Solana has experienced exponential growth since it first entered the market as an alternative Layer-1 blockchain. Though the network’s market capitalization is still significantly smaller than Ethereum, its top contender, this gap has shrunk considerably over the years.

As Solana grows, some wonder whether it will displace Ethereum as the second-largest cryptocurrency behind Bitcoin. In a conversation with BeInCrypto, Juan Pellicer, Senior Research Analyst at IntoTheBlock, said Solana still has to overcome several hurdles before that can occur.

Solana’s Remarkable Growth

Following Bitcoin, Ethereum has solidified its position as a leading cryptocurrency, pioneering the concept of smart contracts and establishing itself as the dominant platform for decentralized applications.

However, Ethereum’s dominance has been challenged by the emergence of competitors like Solana, which entered the market in March 2020 as an alternative layer-1 blockchain network.

While Ethereum maintains a significant market capitalization advantage over Solana, this advantage has notably shrunk over the years.

Since its launch in March 2020, Solana’s market capitalization reached its first peak in November 2021, when it reached $72.4 billion. One week ago, the token surpassed the $100 billion mark, reaching a new all-time high.

Solana Market Capitalization. Source: CoinGecko.

Solana Market Capitalization. Source: CoinGecko.At the time of writing, Ethereum’s market cap is $392 billion. While its advantage over Solana is significant, some have begun to wonder how long Solana needs to surpass Ethereum.

As the network exceeds key metrics like daily active users, daily transactions, and the number of new addresses created monthly, some say 2025 will be the year Solana takes the second-place trophy.

Though Solana’s success is impressive, according to Pellicer, it still lacks what it takes to overthrow Ethereum.

“While Solana may continue to grow and potentially challenge Ethereum in specific niches, overcoming Ethereum’s entrenched position as the dominant platform in the immediate future is still unlikely, though the competitive landscape is dynamic and evolving,” he said.

Pellicer considered many factors before coming to that conclusion.

High Throughput and Low Transaction Costs Maintain Solana’s Competitiveness

Solana and Ethereum boast particular strengths that, in turn, attract different audiences.

Ethereum’s continued dominance is largely due to its established trust, widespread adoption, and ongoing development efforts. As the first platform to enable the development of decentralized applications, Ethereum continues to lead the market, powering most decentralized finance (DeFi) projects and hosting major non-fungible token (NFT) marketplaces.

“Ethereum’s infrastructure is unmatched in economic security, maintaining a flawless uptime record since inception, which fosters unparalleled trust for institutional and high-value applications. Its DeFi ecosystem remains the most mature, with pioneering protocols setting industry standards, though competitors like Solana are rapidly closing the gap with faster, cheaper alternatives,” Pellicer told BeInCrypto.

Solana’s competitive edge comes from its high throughput and low transaction costs. The network uses two consensus mechanisms: Proof-of-History (PoH) and Proof-of-Stake (PoS).

The combination of PoS and PoH allows individual nodes to validate the entire blockchain using only a small piece of information. This is possible because PoH creates a verifiable history of transactions, which means a node doesn’t need to be constantly connected to the network to verify its validity. In turn, transaction speeds are much faster.

Originally running on a Proof-of-Work (PoW) consensus mechanism, Ethereum transitioned to PoS in September 2022. Regardless, the network often suffers from congestion and slow transaction speeds.

While Ethereum can only process around 15 transactions per second, Solana can handle over 2,600.

“This results in a smoother user experience, particularly for high-frequency applications and retail users. This technological differentiation, coupled with effective marketing and a vibrant ecosystem of applications focused on speed and affordability, has fueled Solana’s rapid growth and market cap increase, attracting users and projects seeking alternatives to Ethereum’s higher gas fees and slower transaction finality,” Pellicer explained.

However, Ethereum has other advantages that outweigh Solana’s speed.

Ethereum Excels in DeFi

Since its launch in 2015, Ethereum has become a widely used blockchain platform for developers and enterprises.

The platform’s smart contract functionality has enabled the creation of numerous decentralized applications (dApps), contributing to the growth of ecosystems focused on DeFi, gaming, and NFTs.

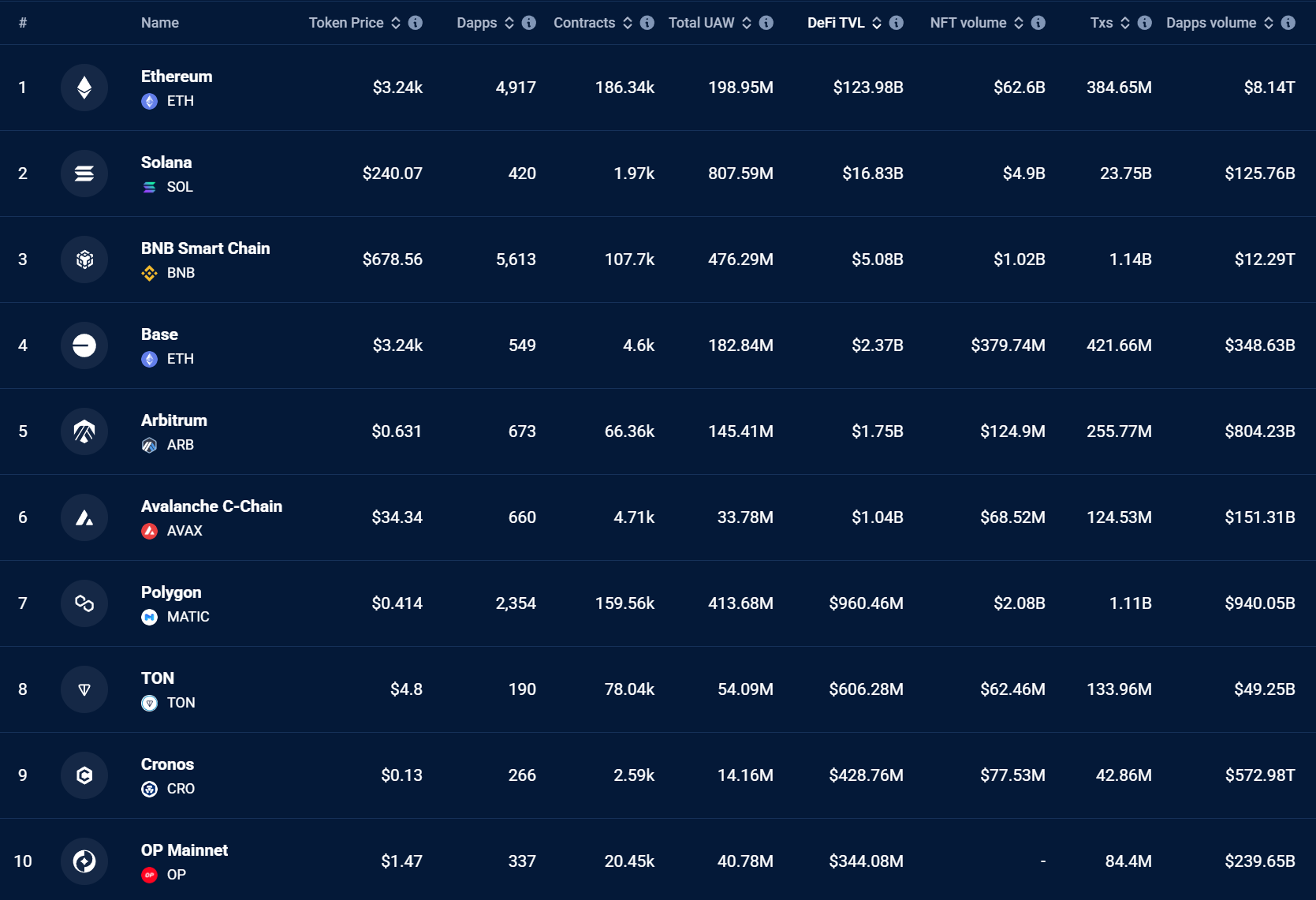

Ethereum’s DeFi TVL. Source: DappRadar.

Ethereum’s DeFi TVL. Source: DappRadar.Today, Ethereum’s DeFi total value locked (TVL) stands at nearly $124 billion.

“This creates deep liquidity, robust infrastructure, and a rich ecosystem, making it difficult for newer platforms like Solana to replicate quickly. This entrenched network effect provides Ethereum with significant inertia and competitive advantage, as users and developers benefit from the existing infrastructure, community support, and established protocols within the Ethereum ecosystem,” Pellicer said.

A strong driver behind Ethereum’s solid developer base is its use of Solidity as its base programming language.

Solidity is a language specifically designed for smart contracts and the Ethereum Virtual Machine (EVM). It benefits from a mature ecosystem, extensive tooling, and a large pool of already proficient developers.

Solana’s core programming language is Rust. This system offers advantages in terms of rapid performance rates and overall safety.

“While Rust offers advantages in terms of execution speed and security, it has a steeper learning curve and a smaller developer community within the blockchain space compared to Solidity. This difference can impact developer adoption rates and the types of applications built, with Ethereum attracting a broader range of developers initially, while Solana may appeal to those focused on performance-critical applications and those already familiar with Rust,” Pellicer added.

Ethereum also remains the preferred network for users who prioritize decentralization before speed.

Solana Centralization Concerns

Solana’s validator node requirements, which demand significant hardware investments, can create barriers to entry, potentially leading to a concentration of power within the network among those capable of affording the necessary infrastructure.

While Solana currently has around 2,000 active validators, Ethereum passed the one million benchmark last year– the largest number recorded by any blockchain network. Though Solana’s reliance on this type of hardware expedites the network, this has raised concerns about whether this high-efficiency rate comes at the cost of decentralization.

During last October’s Token2049 conference, whistleblower Edward Snowden gained attention for bringing up this point.

Speaking through a video link, Snowden raised concerns that Solana’s focus on speed and efficiency comes at the cost of decentralization, which he sees as essential for keeping blockchain technology trustworthy. He also said that it makes the network more susceptible to government interference.

His comments reflected doubts shared by many crypto community members.

“Solana faces valid concerns regarding centralization due to its validator hardware requirements and relatively smaller validator set, which could potentially lead to network control by fewer entities. While Solana prioritizes performance at a potentially higher centralization trade-off, Ethereum prioritizes decentralization and security, now with improved energy efficiency and ongoing scalability enhancements,” Pellicer said.

For Solana to become more competitive, it will need to address these risks.

What Solana Needs to Surpass Ethereum

Solana would have to take several significant steps to surpass Ethereum regarding market share and influence. According to Pellicer, it would need to overcome four specific hurdles.

“Firstly, achieving parity or surpassing Ethereum in developer adoption is crucial, requiring significant investment in developer tooling and community building. Secondly, Solana needs to cultivate truly innovative and unique DeFi applications that differentiate it beyond speed and cost advantages. Thirdly, addressing centralization concerns and demonstrating long-term network stability and resilience are vital for attracting institutional capital and broader trust. Finally, Solana would need to capture emerging market segments or use cases where Ethereum is less dominant to carve out a truly leading position,” he said.

Solana has previewed upcoming products that are scheduled for launch this year. Among them is the Solana Seeker, an Android-powered smartphone designed for Web3 applications. This device offers enhanced functionality and design for users interacting with the Solana ecosystem, including managing crypto assets.

Meanwhile, Solana’s upcoming Firedancer validator client is designed to improve network stability and transaction processing. Its distinct codebase offers greater resilience against widespread outages and is expected to enhance Solana’s performance.

In the United States, there is widespread anticipation over the potential launch of a Solana spot exchange-traded fund (ETF). How significantly these initiatives will contribute to increased network adoption remains to be seen.

Scalability Continues to be Ethereum’s Achilles Heel

Ethereum must address its points of contention to maintain its dominance over the crypto market. Scalability remains a central challenge.

The network’s current architecture, which can only handle a limited number of transactions per second, limits its ability to accommodate users’ increasing demand. Users tend to experience intense network congestion, which results in slower transaction times and increased fees for those interacting with dApps on the network.

Ethereum has developed a Layer-2 ecosystem to reduce congestion in response to these issues. However, these solutions have received criticism for causing user fragmentation.

“Ethereum must continue to innovate and successfully roll out its scaling solutions to maintain its competitive advantage. It needs to ensure its Layer-2 ecosystem becomes seamless and user-friendly,” Pellicer told BeInCrypto.

Also, safeguarding and expanding the aspects that already make Ethereum so competitive will prove essential to maintain its edge over other networks.

“For Ethereum, sustained success hinges on the successful scaling of its ecosystem through Layer-2 solutions, continued innovation in DeFi and broader application areas, and maintaining its strong developer community,” he added.

Though Pellicer doesn’t expect Solana to surpass Ethereum anytime soon, the increasing stakes between competing networks is a good sign.

“Ultimately, increased competition and the rise of a strong alternative platform like Solana could be beneficial for the broader crypto ecosystem, fostering innovation and driving adoption by offering users more choices and diverse functionalities,” Pellicer said.

Whether Solana can continue climbing the ranks will only be answered in time.

The post IntoTheBlock Analyst Says Solana Still Has a Long Way to Go Before It Can Surpass Ethereum appeared first on BeInCrypto.

7 months ago

32

7 months ago

32

English (US) ·

English (US) ·