The cryptocurrency market is currently facing turbulence following reports of a U.S. investigation into Tether, one of the market’s most crucial stablecoins.

As uncertainty looms, the implications of this investigation could have far-reaching effects on the broader crypto ecosystem. The potential outcomes could reshape market trends, influence investor behavior, and alter liquidity dynamics, as the industry waits for more details on the situation.

WSJ Report and Tether’s Response

The WSJ recently reported that U.S. authorities are investigating Tether (USDT). This report has caused concern among market participants, leading to increased speculation about potential outcomes.

However, Tether’s CEO has denied the existence of any such investigation, stating that no inquiries are currently taking place. This contradictory information has added to the uncertainty, keeping investors on edge as they await further clarification.

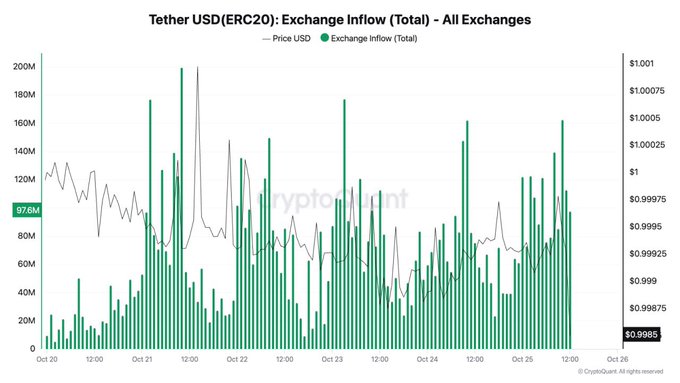

From an on-chain data perspective, USDT inflows to exchanges remain at a normal level, suggesting that traders have not yet made drastic shifts away from the stablecoin. Nevertheless, the price of USDT has experienced a slight decline, indicating that some market participants may be adjusting their positions in response to the news.

Tether’s Role in the Cryptocurrency Market

Tether (USDT) is a key player in the digital asset space, often serving as a bridge between traditional and crypto markets. Its value is pegged to fiat currencies, providing stability amidst crypto’s well-known volatility. Many investors and traders use USDT to move in and out of more volatile assets like Bitcoin and other altcoins, making it a preferred tool for maintaining liquidity.

However, any uncertainty around the stablecoin issuer’s stability can create significant market ripples. The recent reports about a U.S. investigation into Tether’s practices have raised concerns about the transparency of its reserves and its overall regulatory standing.

If this investigation reveals serious issues, it could disrupt the usage of USDT across global exchanges, impacting liquidity and the overall flow of funds in the crypto market.

Potential Shifts in Investor Behavior

The reports of an investigation into Tether have already sparked apprehension among investors. This unease has contributed to a temporary dip in cryptocurrency prices, as traders brace for potential disruptions. Historically, Tether-related concerns have been followed by increased volatility, yet they have also triggered significant market rebounds.

For example, past instances of uncertainty around the stablecoin issuer have often coincided with substantial surges in Bitcoin’s price. Following USDT-related controversies in January 2019, Bitcoin gained 268%, while a similar situation in December 2020 saw Bitcoin rise by 255%. More recently, in June 2023, another bout of Tether-related uncertainty preceded a 200% increase in Bitcoin’s value.

This historical trend has led some market analysts to suggest that concerns over Tether could once again precede a bullish turn in the market. Investors might move out of USDT into riskier assets like Bitcoin and altcoins, potentially driving up their prices if confidence returns.

Impact on USDT Dominance and Market Liquidity

The investigation into the stablecoin issuer could also influence USDT’s dominance in the cryptocurrency market, referring to the proportion of the stablecoin issuer’s market capitalization compared to other digital assets. USDT dominance has been on a downtrend since March 2024, and the news of the investigation has put further pressure on this trend.

A decline in USDT dominance generally indicates that investors are seeking higher-risk assets, suggesting an increased appetite for alternatives such as Bitcoin and other cryptocurrencies.

As investors shift away from USDT, liquidity may become more dispersed across other cryptocurrencies, resulting in a more diversified market structure. This shift could enhance the trading volumes of other digital assets, potentially setting the stage for a broader market rally. However, if the investigation results in restrictions or reduced access to USDT, some exchanges and traders might face challenges in maintaining liquidity, affecting their ability to trade smoothly.

Broader Economic and Regulatory Repercussions

The implications of a U.S. investigation into Tether extend beyond the crypto market, potentially affecting broader financial stability. In several countries, particularly those with unstable banking systems, stablecoins like Tether have become a critical medium for transactions. Disruptions to USDT could push users back into less stable currencies, exacerbating financial challenges in these regions.

Moreover, regulatory scrutiny on the stablecoin issuer could prompt calls for greater transparency across the entire stablecoin sector. This could result in more rigorous oversight for other stablecoin issuers, aiming to ensure that their reserves are fully backed and verifiable. While tighter regulations might increase confidence among institutional investors, they could also limit the flexibility and innovation that has characterized the crypto market.

At the same time, scrutiny of centralized stablecoins like Tether could encourage interest in decentralized finance (DeFi) solutions. Decentralized stablecoins, designed to operate without a central issuer, might see increased adoption as investors seek alternatives that offer greater transparency.

The post How The Tether Investigation Could Impact The Crypto Market? appeared first on CoinGape.

2 weeks ago

36

2 weeks ago

36

English (US) ·

English (US) ·