Infinite Money Glitch: How MicroStrategy Convertible Bonds Profit from Gamma Trading — Part 2

Picture this: You’re at a casino, but instead of gambling, you’re playing a game where the odds are stacked in your favor.

Let’s dive into the scenario: MicroStrategy (MSTR) stock just hits $800, and now 2 scenarios can play out —

What happens if the stock surges to $1,000?

Or

What if it tumbles back to $500?

Here’s how the math unfolds — and why it feels like discovering a cheat code for infinite money.

The $800 Crossroads: Two Scenarios

When MicroStrategy’s (MSTR) stock price reaches $800, the convertible bonds in play become deep in-the-money. At this point, the bond’s delta — the measure of how much the bond behaves like the stock — approaches 1, meaning the bond acts almost entirely like the stock itself. By now, the hedge fund has already shorted 1,000,000 shares of MSTR stock to match the bond’s delta. From here, two potential scenarios unfold: the stock price rises further to $1,000, or it falls back to $500. Let’s explore each.

Scenario 1: Stock Price Increases to $1,000

If MSTR’s stock price climbs to $1,000, the convertible bond remains deep in-the-money, and its delta remains close to 1. This means the bond still behaves like owning 1 million shares of the stock.

Hedge Adjustment

- No additional shares need to be shorted because the bond’s delta is already fully hedged at 1.

- The hedge fund maintains its 1,000,000-share short position.

Impact on Profits

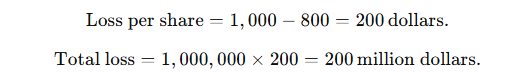

While the hedge fund doesn’t trade further, the short position incurs a paper loss as the stock price rises:

Outcome at Conversion:

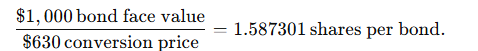

At maturity, the hedge fund converts the bonds into 1,587,301 shares (based on the conversion ratio of $1,000 face value ÷ $630 conversion price).

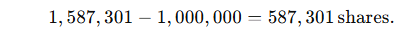

The fund uses 1,000,000 shares to cover its short position, leaving a net long position of:

At $1,000/share, these remaining shares are worth:

Net Gain:

The fund’s total net gain is calculated as:

Scenario 2: Stock Price Drops to $500

If the stock price drops to $500, the bond delta decreases from 1 to approximately 0.8. This reflects the bond becoming less sensitive to stock movements, as the price moves closer to the conversion price of $630.

Hedge Adjustment:

The new required short position is:

Current short position: 1,000,000 shares.

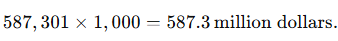

The fund buys back 200,000 shares (previously shorted at $800) at $500.

Profit from Adjustment:

The shares were shorted at $800 and bought back at $500:

Outcome at Conversion:

At maturity, the fund converts the bonds into 1,587,301 shares. The hedge fund uses 800,000 shares to cover its short position, leaving a net long position of:

At $500/share, these remaining shares are worth:

Net Gain:

The fund’s net gain, including the profit from buying back shares, is:

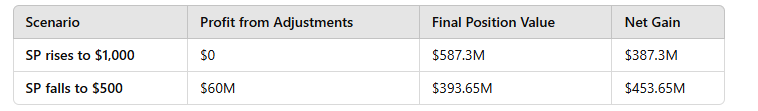

Summary of scenarios

Key Takeaways

- If the stock rises to $1,000, the hedge fund doesn’t gain additional profits from gamma trading but still secures significant returns from holding the convertible bonds.

- If the stock falls to $500, the hedge fund benefits from adjusting its short position and enjoys robust gains from holding the bonds through conversion.

This is the essence of gamma trading — it’s not about guessing whether prices go up or down. It’s about playing the volatility game skillfully, profiting from every twist and turn in the market.

Infinite Money Glitch: How MicroStrategy Convertible Bonds Profit from Gamma Trading — Part 2 was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

3 months ago

47

3 months ago

47

English (US) ·

English (US) ·