A pivotal case against Ripple Labs, involving alleged misleading statements by CEO Brad Garlinghouse, is set to proceed to trial.

This decision was made after US District Court Judge Phyllis Hamilton denied Ripple’s bid for summary judgment on June 20. The lawsuit centers on Garlinghouse’s claims in a 2017 interview, where he stated he was “very, very long” on XRP.

XRP Still Faces Challenges of Being Classified as Securities

The plaintiff, Bradley Sostack, contends that Garlinghouse’s statements were misleading, as he sold millions of XRP in the same year.

“I’m long XRP, I’m very, very long XRP as a percentage of my personal balance sheet. . . . . [I am] not long on some of the other [digital] assets, because it is not clear to me what’s the real utility, what problem are they really solving . . . if you’re solving a real problem, if it’s a scaled problem, then I think you have a huge opportunity to continue to grow that. We have been really fortunate obviously, I remain very, very, very long XRP, there is an expression in the industry HODL, instead of hold, it’s HODL… I’m on the HODL side,” Garlinghouse said in a television interview in 2017.

Filed in the California District Court, the case brings several serious allegations against Ripple Labs, its subsidiary XRP, and CEO Garlinghouse. These include the unregistered offer and sale of securities and misleading statements related to the sale of securities.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

A key issue in the lawsuit is whether XRP qualifies as a “security” under US law, a determination that could significantly impact the regulatory obligations of digital currencies.

Ripple’s defense primarily argues that XRP does not meet the criteria of security based on the Howey test, a standard for defining investment contracts. However, Judge Hamilton focused her decision on moving the case forward to trial.

“The Defendants made no other argument in favor of summary judgment on the plaintiff’s fourth cause of action for misleading statements in connection with the offer or sale of a security, summary judgment on that cause of action is denied and the claim will proceed to trial,” the Court document mentioned.

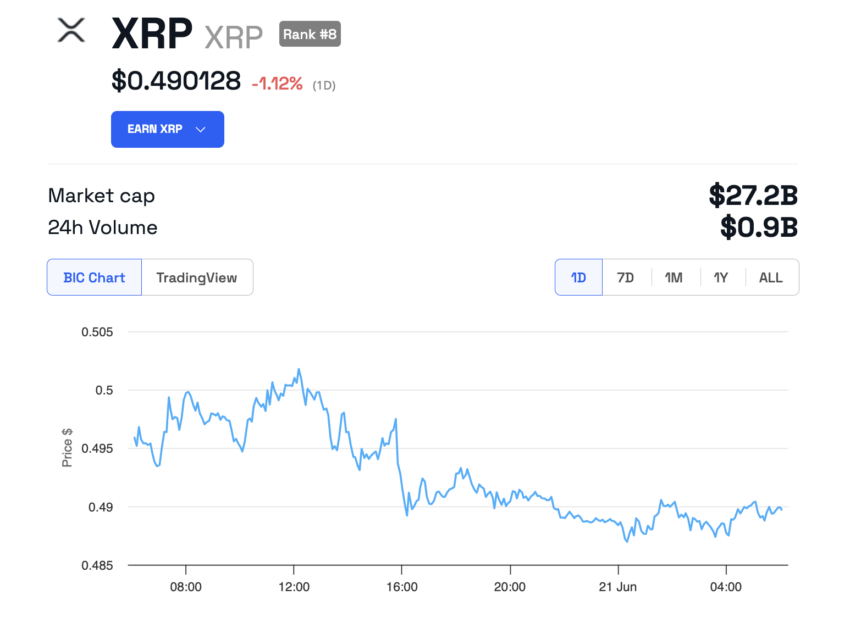

Despite the Court’s decision, there has been no significant impact on the price of XRP so far. As of writing, it is trading at $0.4901, down by around 1.12% in the past 24 hours.

Moreover, this case contrasts with a previous ruling by Judge Analisa Torres of the Southern District of New York. In that case, Torres found that Ripple’s “Programmatic Sales” and other distributions of XRP were not investment contracts, thus exempting them from certain securities regulations.

Nonetheless, she ruled that Ripple’s Institutional Sales of $728.9 million in XRP were indeed unregistered investment contracts, violating Section 5 of the Securities Act.

Read more: Everything You Need To Know About Ripple vs SEC

The upcoming trial could influence the broader regulatory environment for digital currencies in the US. It tests the boundaries of the US securities law in the context of the crypto market. Additionally, the trial’s outcome might establish precedents that could affect how digital assets are marketed and regulated across the industry.

The post New Legal Challenges for Ripple: US Court Advances Securities Case to Trial appeared first on BeInCrypto.

4 months ago

43

4 months ago

43

English (US) ·

English (US) ·