The introduction of DEX integration features by centralized exchanges (CEX), transforming them into hybrid platforms, reflects a growing trend of blending centralization and decentralization to attract both traditional users and DeFi enthusiasts.

With increasing regulatory pressure on CEX, like KYC and AML requirements, decentralized exchanges (DEX) have become a more appealing option due to their anonymity and decentralized nature. Integrating DEX functionalities allows CEX to retain users while still complying with regulations.

CEX-DEX Integration for Growth

CEX and DEX represent the two primary exchange models in the crypto market. The boundaries between the two types of exchanges are increasingly blurred in today’s evolving market. Both models are beginning to adopt and integrate each other’s strengths to meet users’ growing and diverse demands.

Recently, several centralized exchanges have launched hybrid platforms. For example, Binance introduced Binance Alpha 2.0 (another updated version of Binance Alpha), enabling CEX users to purchase DEX tokens without withdrawals, combining CEX convenience with access to decentralized tokens.

Similarly, MEXC launched DEX+, blending on-chain and off-chain trading for a seamless experience. This reflects a trend of integrating centralization and decentralization to appeal to traditional users and DeFi participants.

“This is a brilliant move. Allowing CEX users to buy any DEX tokens directly from the CEX, no withdrawals needed.” said former Binance CEO CZ.

Interestingly, DEXs started gaining prominence in 2020. They slightly surpassed CEX in on-chain trading volume in 2020, and peaked in 2021. The rise of platforms like Solana contributed to this sudden growth. But DEXs slowly started losing momentum in 2022 and 2023.

According to a report by OAK Research, at the beginning of 2024, DEXs accounted for just 9.3% of the trading volume market share compared to CEXs. However, in January 2025, DEXs surpassed $320 billion in monthly trading volume as they captured over 20% of the spot trading volume for the first time in crypto history.

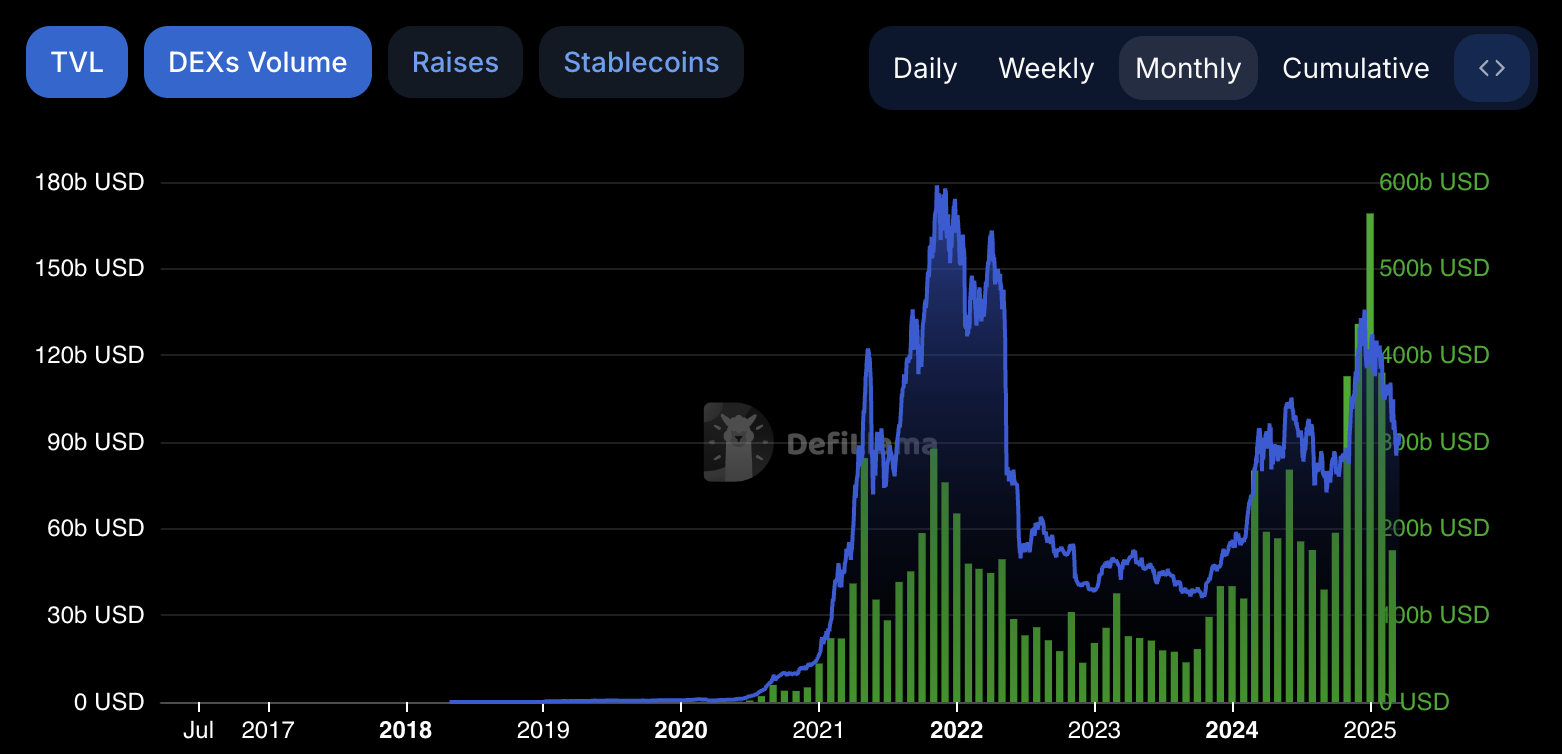

DEX Volume and TVL. Source: DefiLlama

DEX Volume and TVL. Source: DefiLlamaSimilaryly, according to data from DeFiLlama, Total Value Locked (TVL) in DEX was approximately $163.6 billion at the beginning of 2022. In 2023, the TVL dropped to around $52 billion and stayed around the same figure for most of 2024.

Nevertheless, by December 2024, this figure had surged to around $140 billion, marking an increase of nearly 160% since the beginning of the year. This shows the rising preference for DEXs among crypto traders.

According to CoinGecko, around 959 DEX platforms are now active in 2025, compared to 217 CEXs.

Benefits and Challenges of CEX-DEX Integration

The current differences between CEX and DEX creates disadvantages for users. As a result, users seek to combine the strengths of both models: the speed and liquidity of CEX with the control and transparency of DEX. The launches of Binance Alpha 2.0 and MEXC DEX+ demonstrate how major exchanges are addressing this need.

Moroever, DEXs led innovation in the current cycle with AMMs and liquidity pools, forcing CEXs to adapt to avoid falling behind.

With mounting regulatory pressure on CEXs, the anonymity and decentralization of DEXs make it more attractive. DEX integration enables CEX to retain users while navigating compliance.

However, creating hybrid platforms comes with challenges. Integrating on-chain and off-chain systems requires complex infrastructure, potentially leading to errors or high gas fees for DEX users. Additionally, hybrid platforms may face stricter regulatory scrutiny, especially when combining CEX’s fiat-to-crypto trading with decentralized tokens.

Despite these hurdles, given the advantages outlined, hybrid platforms like Binance Alpha 2.0 and MEXC DEX+ will continue to emerge.

The post Hybrid Crypto Exchanges in 2025: How CEXs Are Embracing DEX Features appeared first on BeInCrypto.

13 hours ago

11

13 hours ago

11

English (US) ·

English (US) ·