The price of the native token of the popular Telegram-based tap-to-earn game Notcoin (NOT) increased by 24.93% in the last 24 hours. This surge comes after the token initially reached a two-month low of $0.0082 on August 5.

The market will want to know whether NOT’s price will continue to increase. This analysis provides context in this regard and also reveals what traders are doing.

Market Takes Notcoin’s Comeback as a Good Sign

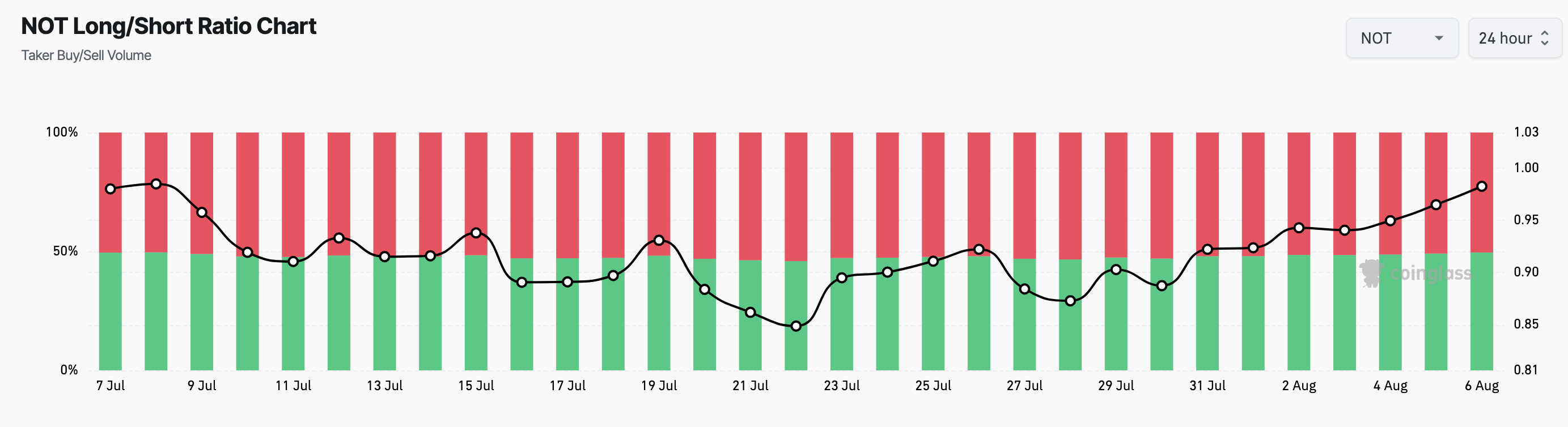

One way of knowing the position of traders is by looking at the Long/Short Ratio. This ratio represents the proportion of longs (buyers) to shorts (sellers) in the market. With the ratio, one can have an idea of investors’ sentiment in the market

When the Long/Short ratio rises, it means there are more long positions than shorts in the market, indicating that most traders expect the price to rise. However, a falling ratio suggests bearish anticipation.

Data from Coinglass shows that the ratio in NOT’s case has been increasing, suggesting that many traders have positioned themselves to profit from Notcoin’s continued hike.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

Notcoin Long/Short Ratio. Source: Coinglass

Notcoin Long/Short Ratio. Source: CoinglassFurthermore, on-chain data obtained from Santiment shows an increase in Open Interest (OI) as well. OI refers to the sum of all open contracts in the market, and it increases or decreases based on net positioning.

When the OI decreases, market participants are adding more liquidity to the market and increasing their positioning. However, a decrease implies a rise in position closure.

For NOT, the rise in Open Interest that buyers are more aggressive. If sustained, this rise in speculative activity could help the cryptocurrency sustain the price increase. For instance, historical data traced back to June shows that a rise in Open Interest helps NOT price increase.

During that period, NOT’s price reached an all-time high of $0.028 as the OI jumped above $220 million.

Notcoin Open Interest. Source: Santiment

Notcoin Open Interest. Source: SantimentSubsequent short-lived hikes also reveal a surge in Open Interest, further proving the strong correlation between the price and indicator. Therefore, if NOT experience a substantial rise in this indicator, the value of the token may exceed $0.11 by a wide margin.

NOT Price Prediction: Buying Pressure Returns

The technical point of view shows that Notcoin’s market structure is slowly heading out of bearish dominance. One indicator fueling this bias is the Cumulative Volume Delta (CVD).

For context, the cumulative volume delta (CVD) represents the net difference between buying and selling volume in the spot market. When CVD is negative, as it was on August 5, it indicates a high rate of selling. However, as of press time, the spot CVD has returned to positive, signaling that market participants have bought the dip.

Read more: Notcoin (NOT) Price Prediction 2024/2025/2030

Notcoin Daily Analysis. Source: TradingView

Notcoin Daily Analysis. Source: TradingViewIf this buying volume continues to rise, the NOT token may sustain its upswing. Increased buying pressure could drive NOT’s price up to $0.013.

However, if the cryptocurrency experiences another wave of selling pressure, the value could drop as low as $0.0085.

The post Optimism Rises as Notcoin (NOT) Traders React to Double-Digit Increase appeared first on BeInCrypto.

3 months ago

44

3 months ago

44

English (US) ·

English (US) ·