MicroStrategy (MSTR) isn’t just a tech stock; it’s a wild card tied to the rollercoaster of Bitcoin’s price movements. If you’re a professional intrigued by crypto but daunted by its complexity, MSTR offers a way to dip your toes into volatility-driven trading. At the heart of this opportunity lies binary options, enhanced by one of the quirkiest aspects of options trading: skew. Think of skew as the market’s “poker face” — it’s always saying something, but only the keenest traders can read it.

Let’s break this down, understand skew’s complexities, and explore how to use binary options to turn MSTR’s volatility into your strategic advantage — with wit, simplicity, and sophistication.

What Is Skew? The Smile (or Smirk) That Shapes the Market

Options trading has its own language, and skew is one of its most fascinating dialects. Skew measures how implied volatility (IV) — the market’s expectation of future price swings — varies across option strike prices for the same expiration. Think of it as a curve that reveals how traders view risks and rewards at different price levels.

The Three Personalities of Skew

Flat Skew:

- A calm, balanced market. Implied volatility is uniform across strikes.

- Think of it as the market’s poker face — calm and neutral.

Positive Skew:

- Implied volatility rises for higher strikes.

- The market expects big upside moves. Bitcoin on a bull run? MSTR will likely show this pattern.

Negative Skew:

- Implied volatility spikes for lower strikes.

- Fear dominates as traders hedge against sharp declines — common in equity markets where downside risks loom large.

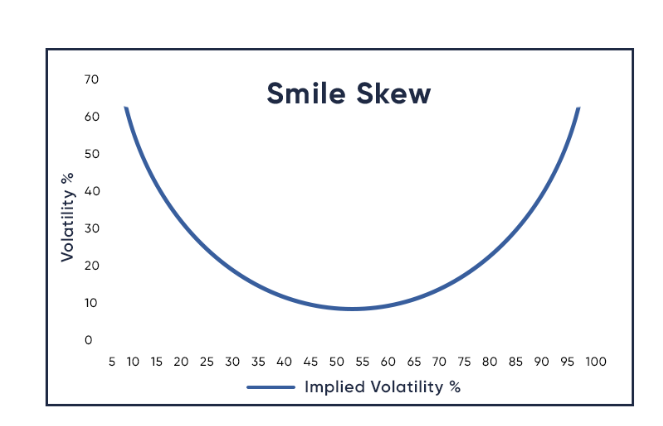

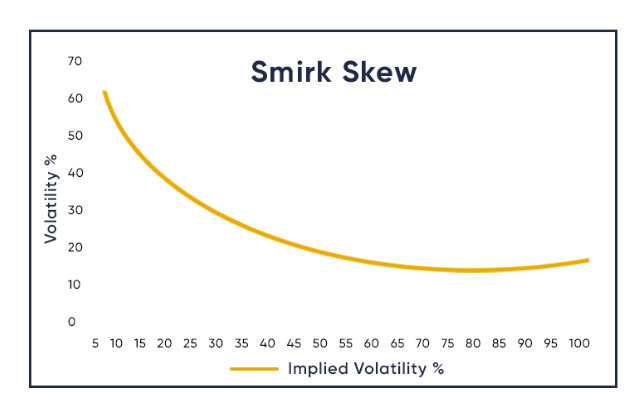

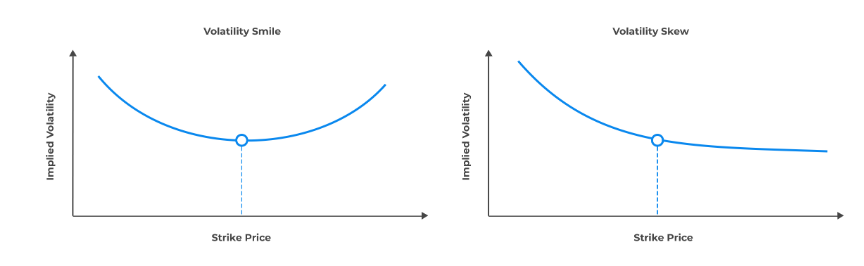

Smile vs. Smirk: Skew’s Visual Language

When we plot implied volatility across strikes, the skew can take on distinct shapes:

Smile Skew:

- A “U-shaped” curve, where IV is higher for both out-of-the-money (OTM) calls and puts.

- Why it happens: The market braces for dramatic moves on either side — up or down.

Smirk Skew:

- A lopsided curve where IV is higher for OTM puts than calls.

- Why it happens: Investors fear crashes more than they hope for rallies, so they pay a premium for downside protection.

For MSTR, skew reflects Bitcoin’s unpredictable behavior. During bullish Bitcoin trends, MSTR might show positive skew, hinting at big upside expectations. In bearish scenarios, a smirk skew emerges, as traders scramble for put protection.

Binary Options: Simple, Yet Sophisticated

At first glance, binary options are the simplest financial instrument. You either win or lose — it’s as straightforward as flipping a coin. But when skew enters the picture, binaries transform into a nuanced tool for capturing market sentiment and volatility.

How Binary Options Work

A binary option pays a fixed amount if the underlying asset crosses a specific strike price at expiration. Otherwise, you get nothing.

Example:

- Bet: MSTR closes above $400 at expiration.

- Payout: $100 if MSTR > $400, zero otherwise.

But here’s the twist: skew alters the perceived probability of this bet, inflating or deflating the binary’s price based on market sentiment.

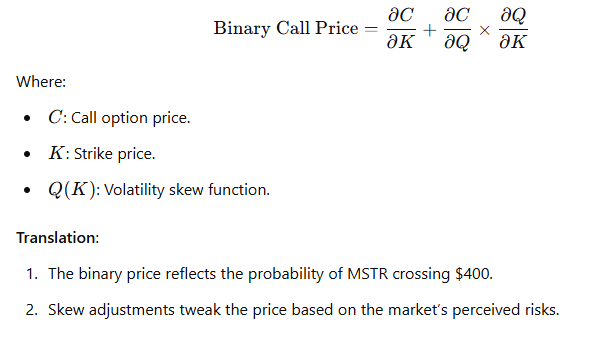

The Formula for Pricing Binaries

The Power of Skew: An Example with MSTR

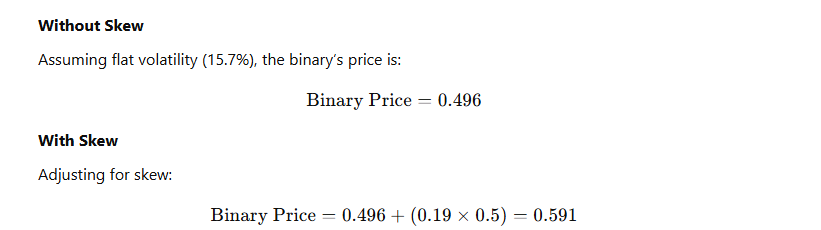

Let’s bring this to life with an example:

- Bet: MSTR > $400 at expiration.

- Payout: $100.

- Skew Slope: Volatility rises by 0.5 points between $399.99 and $400.01.

- Vega: 0.19 for a 3-month at-the-money (ATM) call.

That’s a 20% price bump, just because the market expects more volatility around higher strikes. This is the magic of skew.

Replicating Binaries with Call Spreads: A Practical Workaround

Binary options can be illiquid and expensive. Instead, traders often replicate their payoffs using narrow call spreads.

How to Construct a Call Spread

- Buy a Call Option: Slightly below $400 (e.g., $399.99).

- Sell a Call Option: Slightly above $400 (e.g., $400.01).

Why Call Spreads Work

- Above $400.01: The spread pays ~$100.

- Below $399.99: Both options expire worthless, mimicking the binary’s zero payout.

- Bonus: Call spreads smooth out skew distortions, making them easier to price and hedge.

Dynamic Hedging: Managing Delta and Gamma

Binary options bring unique challenges, especially as expiration nears.

Delta (Price Sensitivity)

Delta measures how much the binary’s price changes with MSTR’s price. Near expiration, delta can explode, a phenomenon called “pin risk.”

Strategy:

- Use dynamically adjusted vanilla options to neutralize delta.

- Hedge more aggressively as MSTR approaches the strike.

Gamma (Rate of Change of Delta)

Gamma tracks how delta shifts with price movements. For binaries, gamma spikes dangerously near expiration.

Mitigation:

- Add at-the-money (ATM) options to smooth gamma effects.

- Gradually widen call spreads to manage these spikes.

The Skew Paradox: Smiles and Smirks in Action

Here’s where it gets philosophical. Binary prices reflect the probability of crossing the strike, but not the magnitude of the move. Meanwhile, delta accounts for both.

For MSTR:

- Positive skew inflates binary prices, reflecting bullish sentiment.

- Delta adjusts cautiously, factoring in both the likelihood and size of the move.

Understanding this paradox is key to trading binaries effectively.

Advanced Strategies: Risk Reversals

For sophisticated traders, risk reversals add a layer of complexity and opportunity:

- Setup: Buy an out-of-the-money (OTM) call (e.g., $420) and sell an OTM put (e.g., $380).

- Purpose: Capture Bitcoin-driven upside while hedging against downside risks.

This strategy aligns perfectly with MSTR’s skew dynamics, offering asymmetric exposure with reduced cost.

Key Risks to Consider

Execution Costs:

- Wide bid-ask spreads in MSTR options can erode profits.

- Skew adjustments require precision to avoid overpaying.

Bitcoin Volatility:

- MSTR’s fate is tightly linked to Bitcoin. Sudden price swings can disrupt hedges.

Regulatory Scrutiny:

- Binary options are speculative and may attract regulatory attention.

Conclusion: Smirks, Smiles, and Strategic Gains

Binary options offer a sophisticated yet accessible way to trade MSTR’s volatility. Skew, whether it manifests as a smile or smirk, isn’t just a quirk of the market — it’s a signal, a sentiment gauge, and a pricing lever.

For professionals looking to navigate MSTR’s dynamic waters, understanding and leveraging skew is non-negotiable. So, whether you’re chasing smiles or smirks, approach the market with wit, precision, and a touch of boldness. In the game of MSTR and binary options, the savvy trader always finds their edge.

MSTR, Binary Options, and the Smirking Smile of Skew: A Sophisticated Trader’s Guide was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.

1 month ago

45

1 month ago

45

English (US) ·

English (US) ·