The crypto market celebrated the fourth Bitcoin halving on April 20, but Bitcoin and crypto prices didn’t see a significant rally or major upside. Traders are actually awaiting the first crypto market expiry after the Bitcoin halving, which is also a monthly expiry and can cause more volatility. Deribit reported over $9.4 billion in crypto options are set to expire this Friday.

$9.4 Billion in Crypto Options Expiry

The overall optimism after the Bitcoin halving remains bullish and investors hold Bitcoin price above $66,000. As crypto market sentiment by the Fear & Greed Index indicates an uptick in sentiment, with an increase in sentiment from 57 (neutral) to 72 (greed), the market participants are waiting for some headwinds to disappear before taking new positions.

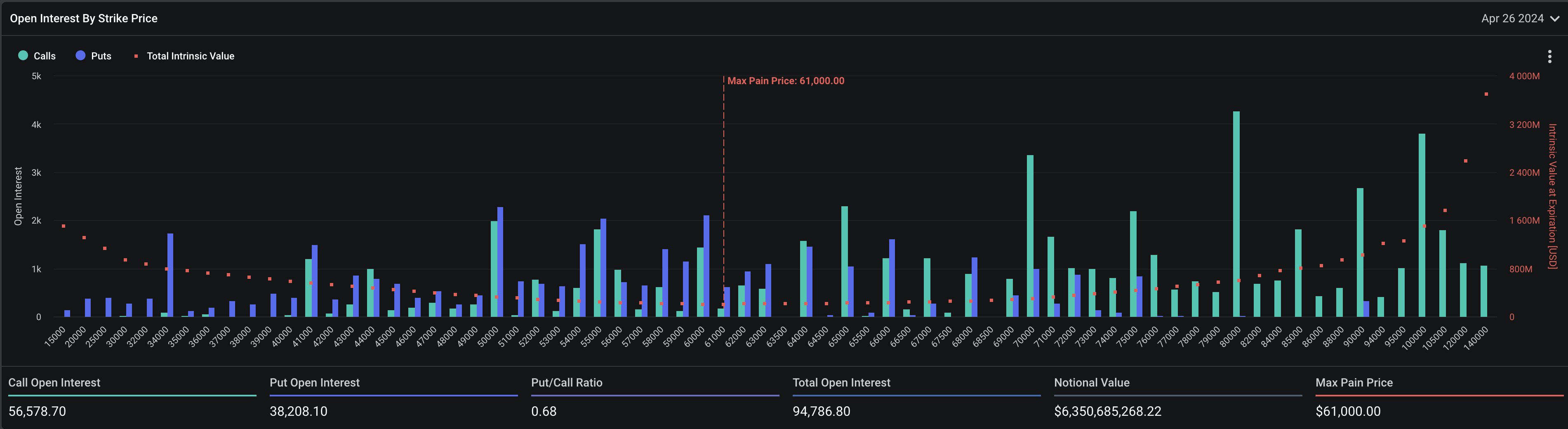

Over 94k Bitcoin options of $6.3 billion in notional value are set to expire on Friday. The put-call ratio is 0.68, indicating a rise in put options recently as monthly expiry approaches. The max pain point is $61,000, below the current price. The market can expect huge volatility with a pullback in price expected on the expiry day.

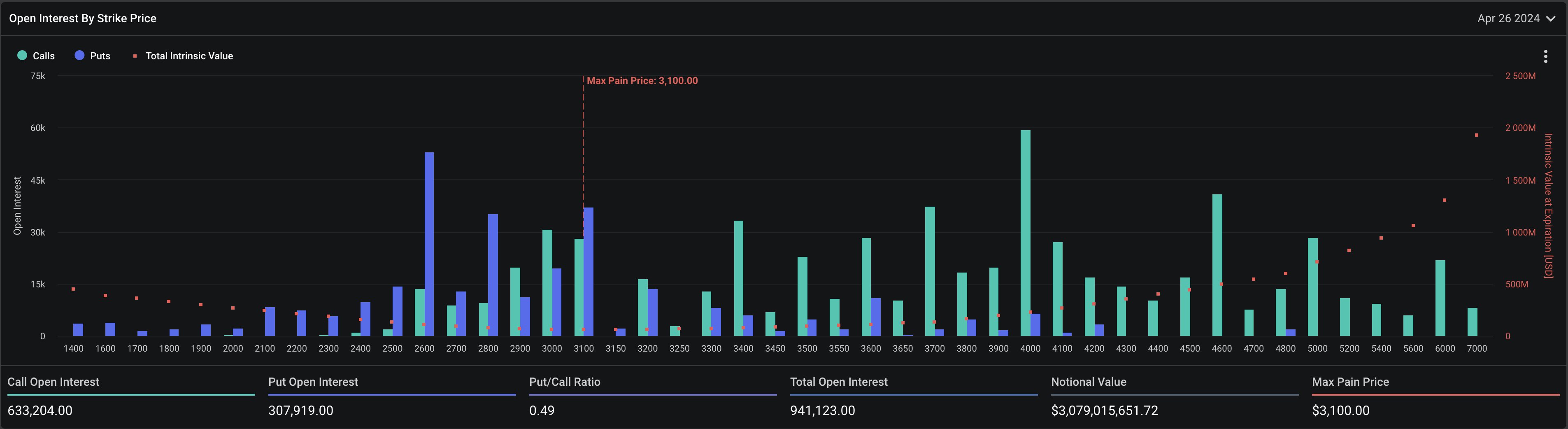

Moreover, 941k Ethereum options of notional value $3.1 billion are set to expire, with a put-call ratio of 0.49. The max pain point is $3,100, with the ETH price currently trading above the max pain point at also higher than the current price of $3,252.

The trades in the last 24 hours indicate an increase in put open interest with a put/call ratio of 0.84. The price could witness a decline to max paint point.

Notably, Deribit in a post on X revealed that realised volatility has surged as BTC Volatility Index (DVOL) saw a sharp increase as crypto options expiry comes near.

Furthermore, on-chain analyst IT Tech has warned about potential liquidation in the short-term due to high leverage. He said the CVD Perp shows more selling orders have been filled, while CVD Spot is showing some early signs of demand. This will set a potential recovery in BTC price for a massive rally.

Also Read: Glassnode Founders Predicts Bitcoin Climbing Back to $72K Soon

Bitcoin Price Performance

BTC price action remains volatile in the past 24 hours, with the price currently trading near $66,500. The 24-hour low and high are $65,864 and $67,148, respectively. Furthermore, the trading volume has decreased slightly in the last 24 hours.

Total Bitcoin futures open interest across crypto exchanges has increased by over 1% in the past 24 hours, with the buying mostly coming in the last few hours. The BTC futures OI of 480.07K are worth $31.96 billion.

A new whale accumulated 500 BTC worth $33 million amid consolidation for potentially taking BTC price to $70,000. However, U.S. PCE inflation data is also set to release on Friday, keeping the trading activity flat.

US dollar index (DXY) fell slightly under 106, but still high as compared to earlier weeks. Also, the US 10-year Treasury yield (US10Y) has jumped to a 6-month high of 4.636%, putting pressure on Bitcoin price.

Also Read: Dogwifhat (WIF) Price Skyrockets Over 20%, Here’s Why

The post How To Trade This Week As $9.4 Billion in Crypto Options Set to Expire appeared first on CoinGape.

1 week ago

11

1 week ago

11

English (US) ·

English (US) ·