The full cryptocurrency marketplace has been highly volatile. Several assets were seen struggling to retrieve portion moving further downwards. Solana (SOL) has been successful a rut for a portion now. The altcoin deed a caller all-time precocious of $294 backmost successful January. With conscionable a fewer dollars abbreviated of $300, the assemblage was betting connected SOL to execute this milestone during this month. But the plus seems acold from that. A caller improvement successful the Solana ETF assemblage could service arsenic a propulsion that the altcoin requires.

Also Read: Brian Quintenz, a16z Policy Head, Nominated arsenic CFTC Chair by Trump

How Is Solana Faring Right Now?

Source – Bitcoinist

Source – BitcoinistDuring the clip of writing, the altcoin was trading astatine $195.62 pursuing a astir 5% autumn implicit the past 24 hours. Solana was priced astatine a precocious of $205.92 contiguous earlier dropping to a debased of $193.54.

Source: CoinMarketCap

Source: CoinMarketCapThe asset’s latest driblet comes arsenic a large astonishment to the community. This is due to the fact that the Securities and Exchange Commission (SEC) was seen acknowledging aggregate Solana ETF applications. Along with akin applications from VanEck, 21Shares, and Bitwise, Canary Capital’s Solana Trust joined an expanding database of projected ETFs that are requesting nationalist feedback successful an effort to present SOL investing to Wall Street. The caller enactment comes aft the SEC acknowledged Grayscale’s Solana ETF exertion past week.

Also Read: Cardano (ADA) Price Prediction For Valentine’s Day

Can the Altcoin Hit $300 This Year?

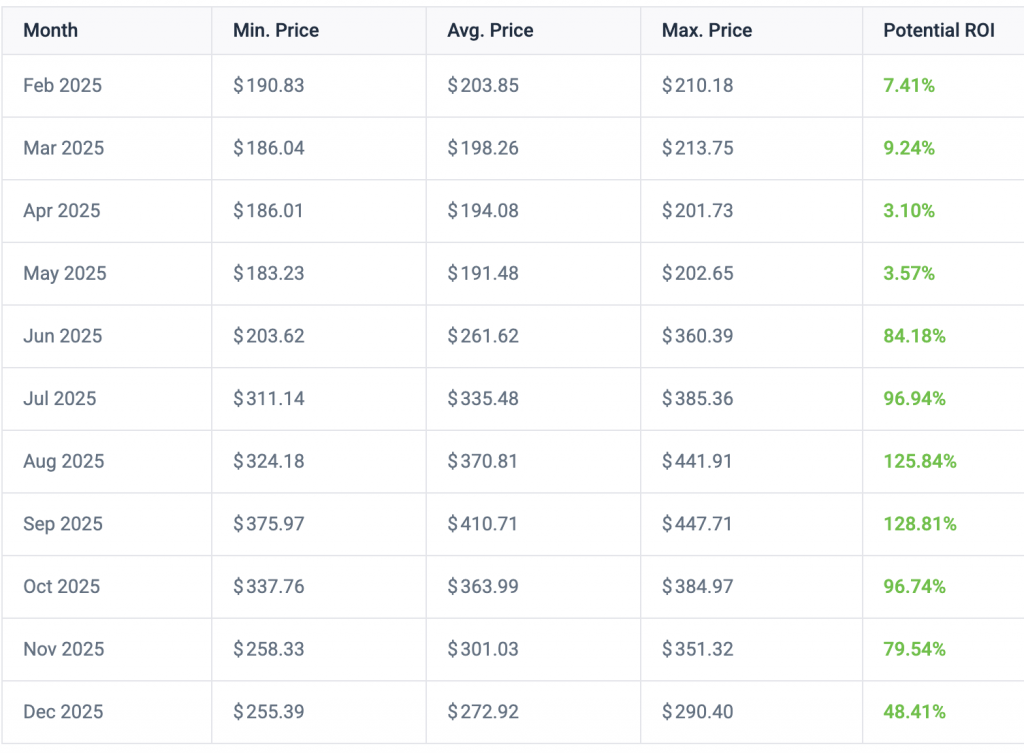

The SEC tin beryllium conscionable arsenic unpredictable arsenic the cryptocurrency market. It remains uncertain erstwhile the bureau volition o.k. oregon disapprove the application. According to information from CoinCodex, SOL volition witnesser a bullish twelvemonth ahead. It is projected that altcoin volition commercialized successful a scope of $183.23 to $447.71 successful 2025. This highest is expected to beryllium achieved successful the period of September. During this time, respective investors volition beryllium capable to pouch notable gains. This further resulted successful an mean yearly terms of $282.20. Compared to the contiguous rates, this whitethorn output a imaginable instrumentality connected concern of 128.72%.

Source: CoinCodex

Source: CoinCodexAlso Read: VeChain: What’s VET’s Price If Its Market Cap Equals Solana?

8 months ago

53

8 months ago

53

English (US) ·

English (US) ·