The reaction and market sentiment towards Ethereum spot ETFs is somewhat muted in comparison to when Bitcoin products launched earlier this year.

These are the findings of crypto entrepreneur and investor Andrew Kang, who published a lengthy analysis of the impact of Ethereum ETFs on X on June 23.

Bitcoin ETFs opened the door for many new buyers to make BTC allocations within their portfolios. However, “the impact of ETH ETFs is a lot less clear-cut,” he said.

ETH Price Could Tank

Kang estimates that the Ethereum ETF flows will be around 10% to 15% of Bitcoin ETF flows, resulting in roughly $500 million to $1.5 billion in true net buying within six months.

It was reported last week that Fidelity will seed its Ethereum ETF With $4.7 million, so the buying has already begun. In March, Standard Chartered predicted that inflows would reach $45 billion in the first 12 months of Ethereum ETF trading.

Nevertheless, Kang offered several reasons why the impact of an Ethereum ETF is expected to be less significant than that of Bitcoin.

Ethereum is seen as more of a tech asset rather than a macro asset like BTC. Additionally, there is less institutional interest and buying pressure for it since the its current valuation metrics, such as the price-earnings ratio, make it harder to justify to traditional finance allocators, he said.

“It is natural that those deep in the crypto space have a relatively high mind share and buy-in of Ethereum. In reality, it has much less buy-in as a key portfolio allocation for many large groups of non-crypto native capital.”

— Andrew Kang (@Rewkang) June 23, 2024

Moreover, Ethereum’s positioning before any ETFs are launched is different from Bitcoin’s as the asset is already up 4x from its lows while BTC was up 2.75x before its ETF launches, he added.

Therefore, Kang expects ETH to trade between $3,000 and $3,800 before the ETF launch but potentially fall to between $2,400 and $3,000 after the launch. A dump to the lower estimate would wipe 30% off the asset’s current value.

However, if BTC increases to $100,000 at the end of this year or early next, it could drag Ethereum and altcoins up with it, he predicted.

Kang’s bearish Ethereum stance didn’t end there. He expects a continued downtrend for the ETH/BTC ratio over the next year, ranging between 0.035 and 0.06.

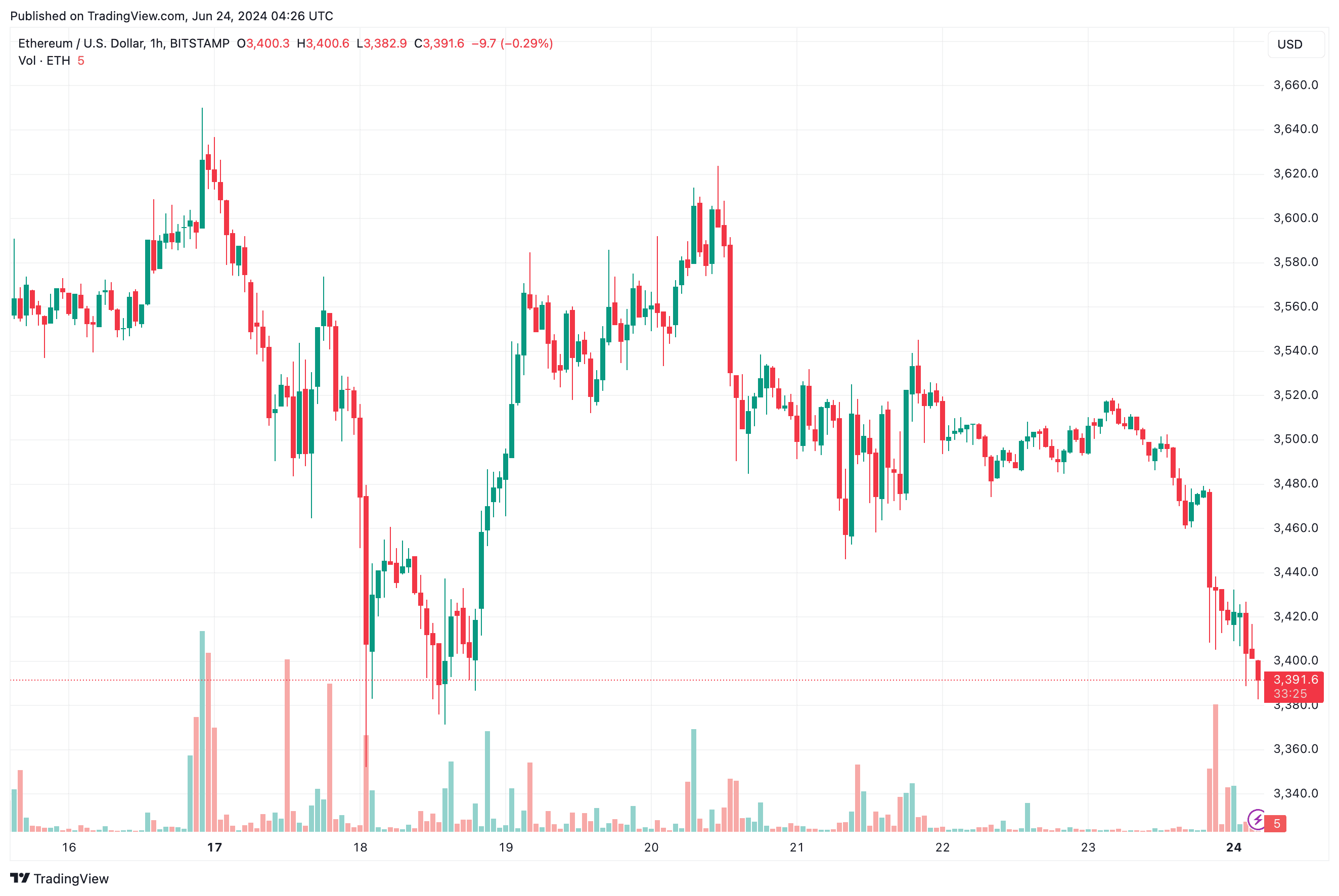

ETH Prices Dip Below $3,400

Meanwhile, ETH’s price tumbled in the past 24 hours alongside the broader cryptocurrency market, which remains riddled with uncertainty.

Source: TradingView

Source: TradingViewAt the time of this writing, Ethereum is found trading below $3,400, down 3.4% on the day and 5.3% on the week.

The rest of the market is also declining. Bitcoin dropped below $63K for a 2.5% loss in the last day, while BNB and Solana lost 3% and 6.2%, respectively.

Not All Bearish On Ethereum

The only bullish prediction was that large asset managers such as BlackRock could use Ethereum to tokenize real-world assets, but “how much value this translates into for ETH and on what timeline is uncertain,” he concluded.

Additionally, ConsenSys said last week that the US Securities and Exchange Commission was closing its investigation into the Ethereum Foundation.

This could solidify ETH’s status as a commodity rather than a security, which is also very bullish for the asset and the rest of the altcoins.

The post Incoming Ethereum Price Crash: Analyst Flags Warnings of Spot ETH ETF Launch appeared first on CryptoPotato.

4 months ago

48

4 months ago

48

English (US) ·

English (US) ·