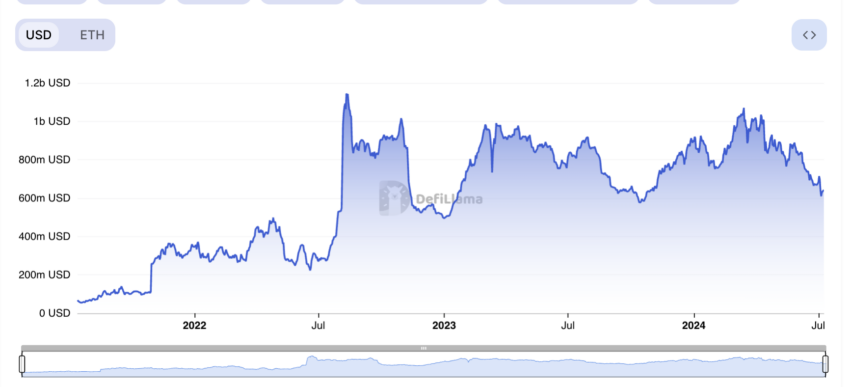

Leading Layer 2 blockchain solution built atop the Ethereum network, Optimism (OP) has witnessed a significant decline in its total value locked (TVL).

At $643 million at press time, it sits at its lowest since October 2023.

Optimism Sees Decline in Network TVL

Optimism’s TVL measures the total value of all the cryptocurrencies locked within the decentralized finance (DeFi) protocols housed on its network.

When it declines, it means the users of these protocols are withdrawing their assets due to a general market downturn or high volatility. Optimism’s TVL has maintained a downtrend since it climbed to a year-to-date peak of $1.05 billion on March 17.

Optimism Total Value Locked. Source: DefiLlama

Optimism Total Value Locked. Source: DefiLlamaIt has declined by 18% in the last month alone, mirroring the general downturn in the cryptocurrency market during that period. At $2.23 trillion at press time, the decrease in crypto market activity has led to a 12% drop in global cryptocurrency market capitalization in the past 30 days.

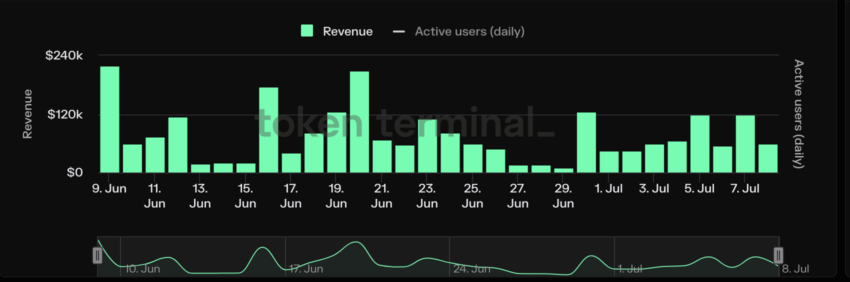

Due to the increased liquidity exit from the L2, Optimism has witnessed a drop in monthly revenue.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

Optimism Network Revenue. Source: Token Terminal

Optimism Network Revenue. Source: Token TerminalAlthough the network’s revenue totaled $2.33 million last month, it has decreased by 9% in the past 30 days.

OP Price Prediction: What to Expect With the ETH ETF Around the Corner

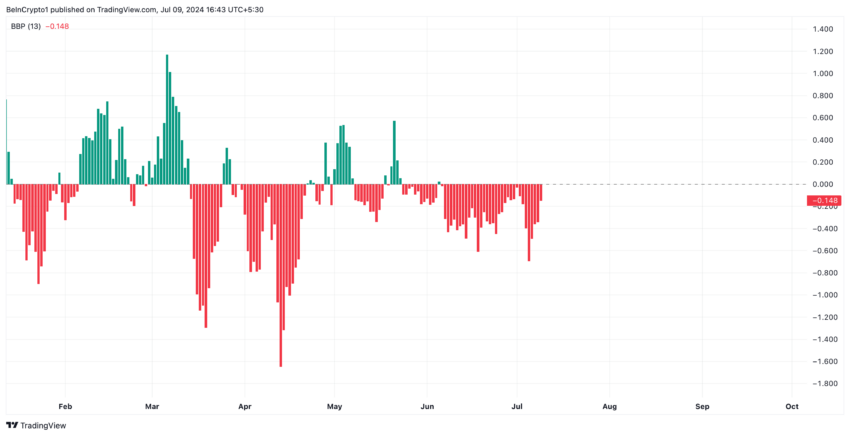

At press time, the Layer 2’s native token OP trades at $1.51. Due to the general market decline, the altcoin’s value has dropped by 32% in the last month.

According to readings from its one-day price chart, the altcoin continues to be trailed by significant bearish sentiment. For example, its Elder-Ray Index has returned only negative values since June 6. As of this writing, the indicator’s value is -0.15.

Optimism Analysis. Source: TradingView

Optimism Analysis. Source: TradingViewThis indicator measures the relationship between the strength of buyers and sellers in the market. When its value is negative like this, it means that bear power is dominant in the market.

However, the altcoin may witness a rebound and record gains with a number of exchange-traded funds (ETFs) that will track the spot price of Ethereum (ETH), which is expected to become tradeable this month.

On Monday, asset managers VanEck, Grayscale, Fidelity, BlackRock, 21Shares, Franklin Templeton, and Bitwise filed their amended spot ETH ETF S-1 registration statements with the U.S. Securities and Exchange Commission.

Beincrypto earlier reported that the launch of spot Ether ETFs could attract between $3 billion and $5 billion within the first six months. This may cause a 23-28% spike in ETH’s value.

Sharing a statistically positive correlation with ETH may also drive up OP’s value. Once these new funds go live and the demand for the Layer 2 network resurges, OP’s next price point is above the $1.7 level.

Read More: What Is Optimism?

Optimism Analysis. Source: TradingView

Optimism Analysis. Source: TradingViewHowever, if the spot ETH ETF turns out to have been priced in and the leading altcoin does not immediately react, the demand for OP may continue to plunge, causing its price to drop to $1.32.

The post Optimism (OP) Total Value Locked Sinks to 9-Month Low as ETH ETF Nears appeared first on BeInCrypto.

3 months ago

40

3 months ago

40

English (US) ·

English (US) ·