On Wednesday, Solana-based decentralized exchange (DEX) Jupiter launched its highly anticipated Jupuary airdrop, distributing 700 million JUP tokens worth approximately $500 million across more than 2 million wallets.

This event has triggered a wave of selloffs, putting significant pressure on the token’s price.

Jupiter’s Airdrop Triggers Selloff

Yesterday, Jupiter airdropped 700 million JUP tokens worth around $500 million to 2 million eligible wallets. Since the distribution, JUP has experienced a decline. The massive influx of tokens into the market has prompted traders to liquidate their holdings for profit, contributing to the downturn.

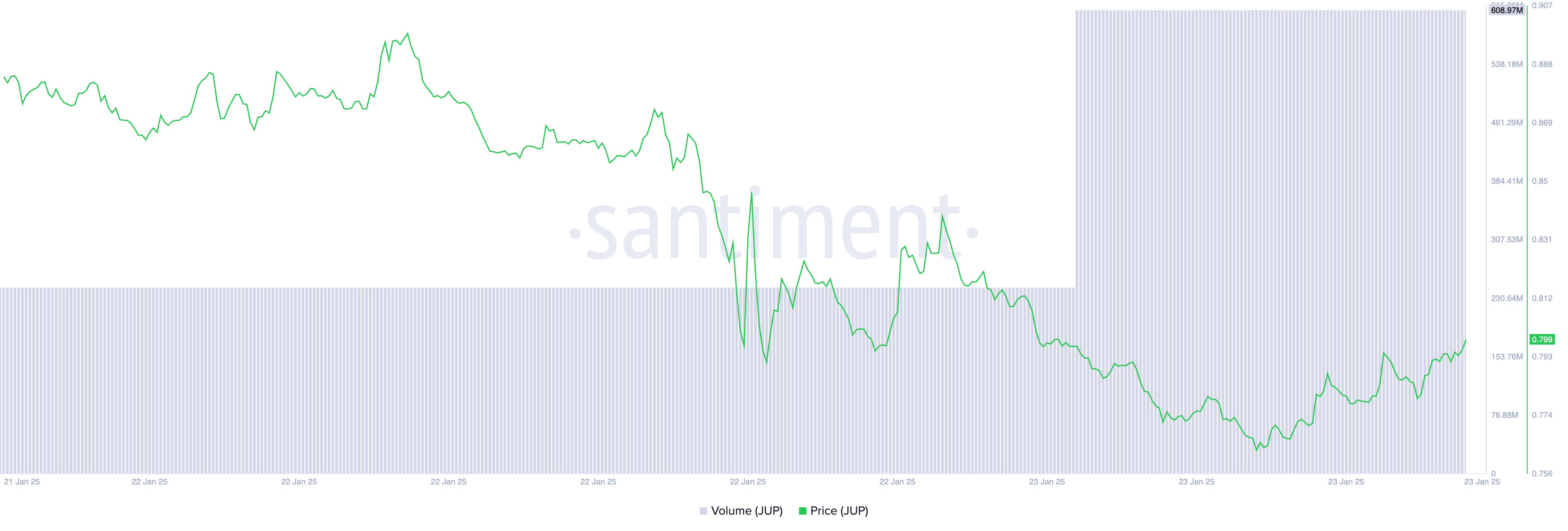

At press time, the altcoin trades at $0.79, noting a 9% price drop in the past 24 hours. During the same period, its trading volume is up 166%, totaling $609 million. This confirms the surge in JUP selloffs among market participants.

When an asset’s price declines while its trading volume surges, it indicates significant selling pressure, with many traders exiting their positions.

JUP Price and Trading Volume. Source: Santiment

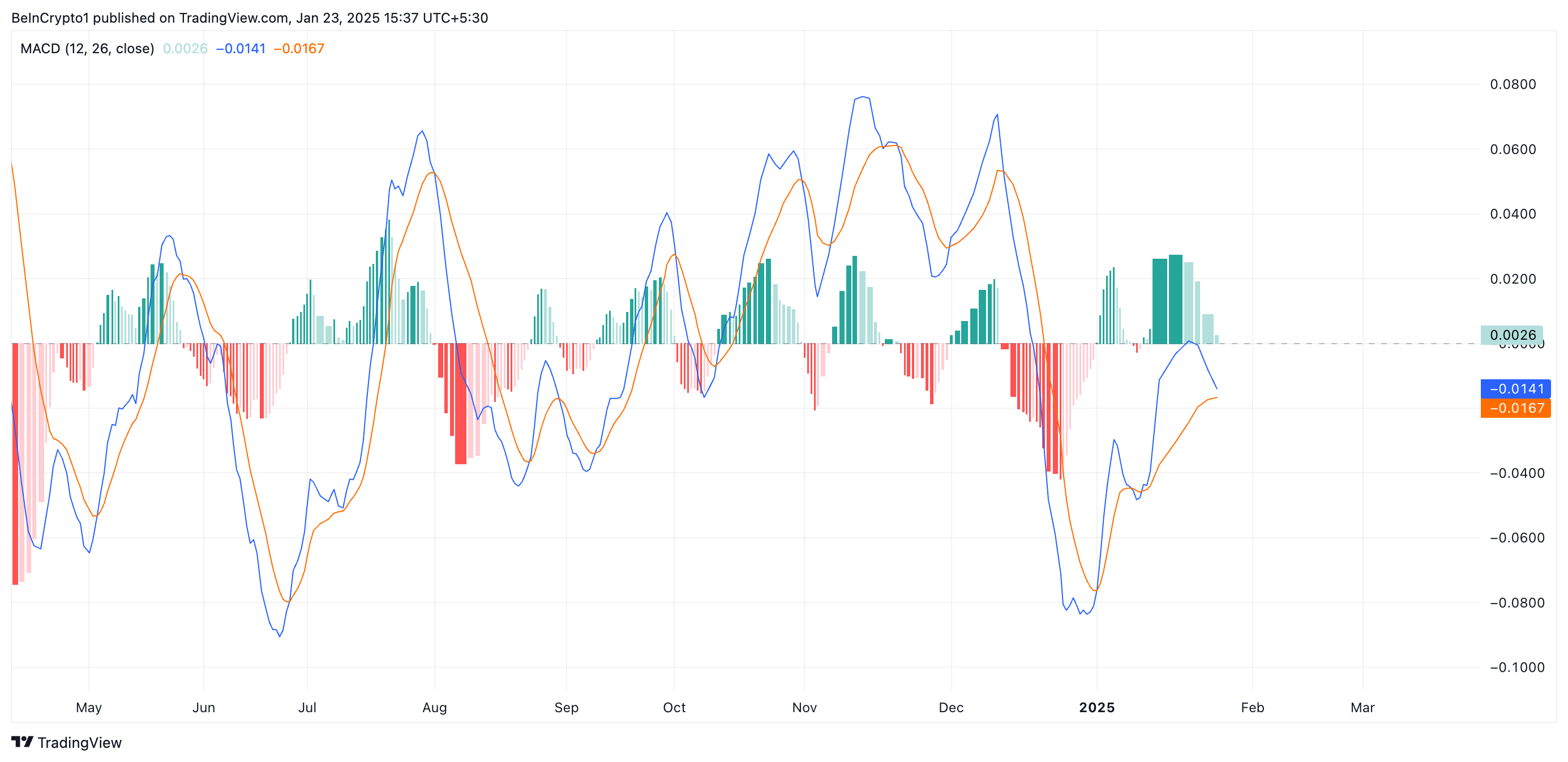

JUP Price and Trading Volume. Source: SantimentFurthermore, readings from JUP’s Moving Average Convergence Divergence (MACD) indicator reflect the rising selling pressure. At press time, the token’s signal line (orange) is poised to break above its MACD line (blue).

This indicator measures an asset’s price momentum and trend direction. When set up this way, it indicates a potential bearish crossover. This suggests that selling pressure is increasing, signaling a downtrend in the asset’s price.

JUP MACD. Source: TradingView

JUP MACD. Source: TradingViewJUP Price Prediction: A 21% Drop to $0.63 or a Potential Rally to $0.95?

If bearish pressure strengthens, JUP’s price could fall to $0.63, a low it last reached last July. This represents a 21% drop from its current value.

JUP Price Analysis. Source: TradingView

JUP Price Analysis. Source: TradingViewOn the other hand, if buying activity resurges, JUP’s price could rally past resistance at $0.81 and attempt to trade at $0.95.

The post Jupiter’s $500 Million Airdrop Sparks Selloff, JUP Drops Nearly 10% appeared first on BeInCrypto.

7 months ago

32

7 months ago

32

English (US) ·

English (US) ·