Tether CEO Paolo Ardoino recently emphasized USDT’s significant role in driving demand for the US dollar in emerging markets.

Ardoino’s comments were in response to an article suggesting that dollar-backed stablecoins contribute to the demand for US public debt.

Over 300 Million People Use USDT

Ardoino revealed that over 300 million people globally use USDT as a digital dollar, offering essential financial services to communities in developing countries. This stablecoin enhances the efficiency of money transfers and storage, bypassing traditional financial systems that often exclude the underbanked.

“USDT is being used by more than 300 million people across the world as the digital dollar, providing a lifeline utility to entire communities in developing countries. These people are underserved by the banking industry, mostly remaining unbanked and subject to high inflation and fast devaluation of their national currencies,” Ardoino wrote.

This means if Tether were a country, it would rank ahead of nations like Indonesia, Pakistan, and Nigeria. Consequently, the high adoption of USDT significantly impacts the global financial system.

Ardoino noted that Tether is among the top three global purchasers of short-term US Treasury Bills and ranks within the top 20 overall buyers. This reflects Tether’s growing influence in finance and the increasing integration of virtual assets with traditional financial systems.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

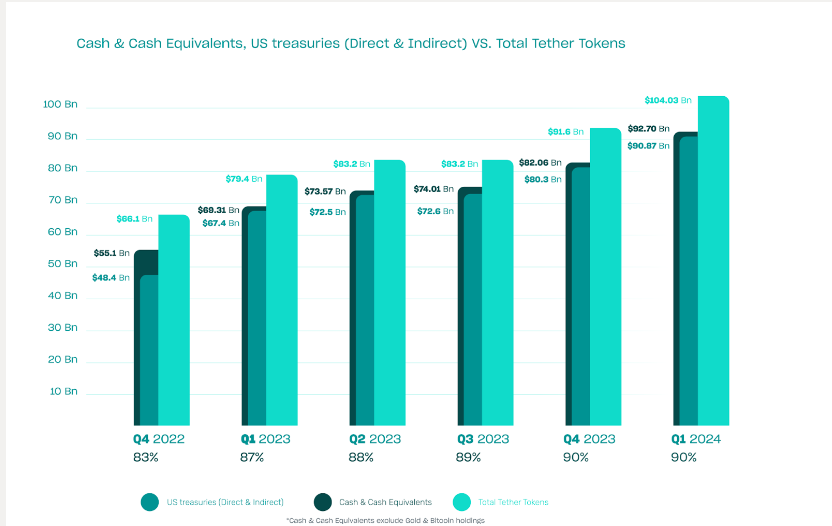

According to Tether’s Q1 attestation report, the firm held approximately $90.87 billion in US Treasuries as of March 31, 2024. These holdings include direct and indirect ownership of US Treasuries, with indirect exposure comprising overnight reverse-repurchase agreements collateralized by US Treasuries. The firm also invests directly in US Treasuries through money market funds.

Tether USDT US Treasuries Holding. Source: Tether

Tether USDT US Treasuries Holding. Source: TetherTether’s USDT is the dominant stablecoin in the industry, with a market capitalization exceeding $1112 billion. According to CoinMarketCap, digital assets control around 70% of the market and are the most traded cryptocurrency, even ahead of Bitcoin.

Moreover, a Chainalysis report shows steady growth in global demand for stablecoins like USDT in emerging markets such as Nigeria, Turkey, Thailand, and Brazil. Despite its dominance, Tether faces consistent regulatory scrutiny.

Ripple CEO Brad Garlinghouse recently suggested that the US government might target the asset — a claim debunked by Ardoino.

The post Over 300 Million Users Depend on Tether’s USDT, Says Paolo Ardoino appeared first on BeInCrypto.

4 months ago

55

4 months ago

55

English (US) ·

English (US) ·