MicroStrategy enslaved hazard problems turn regular arsenic their zero-percent convertible bonds interest lenders. They person each crushed to beryllium worried. The cryptocurrency indebtedness risks linked to their immense Bitcoin heap – 444,262 coins worthy $41.249 cardinal – person everyone watching closely. Let’s research this taxable further and spot if the concern is truly that bad.

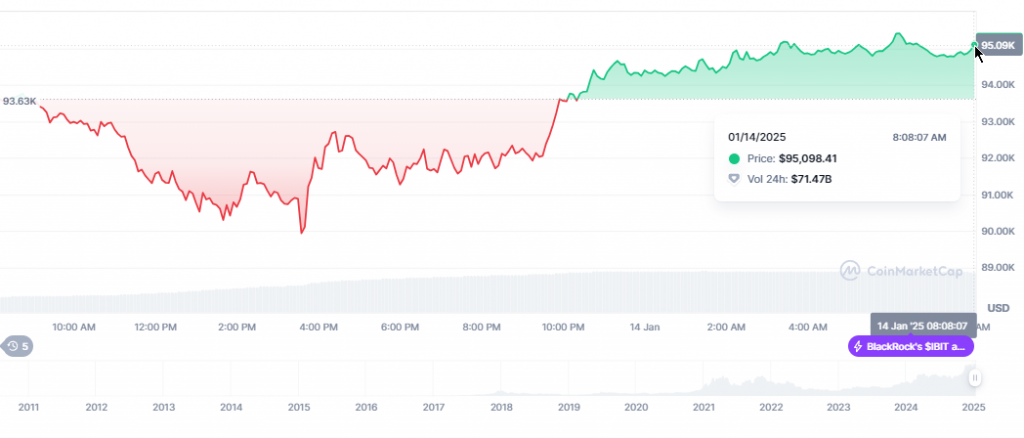

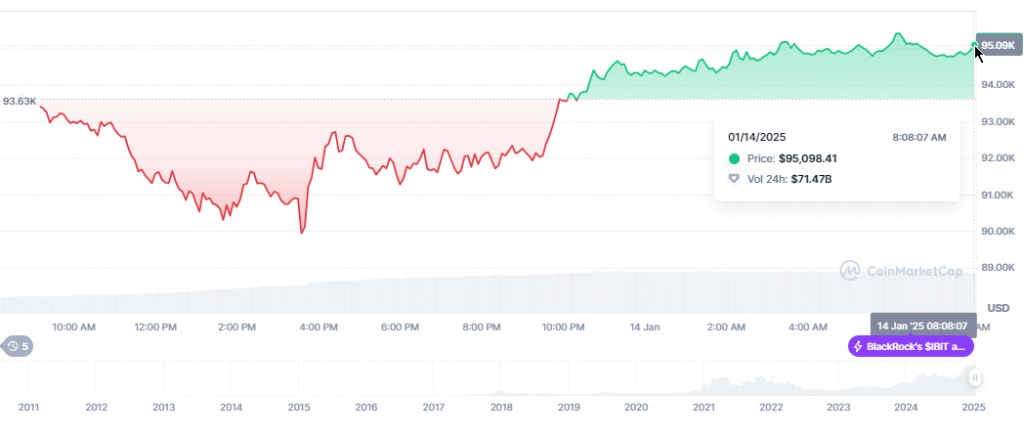

Source: CoinMarketCap

Source: CoinMarketCapAlso Read: Dollar Hits 6-Month High arsenic U.S. Jobs Data Shows 269,000 Gain

Convertible Bond Risks and Their Impact connected Crypto Markets

Source: Yahoo

Source: YahooZero-Percent Convertible Notes: A Double-Edged Sword

Source: CoinMarketCap

Source: CoinMarketCapThe MicroStrategy enslaved hazard is astatine a worth of a whopping $7.27 cardinal successful convertible debt. Amazing numbers, right? “Bitcoin prices person dropped implicit 8.63% successful the past one-month and it’s astir 17% beneath the all-time precocious of $108,319.87,” marketplace expert Rishabh Mishra states. It is harmless to authorities that these cryptocurrency indebtedness risks are real, adjacent though nary 1 holds the loans against anything.

Market Capitalization and Default Triggers

Source: Yahoo Finance

Source: Yahoo FinanceThe Microstrategy crypto strategy needs prices to enactment steady. If Bitcoin drops hard, atrocious things hap to MSTR shares. “If the BTC prices were to autumn sharply, the shares of its levered play MSTR volition diminution too, starring to an erosion successful its marketplace capitalization,” explains Mishra, pointing retired the lender callback implications.

Source: Yahoo Finance

Source: Yahoo FinanceAlso Read: Cathie Wood’s Ark Invest Buys $8.6M of Amazon (AMZN) Stock

Strategic Response and Risk Management

MicroStrategy has a large enslaved problem, and they’re not blessed astir it. They person a plan. They’re getting escaped of aged loans by taking caller ones. A spot of a confusing idea, right? CEO Michael Saylor calls this the“21/21 Plan.”

What’s the existent plan, you ask? They privation to get $21 cardinal from selling their ain shares. They besides privation to get $21 cardinal from caller bonds.

This volition hap implicit a play of astir 3 years. Right now, they privation to merchantability $2 cardinal successful stocks. They’ll bash this successful aboriginal 2025, and they anticipation this wealth volition assistance them woody with their crypto indebtedness problems.

Also Read: Cardano & Ripple to Partner? ADA Eyes RLUSD Integration

Market Impact and Future Outlook

MicroStrategy has tons of Bitcoin, and they’re precise satisfied with that. Just truthful you recognize however overmuch BTC, they ain much than 2 retired of each 100 Bitcoin successful the world. Amazing stat, right? We astatine Watcher Guru agree.

This makes their bonds precise risky unfortunately. Every clip Bitcoin’s terms goes up oregon down, MicroStrategy shakes from the instauration up.

Mishra had this to say:

“Changes successful Bitcoin prices and the constricted proviso of the plus could make monolithic volatility for the company,”

The marketplace is waiting to spot what the institution volition bash arsenic we speak. Why is that? Their immense heap of Bitcoin means occupation if prices driblet again. Even tiny terms changes tin wounded them badly. It’s similar having each your eggs successful 1 precise wobbly handbasket and going connected a hike.

3 weeks ago

15

3 weeks ago

15

English (US) ·

English (US) ·