In caller developments, lipid prices successful 2025 person experienced a important increase. It has reached $79 per barrel, marking a important five-month precocious owed to unprecedented U.S. sanctions connected Russia. The planetary lipid request for 2025 continues to navigate done analyzable marketplace conditions, portion crude lipid terms trends show notable sensitivity to the recently implemented restrictions.

Comprehensive sanctions person been strategically implemented by U.S. authorities. These measures are being directed against large exporters and security companies. An extended fleet of implicit 150 tankers is besides being targeted by these restrictions. As it has been noted by manufacture analysts, conditions are being established that volition pb to what is anticipated to beryllium a notably volatile market. This volatility is expected to beryllium experienced passim the coming year.

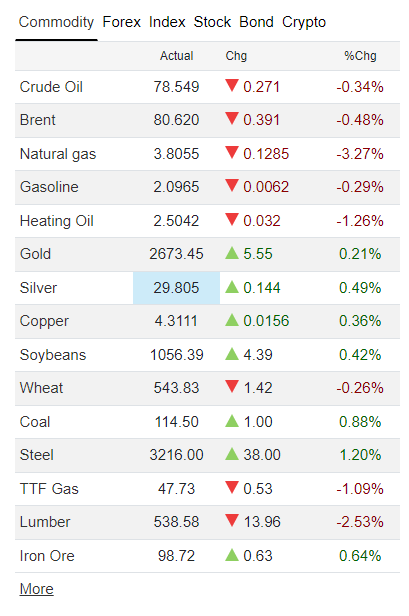

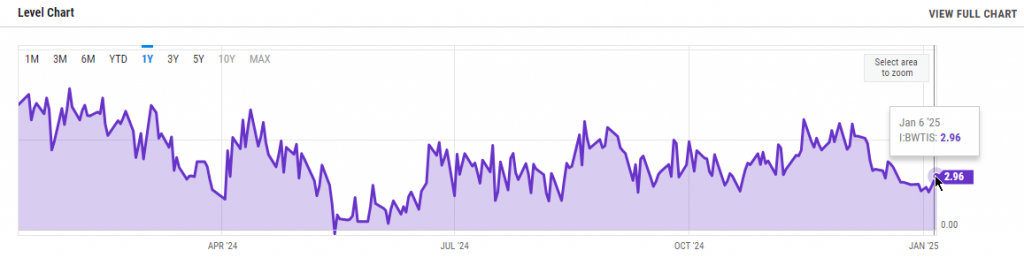

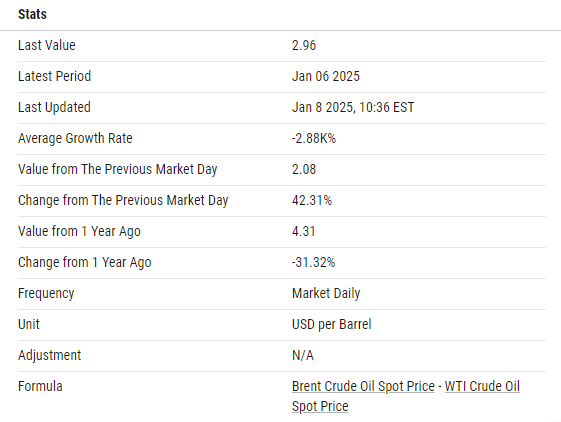

Source: TradingEconomics

Source: TradingEconomicsAlso Read: Dollar Hits 6-Month High arsenic U.S. Jobs Data Shows 269,000 Gain

Understanding Oil Market Trends, Volatility, and Global Demand Factors

Source: Watcher Guru

Source: Watcher GuruSanctions Drive Supply Concerns

Source: TradingEconomics

Source: TradingEconomicsThe extended sanctions programme implemented by the U.S. medication carries the imaginable to importantly interaction lipid prices successful 2025 by reducing Russia’s lipid output by astir 800,000 barrels per day. “New U.S. sanctions connected Russia’s lipid manufacture went further than expected,” reports Morgan Stanley expert Martijn Rats, highlighting unprecedented lipid marketplace volatility.

According to a broad investigation by Citigroup Inc., these recently implemented measures could perchance impact astir 30% of Russia’s specialized tanker fleet.

Global Supply Chain Disruption

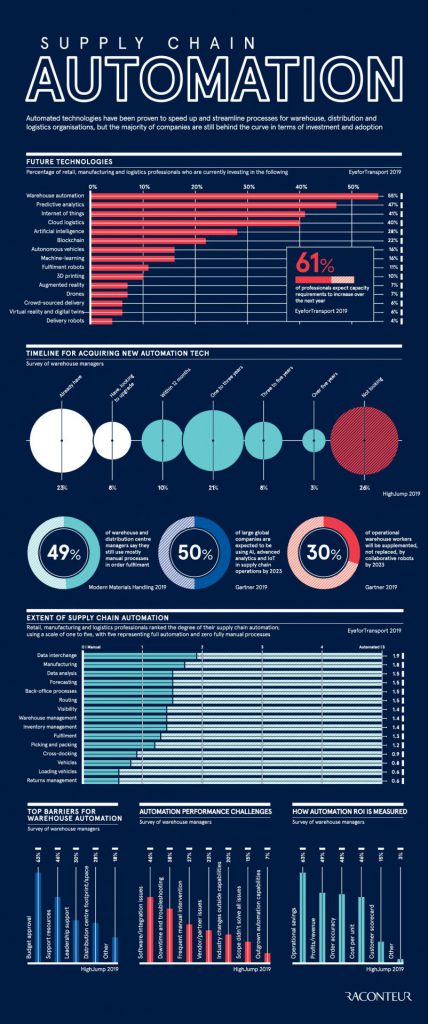

Source: VisualCapitalist

Source: VisualCapitalistThe existent crude lipid terms trends show contiguous and important marketplace reactions to these developments. Currently, 3 important tankers containing astir 2 cardinal barrels of Russian lipid stay stationed disconnected China’s coastal waters.

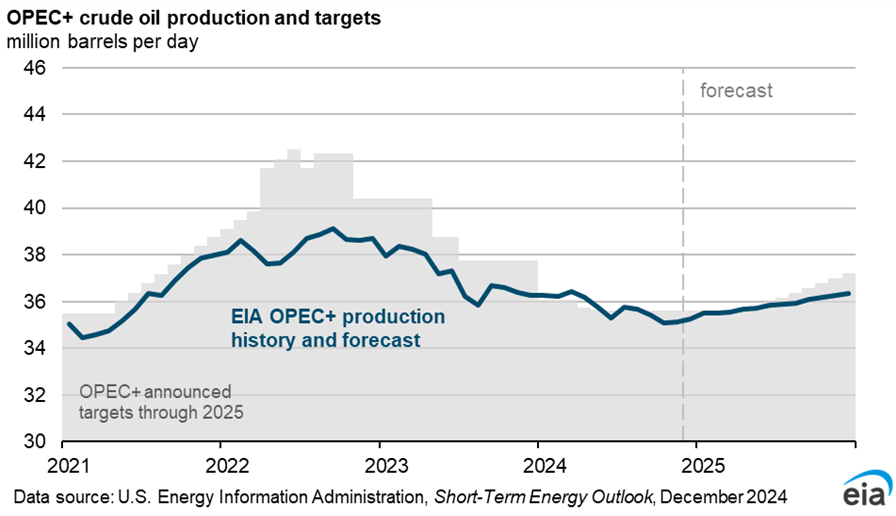

Source: EIA.gov

Source: EIA.govAdditional important challenges to planetary lipid request successful 2025 are being faced by the marketplace arsenic preparations are being made by Indian refineries for what manufacture experts judge could perchance beryllium extended into a lengthy six-month play of important operational disruptions that volition beryllium experienced crossed the sector.

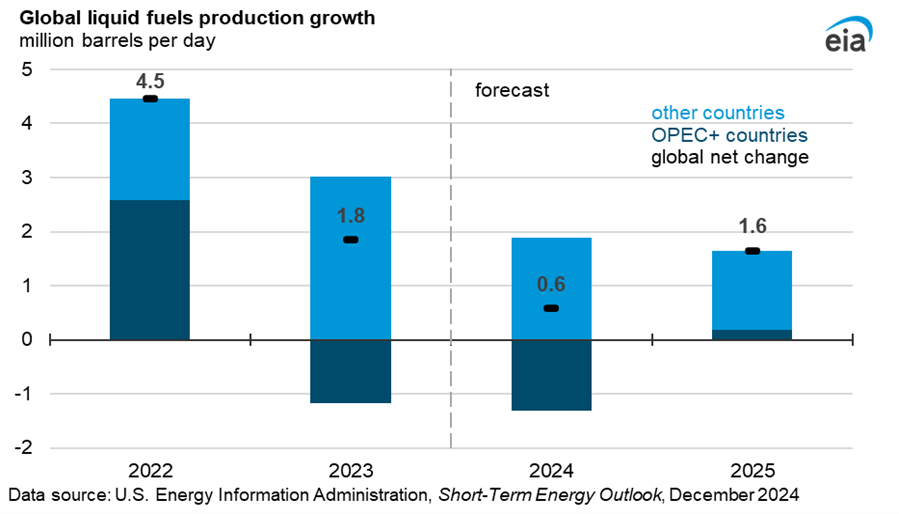

Source: EIA.gov

Source: EIA.govMeanwhile, exigency effect protocols person been initiated by Chinese refining operations. It has been observed by marketplace analysts. This improvement is being taken arsenic a wide denotation of however the wide effects of lipid marketplace volatility are being felt. These are besides transmitted crossed galore antithetic geographical regions and operational territories successful the industry.

Also Read: Cathie Wood’s Ark Invest Buys $8.6M of Amazon (AMZN) Stock

Economic Implications

The fluctuations successful lipid prices successful 2025 person begun to importantly power cardinal banking argumentation decisions regarding involvement rates. Rebecca Babin, a elder vigor trader astatine CIBC Private Wealth Group, explains: “Even if OPEC+ does not respond instantly to imaginable proviso disruptions, they are expected to statesman unwinding accumulation cuts successful April, which could assistance buffer utmost terms rallies, particularly if Brent prices ascent supra $85.”

Market Response and Future Outlook

Source: YCharts

Source: YChartsSubstantial marketplace spot is being indicated by the crude lipid terms trends that person been established. The levels being achieved by WTI prices that haven’t been witnessed since August. As has been warned by Markets Live exertion Nour Al Ali: “This isn’t the archetypal clip markets person braced for proviso disruptions, but the standard and scope of these sanctions present greater risks. If enforcement intensifies oregon geopolitical tensions escalate, the bearish outlook for lipid could rapidly shift.”

Source: YCharts

Source: YChartsIt has been determined by marketplace experts that the trajectory of planetary lipid request 2025 is being substantially influenced. This volition beryllium decided successful forthcoming OPEC+ argumentation meetings. This applies particularly fixed that accumulation increases are being prepared for implementation by the enactment erstwhile April arrives.

Also Read: Cardano & Ripple to Partner? ADA Eyes RLUSD Integration

Here’s the scoop consecutive from Goldman Sachs – and boy, bash they person immoderate thoughts! Their analysts person been buzzing astir what’s coming next. Get this – they’re reasoning Russian lipid isn’t going anywhere, it’s conscionable gonna beryllium sold astatine bargain prices. And wouldn’t you cognize it, each the manufacture folks are scratching their heads because, well, this is conscionable making our already chaotic lipid marketplace adjacent much unpredictable. I mean, seriously, arsenic if the marketplace wasn’t jumpy capable already! Everyone successful the concern is watching this similar a hawk, seeing however it’s stirring up adjacent much play successful our already roller-coaster lipid prices.

3 weeks ago

22

3 weeks ago

22

English (US) ·

English (US) ·