BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about Paraguay’s intensified efforts against illegal Bitcoin miners, the growth of cryptocurrency users in Mexico, and more.

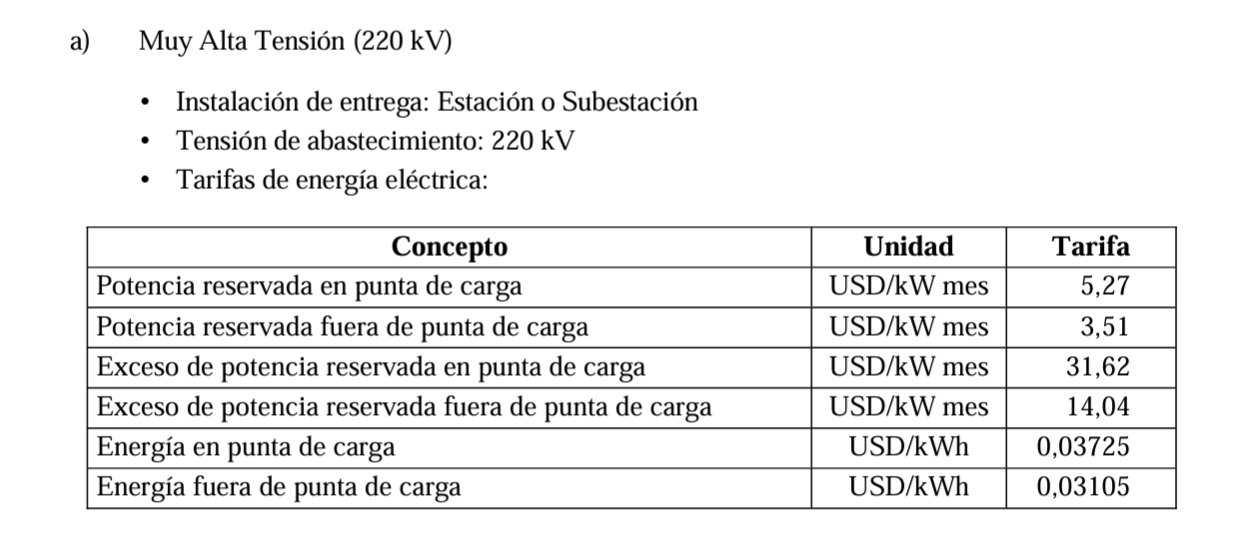

Paraguay Raises Electricity Rates for Bitcoin Miners

Paraguay’s National Electricity Administration (ANDE) has increased electricity rates for cryptocurrency mining companies by 9 to 16 percent. This measure aims to curb losses from illegal mining activities, estimated to cost the country up to 14 billion guaraníes (over $185,000).

On June 26, ANDE issued Resolution 49238, updating electricity tariffs. Hugo Fernández, ANDE’s commercial manager, informed the newspaper Última Hora about intensified efforts against illegal cryptocurrency mining. He revealed that 72,823 KVA (kilovolt-ampere) have been intervened this year. Most energy thefts affect the electrical system.

“The intervention represented a monthly loss of G. 14,720,458,825 for the institution, in terms of unregistered active energy, which added to the intervention costs and fine, must be paid by the person responsible for the theft of electric energy. This fact damages the proper functioning of the electric system”, Fernández explained.

Read more: Is Crypto Mining Profitable in 2024?

Electricity Tariff Adjustments to Bitcoin Miners in Paraguay. Source: ANDE

Electricity Tariff Adjustments to Bitcoin Miners in Paraguay. Source: ANDEIn early June, national deputy María Constancia Benítez de Benítez presented a bill titled “That regulates cryptomining in the Republic of Paraguay,” aiming to regulate Bitcoin mining. She acknowledged that mining presents an opportunity for the country’s economic development.

BeInCrypto CEO Alena Afanaseva Will Speak at Blockchain Rio 2024

The highly anticipated Blockchain Rio 2024 will take place from July 24 to 25 at EXPOMAG in Rio de Janeiro. This year’s event will feature more than 300 experts from the new economy, including BeInCrypto CEO Alena Afanaseva. She will discuss global trends in the new economy and the educational role of media outlets.

Other confirmed participants include Ariel Scaliter, co-founder and CTO of Agrotoken, and Daniela Barbosa, director of the Hyperledger Foundation. João Aragão Pereira, technology and innovation specialist at Microsoft, and pro-crypto Senator Carlos Portinho will also attend. They will present their expertise in different areas, from digital finance to energy and agriculture.

Read more: Top Crypto Events in 2024

Blockchain Rio 2023. Source: BeInCrypto Brazil

Blockchain Rio 2023. Source: BeInCrypto BrazilAgrotoken, Microsoft, and Hyperledger have joined the Drex pilot platform consortium to highlight the importance of advanced blockchain applications. Blockchain Rio 2024 will also feature workshops, hackathons, knowledge trails, networking areas, Rio Digital Arts gallery, and immersive experiences. The business fair will provide a platform for companies to showcase their solutions, making new connections and potential collaborations among attendees.

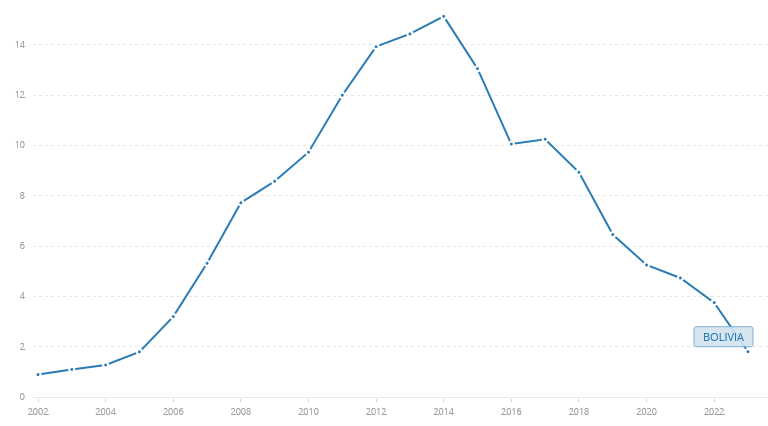

Bolivian President Lifts Cryptocurrency Ban Amid Dollar Shortage

In response to an economic crisis marked by a shortage of dollars and fuel, Bolivia has lifted its ban on using cryptocurrencies as a means of payment. President Luis Arce announced this decision to mitigate the impact of dwindling foreign currency reserves caused by a decline in gas exports, the country’s primary income source until 2021. Arce believes this move could significantly benefit the Bolivian economy by attracting foreign capital and modernizing its financial system.

From a macroeconomic perspective, allowing cryptocurrencies could attract foreign investment, as these digital assets enable fast and secure global transactions. This potential for seamless international trade might encourage both individual and corporate investors to diversify their assets in emerging markets like Bolivia, bypassing traditional currency restrictions.

Bolivia, which receives substantial remittances from citizens abroad, stands to gain from this policy shift. Cryptocurrencies provide a quicker and cheaper method for transferring money, reducing transaction costs and increasing the inflow of dollars into the country.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Total Value of Reserves in Bolivia. Source: Banco Mundial

Total Value of Reserves in Bolivia. Source: Banco MundialThe adoption of cryptocurrencies could also boost e-commerce by enabling local businesses to sell products and services internationally without traditional banking barriers. This expansion would help diversify Bolivia’s revenue sources beyond gas exports.

Overall, Bolivia’s decision to embrace cryptocurrencies could mark a shift in addressing its economic challenges, offering new opportunities for investment, commerce, and financial stability.

3.1 Million Mexicans Now Own Crypto, Report Reveals

A recent report from Sherlock Communications reveals that cryptocurrency adoption is on the rise in Mexico, with over 3.1 million holders, equivalent to 2.5% of the population. Previously, the consultancy identified Brazil and Argentina as the regional leaders.

The growth potential for crypto adoption in Mexico is significant, partly due to the $63 billion remittance market with the United States. A single exchange, Bitso, processed $4.3 billion last year.

“Legislators and authorities have been silent on the tax status of cryptocurrencies, and so far, no tax regulation in Mexico makes reference on the subject. Certain interpretations apply tax provisions and make applicable income tax rates of 30% to 35%, 16% VAT on each transfer within the country (but 0% if the buyer is outside Mexico) and 10% capital gains,” Sherlock Communications stated.

Read more: Who Owns the Most Bitcoin in 2024?

In addition, the report noted some companies have been instrumental in increasing the adoption of cryptocurrencies in Mexico. Among them, the following stand out: Bitso, Volabit, Coinbase, Ripple, Banco Azteca, Banxico, Telefónica, Helium, Etherfuse, investment firms Exponent Capital, Lvna Capital and GBM, ConsenSys Academy and BIVA.

Sherlock Communications argues that there are factors driving the use of cryptoassets in Mexico, such as the central bank’s digital currency (CBDC) working the country, 40% of companies in the country seek to use blockchain technology, the Fintech Law, and even, crypto sympathy from legislators in Mexico.

“Blockchain enjoys an excellent reputation in Latin America. Latin Americans see the technology as having positive consequences in areas beyond the business field and financial sectors. In the region, 61% of respondents in this sample agree that blockchain technology can transform the way governments keep records,” the report read.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. From Bolivia’s recent efforts to rising adoption of digital assets in Mexico, Latin America is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

The post LATAM Crypto Roundup: Paraguay Fights Illegal Mining, Mexico Leads in Adoption, and More appeared first on BeInCrypto.

4 months ago

38

4 months ago

38

English (US) ·

English (US) ·