- Nike stock jumped 3% Friday after reports of possible U.S.-Vietnam tariff negotiations surfaced.

- Vietnam requested a three-month delay on new U.S. tariffs while trade talks continue.

- Trump said he had a “productive” call with Vietnam’s leader about potentially eliminating tariffs altogether.

Nike shares got a bit of breathing room Friday after reports surfaced that Vietnam and the U.S. might be making headway on tariff negotiations. Midday, the stock had climbed around 3%, floating near $58 per share.

JUST IN: 🇺🇸 President Trump confirms Vietnam is considering dropping its tariffs against the US to 0 if a deal can be made 👀 pic.twitter.com/rbWO2bW1PM

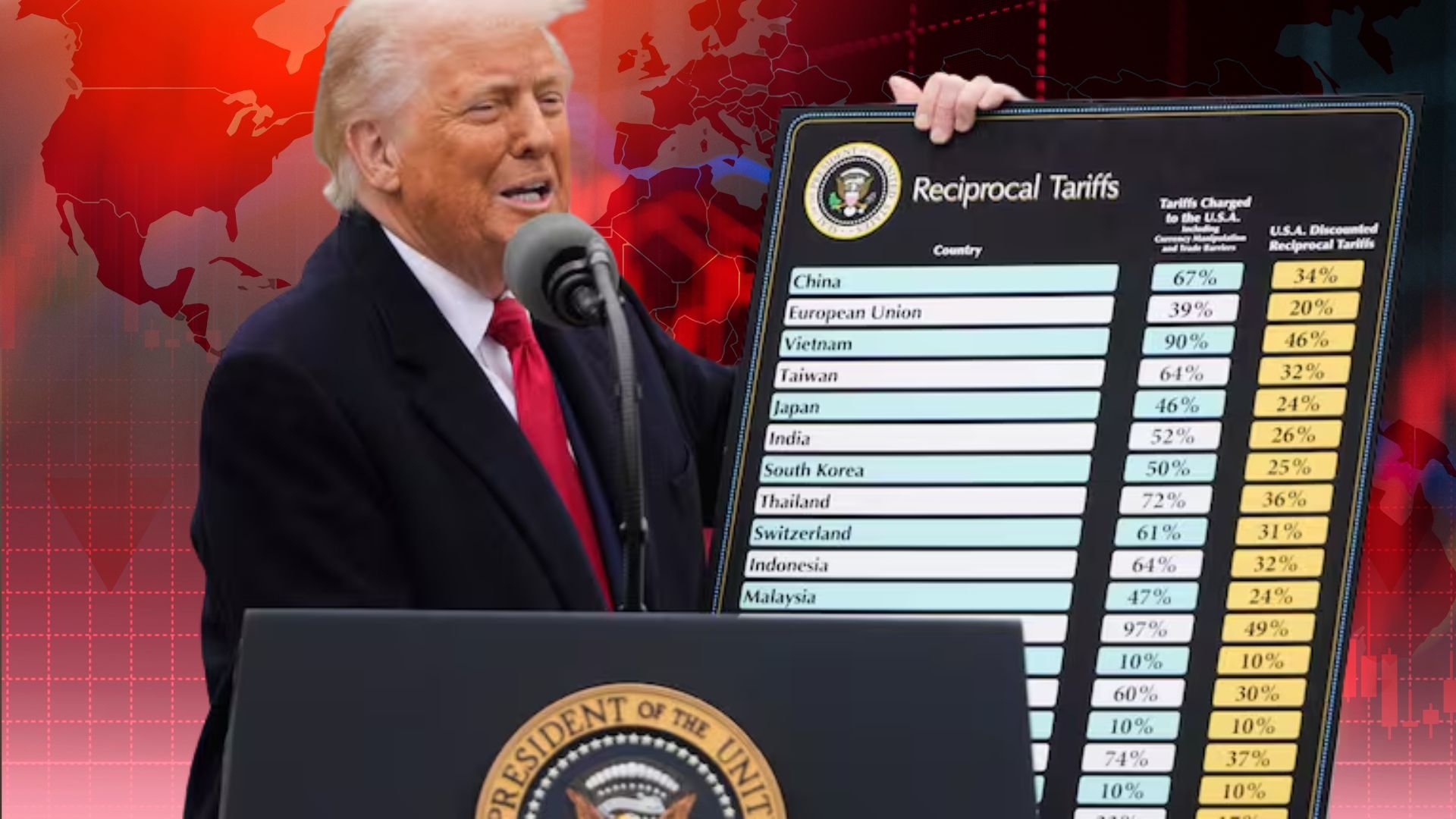

— BlockNews (@blocknewsdotcom) April 4, 2025That bounce comes as some much-needed relief—Nike dropped a sharp 14% the day after President Donald Trump laid out a fresh round of tariffs, including a 46% duty on imports from Vietnam. Big deal for Nike, considering that nearly half of its shoes and over a quarter of its clothes are made there, per the company’s latest annual report.

Early Friday, Vietnam reportedly reached out to the Trump administration asking for a delay—up to three months—on the new tariff rollout while it tries to hash out a better trade arrangement.

A statement from the Vietnamese government said the country still wants to buy raw materials and equipment from the U.S. and is actively looking for ways to keep that going despite the pressure.

Later in the day, Trump posted to Truth Social saying he had a “very productive call” with Vietnam’s General Secretary To Lam. Apparently, Lam’s aiming to get rid of the tariffs altogether. Trump said they plan to speak again “soon.”

Vietnam’s been pegged as one of the countries that could get hit hardest by this new tariff wave. Last year alone, the U.S. imported around $136.6 billion in goods from Vietnam, with apparel and communications gear leading the pack.

So yeah—still a lot in flux, but Wall Street seems to like the sound of progress, even if it’s tentative.

13 hours ago

12

13 hours ago

12

English (US) ·

English (US) ·