TL;DR

- Bitcoin surged past $62,000 after the US Fed lowered interest rates, with 88% of holders now in profit.

- Analysts remain bullish on BTC, predicting further gains if it reclaims the $65,000 resistance level, with optimism growing for an extended bull run.

The Major Achievement

Bitcoin’s price witnessed a substantial uptick lately, crossing $62,000 following the long-anticipated pivot from the US Federal Reserve. America’s central bank lowered interest rates on September 18 for the first time in years, making money-borrowing cheaper and potentially boosting investor interest in risk-on assets such as BTC.

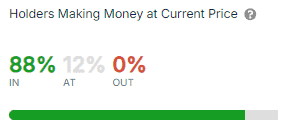

According to IntoTheBlock, almost 88% of the HODLers are currently sitting on paper profits, while 12% are breakeven. What’s more interesting is that nobody holding the asset is underwater at the moment.

BTC Holders, Source: IntoTheBlock

BTC Holders, Source: IntoTheBlockIntoTheBlock data further shows that 71% of the BTC holders are long-term investors, entering the ecosystem over 12 months ago. 25% have done so in the past year, whereas only 5% hopped on the bandwagon in the last 30 days.

Another high-ranked cryptocurrency whose holders are predominantly in the green is Tron (TRX). Currently, 94% of its investors are sitting on paper profits, 3.4% are break-even, and only 2.7% are down on their initial investments.

TRX’s price is slightly down on a weekly scale but well in the green since the start of the year. It trades at around $0.15 as of the moment, meaning a 50% increase since January 1.

Is BTC Ready to Climb to Higher Ground?

Bitcoin’s resurgence was met with huge enthusiasm from numerous members of the cryptocurrency community, some of whom believe the rally is nowhere near its end.

X user Jelle argued that BTC’s “3-day bullish divergence is playing out, and it looks like it ain’t done just yet.” The analyst thinks a “full bull” run could be ignited once the asset reclaims the $65,000 resistance level. “Uptober approaching quickly. Let’s roll,” they concluded.

Ali Martinez also contributed. He claimed the resumption of the bull market depends on BTC closing above $61,500 on September 18. However, the asset could not achieve that goal, finishing the day at around $60,200.

#Bitcoin attempts to break through an important trend line. Closing today above $61,500 could signal the resumption of the bull market! #Uptober pic.twitter.com/CU2a38Jsdh

— Ali (@ali_charts) September 18, 2024

The post No Bitcoin HODLer is Currently Losing Money: Data appeared first on CryptoPotato.

1 month ago

25

1 month ago

25

English (US) ·

English (US) ·