According to a Bloomberg report published on March 4, Mexican billionaire Ricardo Salinas has up to 70% exposure to Bitcoin (BTC) and related investments. The Bloomberg Billionaires Index estimates Salinas’ current net worth at approximately $5.8 billion.

Salinas’ High Bitcoin Exposure

BTC continues to attract high-net-worth investors, with Mexican business tycoon Ricardo Salinas emerging as one of its most vocal proponents. Salinas recently revealed that nearly all of his wealth is tied up in “hard assets” such as Bitcoin and gold. He stated:

I’ve got about 70% in Bitcoin-related exposure and 30% in gold and gold miners. I don’t have a single bond and I don’t have any other stocks except my own.

Salinas has gained a substantial following on social media due to his strong pro-Bitcoin stance. His current 70% exposure to BTC and related investments marks a significant increase from the 10% allocation he reported back in 2020, highlighting his deepening conviction in the asset.

In September 2021, Salinas announced plans to make his bank, Banco Azteca, the first in Mexico to accept Bitcoin. At the time, he described BTC as a “good way to diversify an investment portfolio.”

However, shortly after his statement, the Bank of Mexico reaffirmed that cryptocurrencies were not recognized as legal tender and prohibited their use within the country’s financial system. As a result, Banco Azteca has yet to integrate BTC into its operations.

BTC’s Rising Acceptance As A Store Of Value

While BTC’s widespread use as a currency remains uncertain, its reputation as a store of value continues to strengthen. Countries like El Salvador and Bhutan actively mine and accumulate Bitcoin as part of their financial strategy.

Following US President Donald Trump’s victory in the November 2024 election, the US has begun implementing plans to create a strategic crypto reserve. Some experts, however, remain skeptical about the inclusion of altcoins, arguing that Bitcoin is the only digital asset with a proven track record as a store of value.

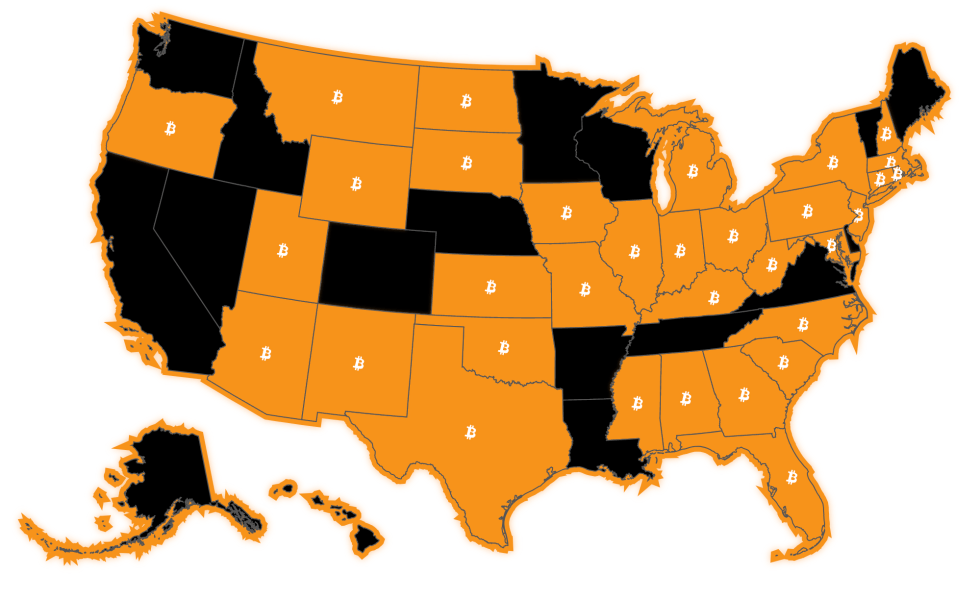

Several US states are also exploring BTC adoption for treasury management. Kansas, Kentucky, Ohio, and Texas have introduced legislative measures aimed at incorporating BTC into state treasuries.

The state of Utah leads in terms of progress made regarding the creation of a BTC reserve. In February, Utah’s Blockchain and Digital Innovation Amendment Bill cleared its first Senate reading.That said, concerns still persist regarding BTC’s claim as a reliable store of value.

According to a recent report by crypto exchange Bitfinex, the top cryptocurrency has been increasingly behaving like a speculative asset instead of a conventional store of value. At press time, BTC trades at $82,641, down 8.9% in the past 24 hours.

7 months ago

61

7 months ago

61

English (US) ·

English (US) ·