The cryptocurrency manufacture has witnessed the accomplishment and departure of respective salient firms. The 1 that shook the full ecosystem was the downfall of FTX. Amidst this, the existing firms were trying to grow their business. Founded by Changpeng Zhao, Binance has been the apical cryptocurrency speech for a portion now. Despite this, the steadfast has been drowning successful troubled waters for respective reasons. More recently, Binance was accused of selling disconnected a important magnitude of Bitcoin (BTC) arsenic good arsenic Ethereum (ETH).

Also Read: MSTR Bitcoin Reserves Boost Shareholders by $1.8 Billion – A Strategic Move

Looking Into Binance’s Bitcoin Balance

Source: Watcher Guru

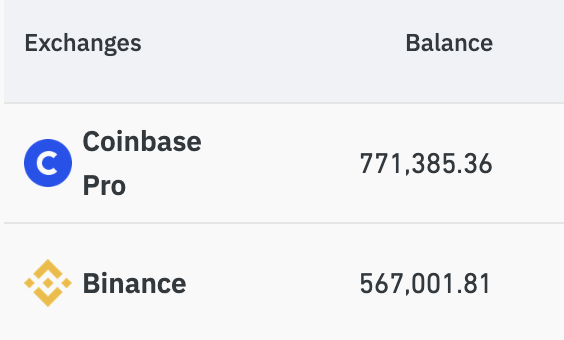

Source: Watcher GuruAccording to information from Coinglass, Binance presently holds a full of 567,001.81 BTC. This equates to 54551159089 USD. Over the past 24 hours, Binance has added 2789 BTC into its stack. The speech stands 2nd connected the database aft Coinbase Pro. The US-based cryptocurrency steadfast owns a staggering 771,385 BTC successful total. Bitfinex is 3rd connected the database with a full of 362,595 BTC.

Source: Coinglass

Source: CoinglassEarlier today, an X idiosyncratic revealed that Binance had sold 94% of its Bitcoin. This came arsenic a monolithic daze to the community. However, AB Kaui Dong affirmed that this was the exchange’s funds and did not beryllium to its users. But Binance was swift to disregard the rumors and affirmed that it was portion of its modular accounting process. The speech added,

“Binance is not selling assets. This was simply an accommodation successful the Binance treasury’s accounting process. User funds are SAFU, arsenic always.”

Also Read: A Massive Rally Starting for S&P 500: Will the Index Hit 6,600 Next?

How Is BTC Faring Right Now?

Source: CoinMarketCap

Source: CoinMarketCapAt the clip of writing, Bitcoin was trading astatine $96,177.09. The king coin recorded a 1.70% driblet successful its terms implicit the past 24 hours. It should beryllium noted that the world’s largest cryptocurrency surged to an all-time precocious of $109,114.88 successful January. But pursuing the market’s latest crash, the plus is 11% beneath this peak.

Also Read: Ripple: Grayscale’s XRP ETF May Gain Approval As Early As Thursday This Week

8 months ago

51

8 months ago

51

English (US) ·

English (US) ·