$65 Million From Nothing: The Hacker Who Beat Wall Street at Its Own Game

Image created by Grok

Image created by GrokWall Street and hacking are not often linked, but there was a story some time ago that merged a major Wall Street scandal with a hacker who made billions from his parents’ house. This is the story of Fugazi, the trader who managed to manipulate the market and earn trillions of dollars from his bedroom.

In England, a young man from a humble family, who regularly ate at McDonald’s and dressed in tracksuits, became interested in the world of trading. Within his first few months, he managed to accumulate a million euros.

Fugazi was a sharp and intelligent trader, and while the S&P 500 was at its lowest point in the last decade, and all the experts were advising to sell, he bought.

It didn’t seem like a very smart strategy… right?

Well, some time later, the U.S. government injected $800 billion into the economy to boost credit… This created a rally that earned him about $15 million. Doesn’t seem so foolish now, does it?

High-Frequency Trading Algorithms

Before continuing, it’s necessary to explain high-frequency trading algorithms.

High-frequency trading algorithms are automated systems that buy and sell stocks faster than any human ever could. They can sell a stock before most people even turn on their computers — processing millions of transactions a day.

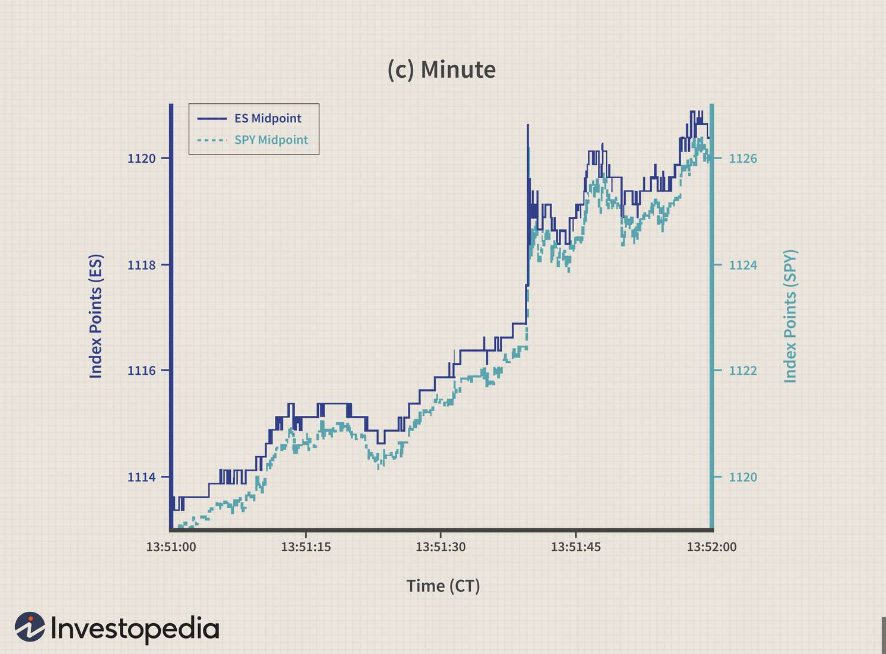

image by investopedia on how this algorithm works

image by investopedia on how this algorithm worksCompanies earn millions using these algorithms, but, as with everything, they have cheat codes, and Fugazi knew them.

Futures markets are widely known for their speculative nature. Our character knew this and was openly critical of it.

Playing Wall Street’s Game

The only way to beat Wall Street is by playing its game. So Fugazi created his own version of high-frequency trading. This led him to design specialized software.

How did he do it? By manipulating the supply and demand of contracts to buy them cheaper and then sell them at their real price. This technique is called spoofing.

Spoofing

Spoofing involves flooding the market with buy or sell offers and canceling them before they are executed. This manipulates the price.

Fugazi was disrupting the global market, all from the comfort of his bedroom. Not bad, right?

But there’s a catch: this technique is illegal, and he received a warning about it. However, this was a technique the big Wall Street players used regularly without facing penalties, so he continued with his strategy…

The Big Crash and the Big Opportunity

Europe was in crisis, with many highly indebted countries realizing they wouldn’t be able to pay off their debts. Massive protests in Greece highlighted the tension.

All it needed was a little push for the system to collapse.

Fugazi did the math and saw his chance. The global economy was in check, and with all the money he had accumulated, he could now make a difference.

Image of UK crash by Jamie Street on Unsplash

Image of UK crash by Jamie Street on UnsplashAt 3:20 PM, he placed massive sell orders worth $120 million, all based on spoofing…

At 3:26 PM, the market dropped 39 points, causing the euro’s value to plummet.

It would’ve been a good moment to stop… right?

At 5:30 PM, another sell order worth $200 million hit, sending the global market into a spiral.

For hours, the market continued to collapse. Wall Street saw its system faltering, but at 7:20 PM, the spoofing stopped — Fugazi had to go have dinner with his parents. That day, he earned a million dollars.

In the days following the crash, he received another email reminding him that transactions must be conducted honestly and transparently. Fugazi responded with a short but clear message:

“Kiss my ass.”Investigation

The United States launched an investigation to identify the company responsible for the spoofing. Their initial focus was on major firms like JP Morgan and Citibank. However, the trail led them to the western outskirts of London. Unfortunately, they couldn’t issue an arrest warrant outside the U.S. — at least, not yet.

The investigation stalled until one investigator had the idea to contact the suspect directly online.

Fugazi was intelligent, but the investigators knew there was a weak spot in anyone who had made $65 million from nothing: ego.

Ego drove him to brag about how smart he was, how poorly others were doing, and how superior he felt to a broken financial system. It was that same ego that gave a Chicago judge enough evidence to issue an arrest warrant.

Arrest

In April 2015, Fugazi’s parents called him downstairs, where a group of FBI agents waited to inform him that he was under arrest for market manipulation.

image of Navinder taken by Bloomberg

image of Navinder taken by BloombergHe was fined $6 million, which wouldn’t have been an issue if the CFTC hadn’t frozen all his funds.

Once the case went public, opinions were divided:

- Some saw him as a scapegoat, arguing that no one with just a laptop could crash the market.

- Others, especially traders, considered Fugazi a hero for beating major firms at their own game.

For the justice system, Fugazi and his actions were part of the problem that led to the economic crash. He was renamed The Flash Crash Trader.

Unable to access his funds, he was extradited to the U.S., where most of his remaining money was drained by legal fees.

A Second Chance

One of his lawyers proposed an idea that could change his fate. Instead of facing 20 charges, he could plead guilty to two and help the U.S. improve its trading system and identify potential cheats.

Image of Fugazi on court, image provided by The Guardian

Image of Fugazi on court, image provided by The GuardianFugazi organized a meeting where he demonstrated how the live market worked, deciphering an overwhelming stream of numbers that only he could interpret. He taught them how to identify fraudulent traders, including major firms and banks using similar techniques.

He was sentenced to one year of house arrest. Back home with his family, he resumed his modest lifestyle. Thanks to the techniques that caused one of the largest financial crashes in history, the world of trading is now a safer place.

Conclusion

Fugazi, or as he is truly known, Navinder Sarao, was a key figure in uncovering the tools used by large corporations to manipulate the markets. Despite the many techniques traders continue to use to deceive the system, Navinder managed to make the world of trading slightly safer. Ironically, his legacy is neither that of a hero nor a villain, but of someone who changed the system from the shadows, leaving an indelible mark.

If you enjoyed this article, feel free to give it a clap or follow me to show your support.

Want to be a trader like Fugazi? Here’s my Binance referral link to get started and receive a 5% discount on trades.

Inside the Mind of the Hacker Who Fooled Wall Street was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

2 months ago

35

2 months ago

35

English (US) ·

English (US) ·