In anticipation of the upcoming US inflation report, savvy investors have purchased 70,000 Bitcoin (BTC), signaling a strategic pivot towards cryptocurrency as a hedge against potential economic volatility.

This massive acquisition follows a significant 1 million BTC sell-off at the close of 2023, underscoring renewed confidence among long-term holders in BTC’s value.

Investors Return to Buy 70,000 BTC Ahead of CPI Report

Recent worries about inflation and the decreasing worth of fiat currencies have sparked renewed interest in alternative stores of value.

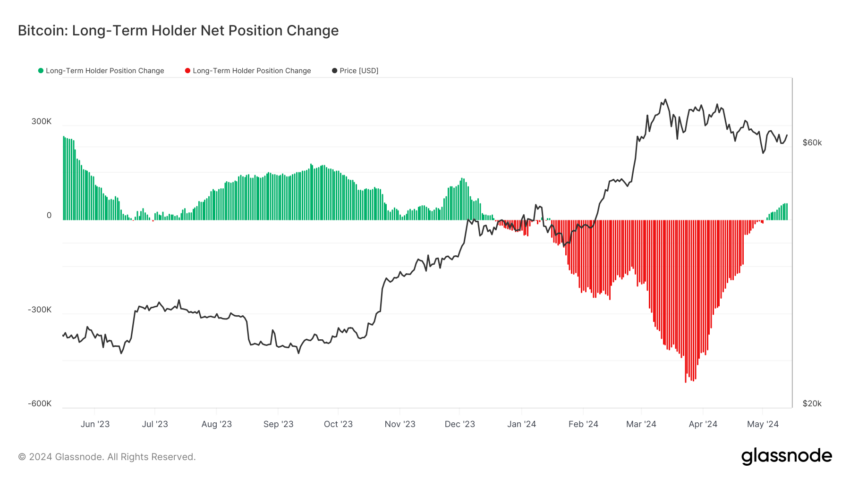

Indeed, on-chain data from Glassnode reveals investors are strategically accumulating more Bitcoin. Their actions suggest a belief in BTC’s enduring value, particularly as it stabilizes above $60,000.

Bitcoin Holder Net Position. Source: Glassnode

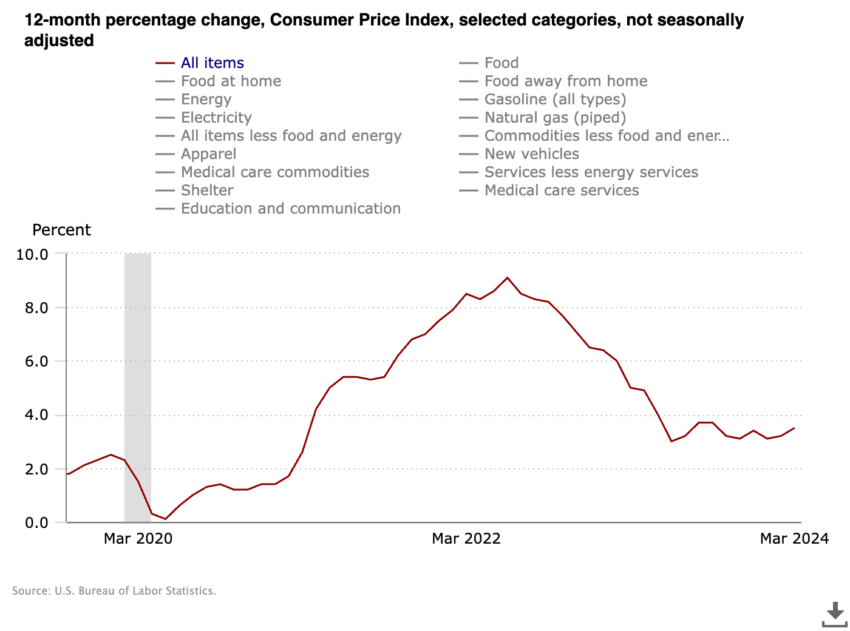

Bitcoin Holder Net Position. Source: GlassnodeThe US Consumer Price Index (CPI) rose 0.4% in March and reached 3.5% over the past year. This number remains historically high and has significantly changed the value of a dollar compared to a decade ago when the inflation rate was just 0.8%.

The upcoming US inflation report on May 15 also has investors on edge as the Federal Reserve remains unlikely to cut rates this year. For this reason, Neil Bergquist, CEO of Coinme, emphasizes Bitcoin’s appeal as a store of value.

He points out that, unlike bank-held dollars, Bitcoin’s capped supply of 21 million BTC presents an inflation-resistant alternative.

“There’ll never be more than 21 million bitcoin ever. It has a fixed supply, unlike fiat currencies, and no one can change that. No one can come in with a new policy, no one can get elected with a new idea and change that. It’s hard-coded into the bitcoin blockchain,” Bergquist explained.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Consumer Price Index. Source: US Bureau of Labor Statistics

Consumer Price Index. Source: US Bureau of Labor Statistics Core inflation, which excludes the more volatile costs of food and gas, will likely remain persistently high due to increased costs of shelter and core services such as insurance and medical care. According to Bank of America, higher energy prices, driven by increased gas prices, are expected to contribute to a “relatively firmer headline CPI print.”

As a result, Bitcoin may be able to establish itself as a decentralized resource, solidifying its standing as a hedge to traditional financial systems.

“If you hold dollars in your bank account over a period of rising inflation, then your balance has less purchasing power than if you were to store your value in Bitcoin,” Bergquist concluded.

The post Investors Buy 70,000 Bitcoin (BTC) Ahead of US Inflation Report appeared first on BeInCrypto.

5 months ago

47

5 months ago

47

English (US) ·

English (US) ·