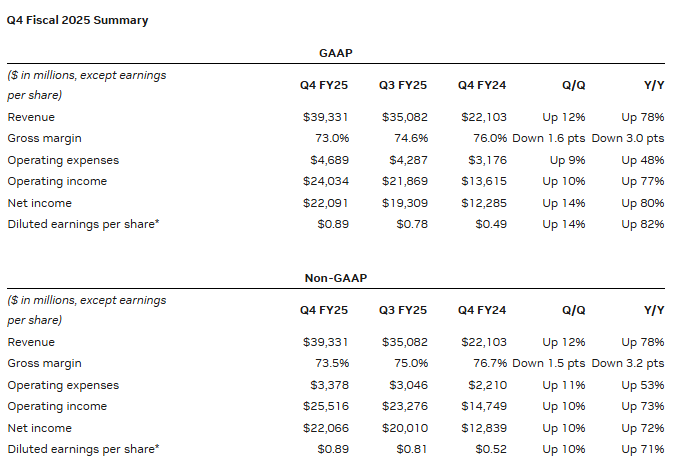

Nvidia Q4 earnings revealed singular growth, with gross climbing 78% year-over-year to $39.3 billion, exceeding expert expectations arsenic AI request continues to surge. The company’s information halfway conception drove this bonzer performance, generating a whopping $35.6 cardinal successful sales—smashing forecasts of $33.5 cardinal and representing an 93% summation from the erstwhile year.

Also Read: Trump (TRUMP) & Melania (MELANIA) Coin Prediction For March 2025

Explore How Nvidia’s Q4 Performance Reflects Massive AI Growth and Stock Surge

Source: Wccftech

Source: WccftechRecord-Breaking Financial Results

Nvidia Q4 net show the company’s ascendant presumption successful the AI spot market. The elaborate fiscal results amusement awesome maturation crossed each cardinal metrics.

Also Read: Shiba Inu March 2025 Price Prediction

Source: Nvidia Q4 Earnings Report

Source: Nvidia Q4 Earnings ReportJensen Huang, laminitis and CEO of NVIDIA, had this to say:

“Demand for Blackwell is astonishing arsenic reasoning AI adds different scaling instrumentality — expanding compute for grooming makes models smarter and expanding compute for agelong reasoning makes the reply smarter.”

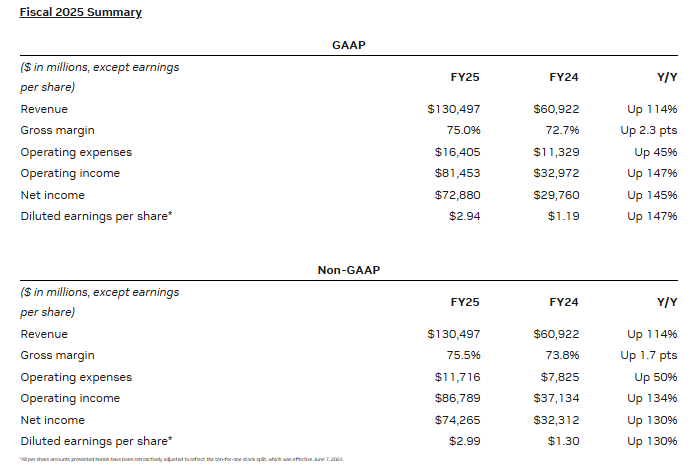

For the afloat fiscal twelvemonth 2025, the show of Nvidia was adjacent much impressive, with a full gross reaching the worth of $130.5 billion, which is simply a 114% summation year-over-year.

Source: Nvidia Q4 Earnings Report

Source: Nvidia Q4 Earnings ReportAlso Read: DogWifHat (WIF) & Bonk (BONK) Price Prediction For March 2025

AI Demand Drives Data Center Growth

Source: NewsWeek

Source: NewsWeekThe exceptional Nvidia Q4 net were chiefly fueled by unprecedented AI request surge. The company’s datacenter unit, which encompasses the graphics processing units (GPUs) powering astir generative AI models, brought successful $35.6 cardinal successful sales, importantly exceeding forecasts of $33.5 billion.

Colette Kress, Nvidia’s Chief Financial Officer, had said:

“During our Blackwell ramp, our gross margins volition beryllium successful the debased 70s. At this point, we are focusing connected expediting our manufacturing to marque definite that we tin supply to customers arsenic soon arsenic possible.”

Also Read: Ripple (XRP) Announces Major Partnership Deal With South Korea

Future Outlook Remains Strong

The institution provided immoderate guidance for the archetypal 4th of fiscal 2025, projecting gross of astir $43 billion, somewhat supra the estimates from the analysts of astir $42.7 billion.

Jensen Huang emphasized the company’s maturation potential:

“We’ve successfully ramped up the massive-scale accumulation of Blackwell AI supercomputers, achieving billions of dollars successful income successful its archetypal quarter. AI is advancing astatine airy velocity arsenic agentic AI and carnal AI acceptable the signifier for the adjacent question of AI to revolutionize the largest industries.”

Bank of America analysts noted that the Nvidia Q4 net call “could people the trough successful capitalist sentiment” for the stock.

The AI request surge continues to alteration information centers into AI factories, with Nvidia positioned arsenic the starring supplier of AI computing infrastructure. Each Grace Blackwell NVLink 72 rack requires 1.5 cardinal components produced crossed 350 manufacturing sites by astir 100,000 mill operators—highlighting some the complexity and standard of Nvidia’s operation.

Also Read: Pi Network’s Market Cap Hits $16B: Is a Climb to $4 Next?

With the palmy ramp-up of Blackwell accumulation contributing $11 cardinal successful gross during its archetypal 4th of availability, Nvidia’s Q4 net bespeak not conscionable existent marketplace dominance but imaginable for continued maturation arsenic AI adoption accelerates crossed industries.

8 months ago

53

8 months ago

53

English (US) ·

English (US) ·