

Thank you for reading this article. Hopefully, you found this article useful! If you did — please give this article some love and clap a few times.

Finally, if you’re into algo trading, check out algo trading platform Aesir. Aesir makes trading bots easy and can help you manage your wealth effectively!

How high can Bitcoin get this bull run? was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

39

2 months ago

39

English (US) ·

English (US) ·