Sone qualified investors volition soon person the accidental to acquisition XRP receipts done the Receipts Depositary Corporation (RDC) and Digital Wealth Partners (DWP).

These depository receipts supply a mode for investors to summation regulated vulnerability to XRP without buying the cryptocurrency straight from an exchange. Instead, they tin acquisition XRP DRs, which correspond ownership of existent XRP held astatine a regulated custodian.

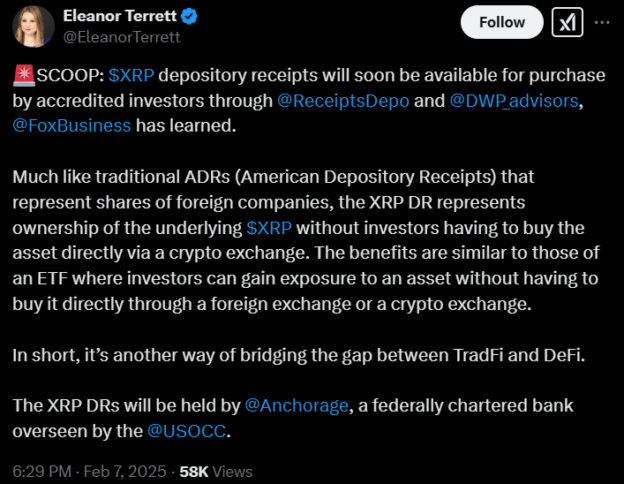

Eleanor Terrett besides confirmed this connected X: “$XRP depository receipts volition soon beryllium disposable for acquisition by accredited investors done @ReceiptsDepo and @DWP_advisors” She tweeted.

FOX said XRP Depository Receipts volition soon beryllium disposable | Source: X

FOX said XRP Depository Receipts volition soon beryllium disposable | Source: XThe depository receipts volition beryllium held by Anchorage, a federally chartered slope regulated by the U.S. Office of the Comptroller of the Currency (OCC).

Each XRP DR works likewise to the American Depositary Receipts (ADRs), wherever a overseas institution tin merchantability shares of their concern with nary request to commercialized connected overseas banal exchanges.

Receipt Depositary Corp, (RDC), a start-up founded by erstwhile Citigroup executives, is starring this effort to present XRP-backed securities to organization investors via the U.S-regulated marketplace infrastructure.

Unlike XRP ETFs and Trusts, which are inactive pending SEC approval, XRP DRs person already been established wrong a regulated framework. This makes them readily disposable to each qualified investors.

The XRP DR programme is DTC-eligible, meaning it is chiefly integrated into organization trading platforms with physics settlement. This allows banks and brokers to grip XRP investments conscionable similar immoderate different security.

It besides enables in-kind convertibility, truthful investors tin make and redeem DRs for existent XRP wherever regulations allow. By utilizing existing marketplace infrastructure, XRP DRs marque crypto investments arsenic elemental arsenic trading stocks.

Moreover, depository receipts person agelong been utilized to assistance investors entree assets that aren’t typically disposable successful U.S. markets. Now, the aforesaid strategy is being applied to cryptocurrencies, making XRP much accessible to organization investors.

Also Read: Coinbase Adds MORPHO, PENGU, POPCAT to Listing Roadmap

8 months ago

46

8 months ago

46

English (US) ·

English (US) ·