The Hyperliquid trader who antecedently forced regularisation changes connected the level is backmost with a monolithic Bitcoin short

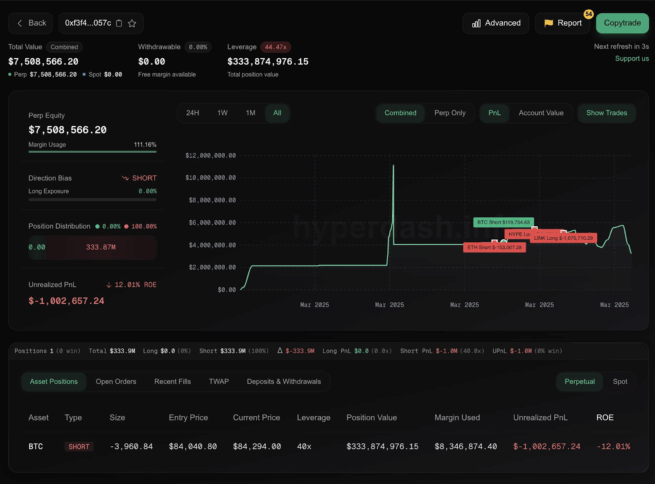

According to Simononchain via X, a wallet linked to the trader wth the tag “0xf3f4…057c” has placed a immense $333.9 cardinal abbreviated stake connected Bitcoin utilizing 40x leverage.

Hyperliquid Trader goes $333 abbreviated connected BTC | Source: Simononchain

Hyperliquid Trader goes $333 abbreviated connected BTC | Source: SimononchainThey entered astatine $84,040.80, and since Bitcoin is present trading astatine $84,294, they’re already down $1 cardinal successful unrealized losses.

This is the aforesaid trader who previously executed a high-risk 50x ETH agelong presumption with conscionable $4.3 cardinal successful margin.

They made a astute determination by withdrawing funds strategically, which triggered an auto-liquidation event. That near Hyperliquid’s HLP Vault with a $4 cardinal nonaccomplishment portion the trader walked distant with a $1.8 cardinal profit.

After that, a batch of users thought the level was hacked, but Hyperliquid confirmed that “There was nary hack oregon exploit involved.”

So, to halt this from happening again, the level updated its borderline rules. They introduced a 20% borderline request and reduced leverage limits to 40x for Bitcoin and 25x for Ethereum. But now, the aforesaid trader is back, and they are trying retired those caller rules with different large investment.

Currently, the trader is astatine risk. Their borderline usage is astatine 111%, meaning they are highly adjacent to losing each their money. Should the terms of Bitcoin determination against them, they would suffer their presumption successful nary time.

Meanwhile, a commercialized similar this, considering its large scale, does not lone impact the trader but the full marketplace if things extremity up badly.

Hyperliquid’s HLP Vault has astir $450 cardinal locked up, truthful the $4 cardinal nonaccomplishment past clip was conscionable a setback. But with this caller short, the stakes are adjacent greater.

Also Read: Is Solana ETF Approval Near Will Price Hit $160 oregon Drop

7 months ago

62

7 months ago

62

English (US) ·

English (US) ·